For The First Time In 25 Years, US Treasury Just Designated China A Currency Manipulator

5 August, 2019

Following the plunge in the yuan overnight, The U.S. Treasury Department on Monday designated China as currency manipulator, a historic move that no White House had exercised since the Clinton administration.

“Secretary Mnuchin, under the auspices of President Trump, has today determined that China is a Currency Manipulator,” the Treasury Department said in a release.“As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.” ""This pattern of actions is also a violation of China’s G20 commitments to refrain from competitive devaluation."

Washington hasn’t labeled a major trade partner a currency manipulator since 1994.

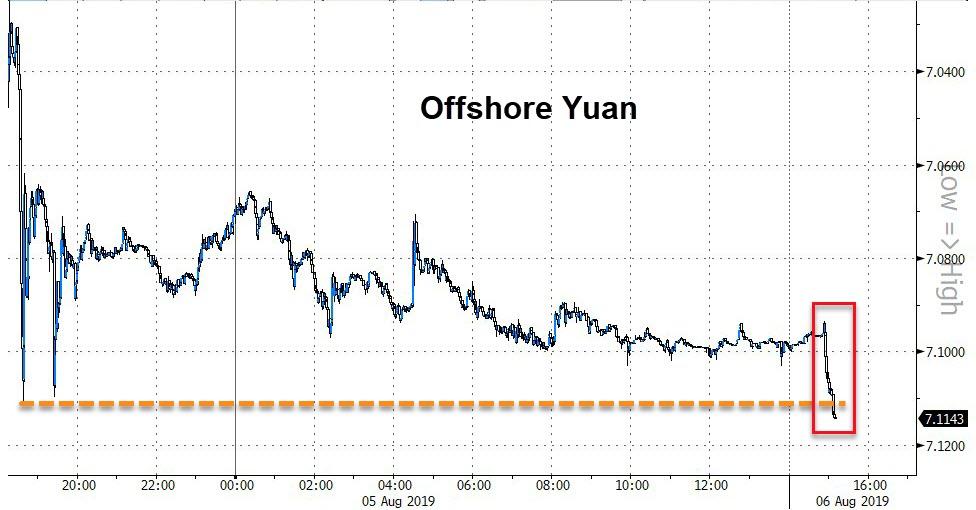

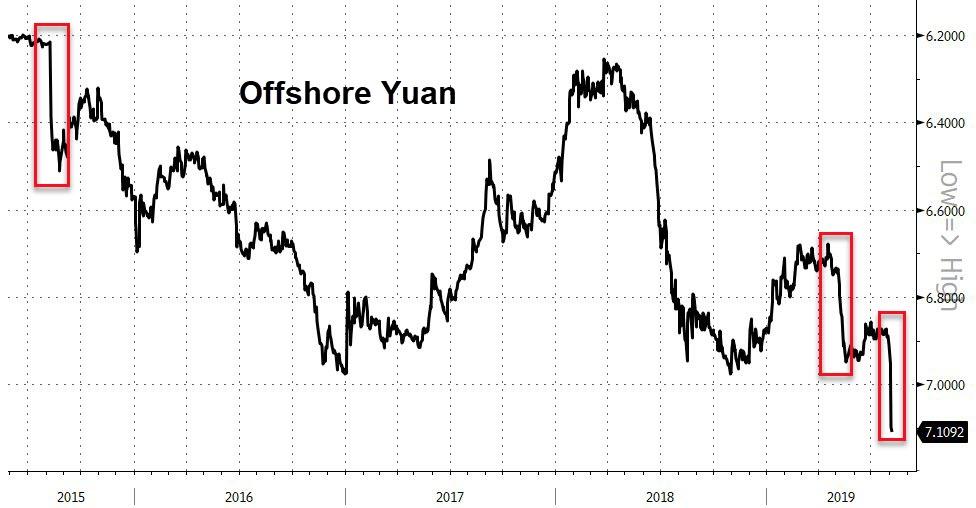

The Offshore Yuan tumbled to a new record low on the headline...

USDJPY is also diving as are US equity futures (Dow futures are down 350 from their close, down 500 from the cash close)...

And gold is spiking above $1485...

* * *

Full Treasury Statement

The Omnibus and Competitiveness Act of 1988 requires the Secretary of the Treasury to analyze the exchange rate policies of other countries. Under Section 3004 of the Act, the Secretary must "consider whether countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustment or gaining unfair competitive advantage in international trade.”Secretary Mnuchin, under the auspices of President Trump, has today determined that China is a Currency Manipulator.As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.As noted in the most recent Report to Congress on the Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States (“FX Report”), China has a long history of facilitating an undervalued currency through protracted, large-scale intervention in the foreign exchange market. In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past. The context of these actions and the implausibility of China’s market stability rationale confirm that the purpose of China’s currency devaluation is to gain unfair competitive advantage in international trade.The Chinese authorities have acknowledged that they have ample control over the RMB exchange rate. In a statement today, the People’s Bank of China (PBOC) noted that it “has accumulated rich experience and policy tools, and will continue to innovate and enrich the control toolbox, and take necessary and targeted measures against the positive feedback behavior that may occur in the foreign exchange market.” This is an open acknowledgement by the PBOC that it has extensive experience manipulating its currency and remains prepared to do so on an ongoing basis.This pattern of actions is also a violation of China’s G20 commitments to refrain from competitive devaluation. As highlighted in the FX Report, Treasury places significant importance on China adhering to its G-20 commitments to refrain from engaging in competitive devaluation and to not target China’s exchange rate for competitive purposes. Treasury continues to urge China to enhance the transparency of China’s exchange rate and reserve management operations and goals.

This is very odd since just a few a weeks ago, The US Treasury Report chose not to label China a currency manipulator as it only triggered one of the criteria.

This is what the Treasury said about China's FX policy then:

Treasury continues to urge China to take the necessary steps to avoid a persistently weak currency. China needs to aggressively address market-distorting forces, including subsidies and state-owned enterprises, enhance social safety nets to support greater household consumption growth, and rebalance the economy away from investment. Improved economic fundamentals and structural policy settings would underpin a stronger RMB over time and help to reduce China’s trade surplus with the United States.

The report also said that "Treasury continues to have significant concerns about China’s currency practices, particularly in light of the misalignment and undervaluation of the RMB relative to the dollar. China should make a concerted effort to enhance transparency of its exchange rate and reserve management."

Despite not accusing China of manipulting the yuan, the report warned that "notwithstanding that China does not trigger all three criteria under the 2015 legislation, Treasury will continue its enhanced bilateral engagement with China regarding exchange rate issues, given that the RMB has fallen against the dollar by 8 percent over the last year in the context of an extremely large and widening bilateral trade surplus. Treasury continues to urge China to take the necessary steps to avoid a persistently weak currency."

The punchline - the US was quite clear in its demands to Beijing:

China needs to aggressively address market-distorting forces, including subsidies and state-owned enterprises, enhance social safety nets to support greater household consumption growth, and rebalance the economy away from investment. Improved economic fundamentals and structural policy settings would underpin a stronger RMB over time and help to reduce China’s trade surplus with the United States.

Well that is all over now.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.