See my other article for general discussion of what is a war being waged against Russia.

With a war being waged against Russia through Ukraine, information about a possible false-flag operation and financial meltdown on top of collapsing oil prices it promises to be an interesting ride.

Meanwhile not a whiff of any of this in NZ's zombie media

Some comments from Facebook:

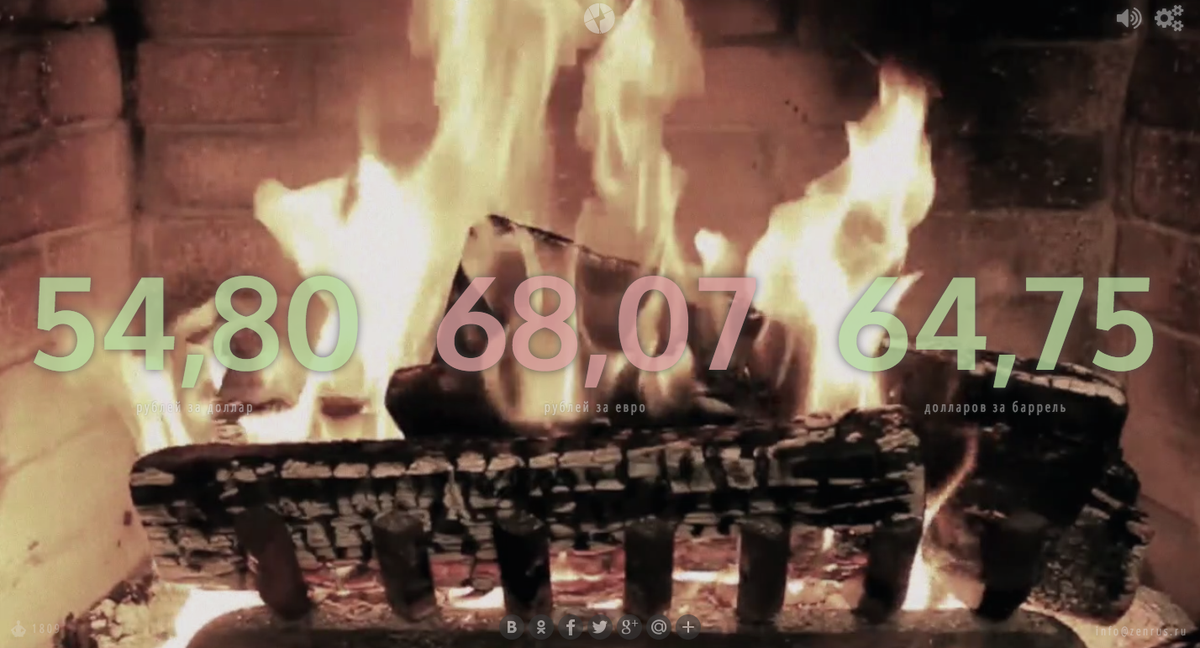

Ruble plummets losing more than 20% in a day, hitting new dollar and euro

lows

With a war being waged against Russia through Ukraine, information about a possible false-flag operation and financial meltdown on top of collapsing oil prices it promises to be an interesting ride.

Meanwhile not a whiff of any of this in NZ's zombie media

Some comments from Facebook:

“Take

a breath everyone – yes the ruble is in chaos, but Russia isn’t.

The ruble has gone sideways because of the oil price – not due to

western sanctions. Russia has a very robust balance sheet. The

country has basically zero debt to western financial institutions.

This makes Russia very strong and resilient. Thus, Washington’s

leverage over Moscow amounts to zero. The downside is inflation is

rising in Russia. But keep in mind the country’s economic and

financial fundamentals are sound. There is nothing to cheer about if

you earn rubles and live in Russia. But at the same time there is no

reason for the doom and gloom western media gloat about.”

---Peter

Lavelle

“…..It

has nothing to do with sanctions. Sanctions are totally irrelevant in

this situation. Even if there were no sanctions with oil having

crashed to $60 western banks would not be lending to Russian banks or

corporates anyway and nor would they be rolling over debt given

attitudes to Russia and the strength of Russia's balance sheet. The

situation would be exactly the same as it is now (and as it was in

2008 when they wouldn't lend to Russian banks and corporates either).

In a strange way what the sanctions are doing is by diverting the

blame for what is happening upon the west they are diverting it away

from the government.”

---Alexander

Mercouris

RT,

16

December 2014

No

end seems to be in sight for the plight of the Russian ruble, which

slumped to new record lows against hard currencies Tuesday. The EUR

traded at 93.5 against the ruble, and the USD at 75.

The

Russian stock market also went haywire, dropping more than 15 percent

as of 2:30pm Moscow time, after it dropped 11 percent the day before.

Sberbank, the country's largest lender, lost 17.77 percent, and VTB,

the second biggest bank, fell by 14.29 percent. State-owned oil and

gas companies Gazprom, Rosneft, and Surgut also saw shares plummet.

The

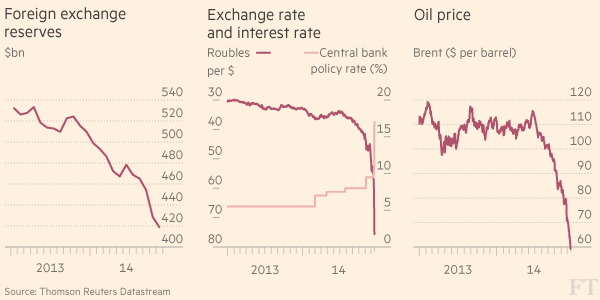

emergency interest rate hike to 17 percent has failed to halt the

ruble’s landslide tumble against hard currencies. The rate increase

only calmed the ruble temporarily.

It

has accelerated its descent in November and December along with

falling oil prices. Investors have been pulling capital out of Russia

over geopolitics since earlier this year, and sanctions levied by the

US and EU have essentially cut Russia off from Western lending.

Most

analysts agree that Russia will enter recession in the first quarter

of 2015, including the Economy Minister Aleksey Ulyukaev, and the

Central Bank.

On

Tuesday, the CBR chief Elvira Nabiullina said a higher rate should

put an end to investor speculation that has been hitting the rule.

“We

must learn to live in a new reality, to focus more on our own

resources to finance projects and give import substitution a

chance,” the

bank chief said in a televised address Tuesday.

However,

neither the rate increase nor the comments have had a big impact on

ruble trading as it continued to slide. Russia’s currency has lost

more than 55 percent against the dollar this year, mostly to external

factors such as slumping oil and sanctions against Russia.

Other stories from Zero Hedge

Those

craving Ruble collapse aren’t immune from aftershocks

Bryan

McDonald

RT,

17

December, 2014

Russia

is enduring a “textbook” emerging market crisis. Only the

economically illiterate or the stupid would either gloat or find

fantastical reasons for it. Unfortunately, we are learning that many

media figures and analysts fit both categories.

First

a hands up. One person imagined a panic in Sochi yesterday and he

wasn’t Russian. It was me. The experience was also a useful example

of how counterproductive Twitter can be. Reading a hyperactive feed,

I supposed that fear was stalking the streets as the ruble tumbled

relentlessly.

There’s

one ATM machine – to my knowledge – that disperses Euros and

Dollars in downtown Sochi not far from the famous beach party zone.

Following the Twitter information overload, I anticipated either a

lengthy queue or that the machine would be out of order. Cash

dispensers have a nasty habit of refusing to work when you need them

most. However, this one was operative.

Outside,

there was no line, just a young couple eating ice creams (it was 17

degrees) and a couple of empty parked cars. Inside the branch, there

were 4 staff and 2 customers. No panic, not even a mild tremble.

Nevertheless,

at a currency exchange closer to the sea, the man running the show

told me he was out of Euros and Dollars. “One guy came down with a

huge amount of money this morning and cleaned me out.” He offered

me some British Sterling instead, I demurred: “He didn’t want

pounds either. Why does nobody ever want pounds?”

The

reason for the relative calm is that Russians don't feel a tangible

crisis, not yet anyway. Despite months of tumult, prices haven’t

risen substantially and the shops are fully stocked. Of course, this

situation could change if the decline accelerates. Russians are also,

more than other Europeans, conditioned to economic shocks. There have

been at least 3 panics in the past 25 years, the most recent in 2008.

Scratch

away the misinformed cant, wishful thinking and scaremongering and

it’s clear that Russia is in the midst of an emerging market

crisis. Russia is not a mature economy. Less than a quarter century

since the demise of communism, it's a late comer to the capitalist

scene. Business practices are at least a generation behind the likes

of Germany and experienced economists are thin on the ground.

Additionally,

many 'new' Russians don't have the same attitude to responsible

saving that their parents did, another side-effect of decades of

frequent instability.

Since

1999, under President’s Putin and Medvedev, Russian living

standards have mushroomed. During this period, Russians attained a

level of affluence and prosperity unprecedented in the country’s

chequered history. Citizens have become accustomed to a standard of

living their grandparents could only have dreamed about. Of course,

this feeling of wealth is now in peril and conditions are almost

certain to precipitate.

On

Twitter, many were rejoicing in this fact. Some of them are the very

same moralistic types who pretend they both care for and want to help

Russian people. Their current schadenfreude exposes their true

motives. Times of need generally expose false friends.

The

Washington Post led the charge.

This is the same Washington that serves as the capital of a country

which 6 years ago imploded and took the rest of the world down with

it.

The

Ruble is falling because the oil price is plummeting. Markets feel

there is a miscorrelation between assets and liabilities. The energy

price decline means less dollars to support the liabilities, so the

Ruble is squeezed as principals try to secure greenbacks.

Additionally, Russia’s pre-existing culture of capital flight

exacerbates the slide. Linking these is really not rocket science.

The

Central Bank in Moscow feels forced to hike interest rates and spend

foreign exchange reserves in an attempt to arrest the currency

downturn. Neither policy has been successful so far. If nothing

changes in this regard, the economy will hurtle into free-fall. This

is the tragic reality. Ordinary Russians will suffer the most, the

rich won’t be skipping dinners or other essentials. If you don’t

believe me, check out Paul Krugman, the Nobel Laureate, who concurs.

The

pain that, quite obviously, awaits decent hard-working people should

be enough reason not to crow. However, the gloaters might be in for

in a rather more personal shock down the line. Anybody who believes

this crisis will remain ensconced in a Moscow bubble is seriously

deluded. In a globalised world, what initially appears like a local

problem can quickly become a much wider contagion.

Pre-crisis,

Russia’s economy was somewhere around 4% of global GDP and whole

sectors, particularly in Europe, are reliant on exports to it.

Furthermore, the fiscal health of central Asian states is worryingly

beholden to their giant neighbor. If Moscow is catching a cold,

Yerevan and Astana are in danger of pneumonia.

Struggling

nations like Ukraine, Moldova and Georgia depend on the Russian labor

market as a pressure valve for their unemployed and remittances are

vital. In the more prosperous part of Europe, some German auto

manufacturers, Italian clothing designers and French retailers, to

name just a few, are sustained by Russia. China won't be getting off

scot free either.

As

economist Dr Constantin Gurdgiev of Trinity College, Dublin puts it,

"Russian imports of goods and services are likely to contract by

between 12 and 15 percent in 2015, with much of this effect being

driven by a decline in capital goods and consumer goods imported

traditionally from Europe. In addition, financial exposures to Russia

run high in Austria, Italy, France and the UK. While the European

banks have seen some strengthening of their balance sheets in recent

months, another adverse shock to their assets is not something they

would like to contemplate.”

"If

Russia opts for capital controls and/or imposes a holiday on

repayment of larger debt tranches coming due in early 2015, the

European financial system will receive another shock as much of

Russian banks and corporate funding was underwritten in Europe,"

Dr Gurdgiev warns.

Russia’s

Central Bank may now be forced to introduce capital controls. This

will, at least partially, prevent companies and households from a

further Ruble sell-off. However, such a measure would also cause the

economy to contract further.

With

sanctions still enforced by western nations, who have a hold on

global finance not proportional to their size, many other corrective

avenues are unavailable to the Kremlin.

Russia’s

economic malaise is not funny. Nor is it any reason to celebrate,

even for the country’s biggest detractors. The phrase “be careful

what you wish for” comes to mind. There is nothing cheerful about

current events and very few, if any, countries will be immune from

the effects.

Nor

is Russia alone in feeling the brunt of the oil-price collapse.

Venezuela is convulsed by disorder and suffers shortages of even

basic goods. The Middle East is choc-a-bloc with countries that need

high crude values to protect their economies. Further volatility in

that region opens up a Pandora’s Box.

In

simple economic terms, everyone around the world would benefit from

Russia, and other oil-rich nations, stepping off the financial

precipice as soon as possible. Even the gloaters who despise Russia's

current government enough to wish ill-will on ordinary folk they

auspiciously care about. These guys don't care for anything or anyone

in Russia. They only care for their own narrow ends.

Western

Banks Cut Off Liquidity To Russian Entities

16

December, 2014

As

Zero Hedge first

reported today,

shortly before noon one (and subsequently

more)

FX brokers advised clients that any existing Ruble positions would be

forcibly closed out because "western

banks have stopped pricing USDRUB",

over concerns of Russian capital controls. Ironically, it was this

forced liquidation of mostly short RUB positions that pushed the RUB

higher, which in turn had a briefly favorably impact on energy

commodities and risk assets, as the market had by then perceived the

Ruble selloff as excessive. Of course, since nothing had actually

changed aside from a temporary market technical, the selloff promptly

resumed into the close of trading once the market finally understood

what we had explained hours previously.

And

unfortunately for the bulls, various falling knife-catchers, and

those who hope the Russian situation will stabilize imminently with

or without capital controls, it appears things in Russia are about to

get a whole lot worse because as the WSJ

reports,

the next driver of the Russian crisis is likely to come from within

the banking system itself because "global

banks are curtailing the flow of cash to Russian entities, a response

to the ruble’s sharpest selloff since the 1998 financial crisis."

Presenting

Russia's banks: now cut off from the outside world as the second cold

war goes nuclear, at least when it comes to the financial system:

Such banks as Goldman Sachs Group Inc. this week started rejecting requests from institutional clients to engage in certain ruble-denominated repurchase agreements and other transactions designed to raise cash, according to people familiar with the matter.

Bankers and traders say the moves to restrict some ruble transactions have become increasingly widespread among major Western financial institutions this week, even as the same institutions continue to try to profit from the ruble’s wild swings. The moves, which the banks are deploying to protect themselves against further swings in the currency, have the potential to add to the strain on Russia’s financial system.

Goldman in recent days largely stopped doing longer-term ruble-denominated repurchase agreements, or repos, in which securities or other assets are swapped in exchange for cash, said a person familiar with the matter. The Wall Street bank is still doing short-duration ruble repos, those that mature in less than a year, this person said.

And

where Goldman goes, everyone else follows, even though according to

the WSJ this has not happened, yet

Other banks, including Bank of America Corp. and Citigroup Inc., haven’t changed their trading with Russia or in rubles, according to people familiar with those banks.

They

will, it is only a matter of time. Meanwhile, the entire Russian

capital market, and not just its currency, is becoming isolated from

the rest of the Western world:

In one sign of the banking industry’s hasty retreat, the London-based manager of an emerging-markets hedge fund said Tuesday that he couldn’t get any banks to trade Russian government bonds with him.

]Of

course, anyone who read our article in early November explaining "How

The Petrodollar Quietly Died, And Nobody Noticed",

predicting the crunch in global intermarket liquidity as a result of

the collapse in crude, would know this is coming. As for the death of

the Petrodollar we warned about, a death which has resulted in the

disintegration of market volume just as warned, suddenly everyone is

noticing.]

Regardless,

what all of the above means is that Russia now has at best a few

weeks in which to find an alternative source of short-term funding.

One coming from the East.

The

question is will Putin swallow his pride and proceed with the next

logical step as the Eurasian axis realizes the time to abandon the

dollar has long past, that now only actions matter and not words, and

joins forces with China in a new monetary union, one which combines

the Ruble and the Yuan, and is backed by China's gold and Russia's

natural resources, as cheap as they may be for the time being...

until one or more of the largest middle-east oil exporters

Russia

Prepares For GDP Surge As Consumers Scramble To Spend Their Plunging

Rubles

16

December, 2014

In

the most ironic twist of all amid the "currency crisis"

enveloping Russia, we suspect the world's central bankers will be

looking on jealously as The

CBR manages to achieve precisely what The BoJ and The Fed are

desperate to achieve.

In raising inflation expectations, The

FT reports,

Russians are hurriedly

turning their depreciating Rubles into jewelry, furniture, cars, and

apartments as

the currency's collapse prompts a shopping spree that will likely

lead to a surge

in GDP.

As one anxious shopper noted, "none

of us know what’s happening. We’re all worried that the currency

will keep falling," and so "it’s time to buy

furniture!" And

sure enough, shopping

centers are currently experiencing a spectacular rush.

Russians hurried to change their savings and pensions into dollars and euros while also stocking up on furniture and jewellery as the rouble’s collapse accelerated.

Their mounting concern was reflected on Tuesday morning in the red lights of the currency exchange booths that dot the city, which were ticking over to show ever weaker rouble rates.

...

“I took out some of my pension and I want to change it into dollars,” said Galina, a retiree, who declined to give her surname. “None of us know what’s happening. We’re all worried that the currency will keep falling.”

The dramatic collapse in the rouble in recent days has not triggered outright panic, but it has prompted a rush to change currency and to stock up on durable goods such as furniture, cars and jewellery before they become even more expensive.

...

"I think the rouble will carry on falling until the end of the year,” she said. “It’s time to buy furniture!”

Indeed, shoppers reported enormous queues even at 2am in Ikea on Monday night as people rushed to stock up before the rouble plunge triggered price rises. The Swedish furniture company had said it would be raising prices from Thursday.

...

"People who didn’t manage to exchange their money at 35 roubles or 40 roubles to the dollar have been buying up high-end goods, cars and apartments because a massive repricing hasn’t happened yet,” said Vyacheslav Trapeznikov, acting director of the Urals Builders’ Guild, in Yekaterinburg.

Car sales in Russia rose in November from the previous month — in spite of a slowing economy — and December is “rather promising”, according to the Association of European Businesses in Russia trade group. “Retail demand has been extraordinary in recent weeks,” said Joerg Schreiber of the AEB.

...

“People are trying to spend their last roubles and buy up things that haven’t been priced, but this trend has an expiration date,” Mr Trapeznikov said.

Russians

are lining up at currency exchange centers to swap their increasingly

worthless Rubles for Dollars...

And

as Germany's N-TV also notes, they

are spending that money...

Shopping centers are currently experiencing a spectacular rush. The most recent example is the Swedish furniture chain Ikea, prior to their department stores in the past few days with long queues. Several hours had to wait for the customers before they could enter.

The reason is that Ikea had announced in early December to try to raise prices in the near future because of the decline of the ruble. While Ikea calmed after its customers that prices would continue to meet the published list prices in the summer. At the same time, the Group achieves in Russia each year well over a billion euros in sales, that its operations were dependent on external factors explained.

...

"At this point, Russia differs from industrialized countries to save where people start when a crisis begins," says the economist Igor Nikolayev. "For us, this is accompanied by a strong degradation of money and the people spend more, which relaxes the situation for some time," adds the analyst of consulting company FBK

...

"People have rushed to buy expensive goods such as televisions, computers, laptops, to save their rubles, which lose value dramatically," says Maria Wakatowa of the consulting firm Watcom, the observed trade.

*

* *

Simply

put - it's all about inflation expectations. And

unlike The Fed or The BoJ, who keep trying to jawbone higher

expectations into their citizens' minds, the CBR has achieved it and

with it - a spending spree before things get more expensive and

implicitly a surge in GDP. Ofcourse, however, the spending surge can

only be short-term and will stop as soon as there are no more Rubles

to spend.

*

* *

Finally

- this seemed to sum it all up nicely...

Total

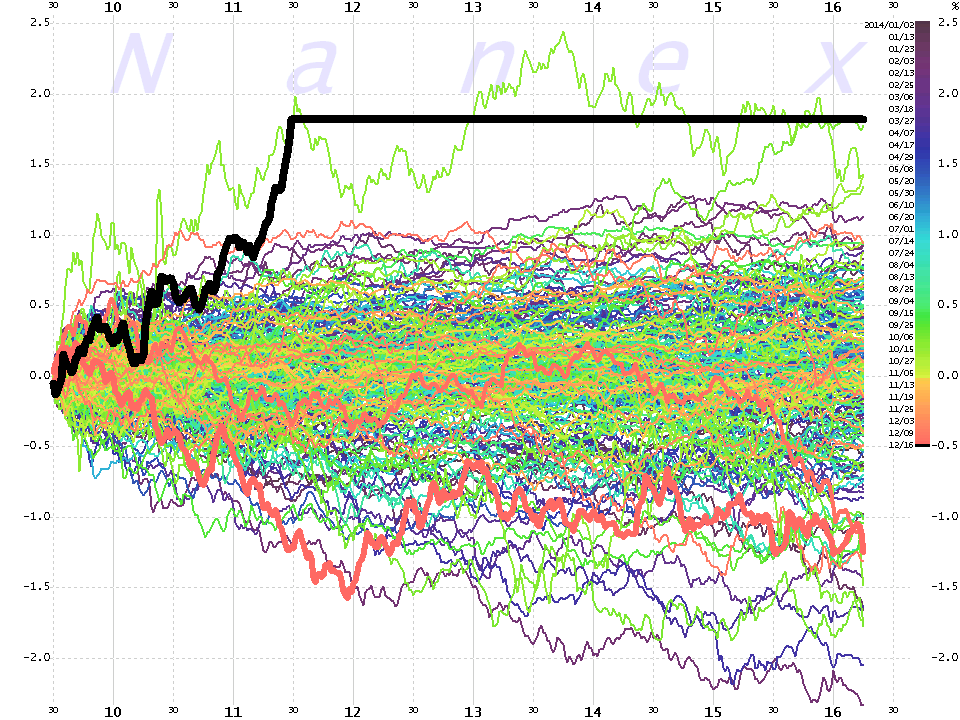

Chaos: Massive Market Moves Spark Selling-Panic Into Close

16

December, 2014

Perhaps

this sums up the day for many FX, bond, equity, and oil traders

today...

Incredible

Volatility today - 100 point roundtrip in the S&P, and 800 points

in the Dow - all driven by a halt in Ruble Trading, the European

close, and Kuwait pissing on the US market's fireworks...

Today's

melt-up into the European close was the biggst of the year...

And

the volatility was incredible across the entire US equity market - as

the S&P ramp ran stops to yesterday's highs then gave it all

back...again around the EU close

Close-up

on S&P 500 e-minis... the machines ran all the stops everywhere

today...

A

massive roundtrip in cash markets...

Leaving

most of the major indices down over 5% from all-time-highs...

Financials

starting to show some risk...

The Russian markets dominated headlines...

but

the US credit markets were more worrisome as it appears the risk has

finally started to appear in the investment-grade credit market.

High

yield bond yields hit 2-year highs... and spreads to 18 month

wides...

And

Investment Grade credit has become infected...

Longer-term...

Every

asset class underwent a roller-coaster...

and

the Treasury yield curve is following the exact smae trajectory as it

did into the last recession/tightening..

Silver

and Gold pumped and dumped.. as oil dumped and pumped and dumped...

FX

markets turmoiled leaving the USD lower on the day but USDJPY wa sin

charge of stocks - and major unwinds into the close - which is very

unusual ahead of FOMC tomorrow and Japan tonioght

Across

the asset classes today - these were the events..

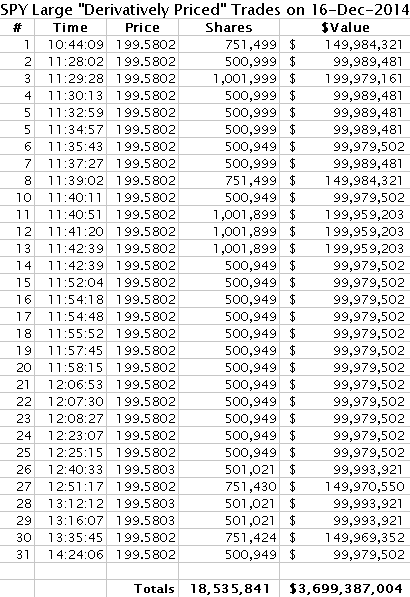

Finally

we wonder... who was this mysterious $3.7 billion trader today...

But

don’t forget...

Charts: Bloomberg

Says Bloomberg hopefully.

Just to remind us that this is a war unleashed on Russia by the West read this

The

Collapse of Putin's Economic System

17

December, 2014

The

meltdown of the ruble, which has plunged 18 percent against the

dollar in the last two days alone, is endangering the mantra of

stability around which Putin has based his rule. While his approval

rating is near an all-time high on the back of his stance over

Ukraine, the currency crisis risks eroding it and undermining his

authority, Moscow-based analysts said.

The

president took over from an ailing Boris

Yeltsin in

1999 with pledges to banish the chaos that characterized his nation’s

post-communist transition, including the government’s 1998

devaluation and default. While he oversaw economic growth and wage

increases in all but one of his years as leader, the collapse in oil

prices coupled with U.S. and European sanctions present him with the

biggest challenge of his presidency.

“People thought: ‘he’s a strong leader who brought order and helped improve our living standards,” said Dmitry Oreshkin, an independent political analyst in Moscow. “And now it’s the same Putin, he’s still got all the power, but everything is collapsing.”

In a surprise move yesterday, the Russian central bank raised interest rates by the most in 16 years, taking its benchmark to 17 percent. That failed to halt the rout in the ruble, which has plummeted to about 70 rubles a dollar from 34 as oil prices dived by almost half to below $60 a barrel. Russia relies on the energy industry for as much as a quarter of economic output, Moody’s Investors Service said in a Dec. 9 report.

New Era

The ruble meltdown and accompanying economic slump marks the collapse of Putin’s oil-fueled economic system of the past 15 years, said an executive at Gazprombank, the lender affiliated to Russia’s state gas exporter. He asked not to be identified because of the sensitivity of the issue.

The higher interest rate will crush lending to households and businesses and deepen Russia’s looming recession, according to Neil Shearing, chief emerging-markets economist at London-based Capital Economics Ltd.

Gross domestic product will shrink 0.8 percent next year under the Economy Ministry’s latest projection. With oil at $60, it may drop 4.7 percent, the central bank said last week.

“How many bankruptcies await us in January?” opposition lawmaker Dmitry Gudkov said on Twitter. “People will be out of work, out of money. The nightmare is only just beginning.”

Gross domestic product will shrink 0.8 percent next year under the Economy Ministry’s latest projection. With oil at $60, it may drop 4.7 percent, the central bank said last week.

“How many bankruptcies await us in January?” opposition lawmaker Dmitry Gudkov said on Twitter. “People will be out of work, out of money. The nightmare is only just beginning.”

Near Critical

Vladimir Gutenev, a lawmaker from the ruling United Russia party, also fretted about the central bank’s actions, calling the scale of the rate increase “unacceptable.”

“The situation concerning the financing of industry from bank credits is getting ever closer to critical,” Gutenev, who’s also first deputy president of the Machinery Construction Union, said by e-mail.

The threats to economic stability have arisen with Putin’s popularity at 85 percent after Russians lauded his approach to Ukraine following ally Viktor Yanukovych’s ouster. In particular, they cheered his annexation of Crimea, part of Russia until 1954, and shrugged off the ensuing U.S. and European sanctions that target the finance and oil industries.

While the unfolding ruble crisis may lead to a gradual erosion of Putin’s support, any protests that occur will mainly be against lower-level officials rather than Putin, said Igor Bunin, head of Moscow’s Center for Political Technologies.

“Putin is the symbol of Russia and the state for ordinary Russians,” according to Bunin, who said some members of the government may be fired as a result of the ruble chaos. “People see him as a lucky star who’ll save them. So they’re afraid to lose him as a symbol.”

Government ‘Incompetent’

Tatiana Barusheva, a 63-year-old pensioner who lives in the Gelendzhik resort city in the southern Krasnodar region, blames Putin’s underlings for the current bout of uncertainty.

“We can’t go far with this government, it’s incompetent,” she said yesterday on Moscow’s Red Square. “It doesn’t matter how hard Putin tries, but his helpers are good-for-nothing.”

Putin has already weathered one economic storm. The global financial crisis that erupted in 2008 wiped out 7.8 percent of Russia’s GDP the following year amid a similar tumble in oil prices. On that occasion, the ruble sank by about a third. The economy has grown each year since.

Even so, the sanctions mean Putin’s in a tougher bind this time round, according to Olga Kryshtanovskaya, a sociologist studying the elite at the Russian Academy of Sciences. Measures to ease the situation, such as imposing capital controls or softening Russia’s position on Ukraine, both carry additional risks, she said.

What’s happening now is worse than five years ago, according to Kirill Rogov, a senior research fellow at the Gaidar Institute for Economic Policy in Moscow. Putin risks losing his image as a leader who’s in control and can steer the country through turmoil, he said.

“After 2009, there was a quick recovery,” Rogov said. “Now we’re facing an uncontrollable shock. This undermines trust in Putin’s whole economic model.”

The Russian Central Bank's "counterattack" lasted 30 mins!

16 December, 2014

The result of the Russian Central Bank's hike in interest rates turned out to be worse then my worst nightmares: it reversed the downward spiral of the Ruble for only about half an hour, then the Russian currency resumed its collapse. Rumor has it that the Central Bank might begin buying Rubles next, which I personally don't see as useful at this point.

I have asked for expert opinions and I hope to get them soon. In the meantime, here is my own take on this which, caveat emptor, is backed by ZERO personal expertise in these matters. Still, for whatever it's worth, my own speculations:

1) The Ruble is falling due to three completely separate reasons:

i) The recession in the West which triggers a drop in oil prices

ii) The AngloZionist pressures on OPEC not to cut production

iii) The impact of western sanctions

2) None of the above are enough to explain what is happening. The real problem is the lack of credibility of the Russian Central Bank and the Kremlin. Thus the key factor in the fall of the Ruble is distrust of the Russian authorities.

3) This distrust is fully deserved. The head of the Central Bank is a notorious 5th columnist which Putin failed to fire, arrest or otherwise remove from that position. But there is worse:

4) Putin personally is not trusted either, at least not on economic matters. Dmitry Orlov put it very well:

Some people are starting to loudly criticize Putin for his inaction; but what can he do? Ideologically, he is a statist, and has done a good job of shoring up Russian sovereignty, clawing back control of natural resources from foreign interests and curtailing foreign manipulation of Russian politics. But he is also an economic liberal who believes in market mechanisms and the free flow of capital. He can't go after the bankers on the basis of ideology alone, because what ideological differences are there? And so, once again, he is being patient, letting the bankers burn the old “wooden” ruble all the way to the ground, and their own career prospects in the process. And then he will step in and solve the ensuing political problem, as a political problem rather than as a financial one.

Orlov, as always, is spot on here. Let me explain, as this is crucial:

First, yes, Putin is an economic liberal. I hate to admit it, but I am convinced of it. So while he is "socialist" in a sense of supporting a social state, which helps the poor, needy, sick or old, he also is a "market capitalist" in the sense that he believes that market forces should be left free to maximize the competitivity of an economy. This might be a result of seeing a (pseudo-) socialist system fail or because he sincerely admires the competitivity of US and other (pseudo-) capitalist economies, I don't know. But there is no doubt in my mind that he is an economic liberal.

Second, it would be typical Putin to let the "Atlantic Integrationist" 5th column to fail so badly as to make their removal a political demand of the Russian people. The problem with that is that this strategic can take a huge toll on the Russian people and economy.

Right now the situation is so bad that the value of some high visibility Russian stocks has begun to plunge. As does the Ruble. As does the price of Brent.

I am not much of an economist, much less so a trader. But I have to agree with the markets here: the current Putin+Nabiulina combo is not one deserving trust and if I had to speculate, I would speculate against Russia right now.

Maybe I am naive or primitive but I see only one way to reverse this death spiral: not only to fire Nabiulina, but to fully nationalize the Central Bank, fire the totality of its current top management and to appoint a new team with Sergei Glaziev as it's director with a rank of Minister of Finance. Then Russia must take the strategic decision drop the current system of backing each printed Ruble with purchased US Dollar and instead back the Ruble with either energy or metals or a combo of real-word resources. My own vote would go for gold.

16 December, 2014

The result of the Russian Central Bank's hike in interest rates turned out to be worse then my worst nightmares: it reversed the downward spiral of the Ruble for only about half an hour, then the Russian currency resumed its collapse. Rumor has it that the Central Bank might begin buying Rubles next, which I personally don't see as useful at this point.

I have asked for expert opinions and I hope to get them soon. In the meantime, here is my own take on this which, caveat emptor, is backed by ZERO personal expertise in these matters. Still, for whatever it's worth, my own speculations:

1) The Ruble is falling due to three completely separate reasons:

i) The recession in the West which triggers a drop in oil prices

ii) The AngloZionist pressures on OPEC not to cut production

iii) The impact of western sanctions

2) None of the above are enough to explain what is happening. The real problem is the lack of credibility of the Russian Central Bank and the Kremlin. Thus the key factor in the fall of the Ruble is distrust of the Russian authorities.

3) This distrust is fully deserved. The head of the Central Bank is a notorious 5th columnist which Putin failed to fire, arrest or otherwise remove from that position. But there is worse:

4) Putin personally is not trusted either, at least not on economic matters. Dmitry Orlov put it very well:

I have asked for expert opinions and I hope to get them soon. In the meantime, here is my own take on this which, caveat emptor, is backed by ZERO personal expertise in these matters. Still, for whatever it's worth, my own speculations:

1) The Ruble is falling due to three completely separate reasons:

i) The recession in the West which triggers a drop in oil prices

ii) The AngloZionist pressures on OPEC not to cut production

iii) The impact of western sanctions

2) None of the above are enough to explain what is happening. The real problem is the lack of credibility of the Russian Central Bank and the Kremlin. Thus the key factor in the fall of the Ruble is distrust of the Russian authorities.

3) This distrust is fully deserved. The head of the Central Bank is a notorious 5th columnist which Putin failed to fire, arrest or otherwise remove from that position. But there is worse:

4) Putin personally is not trusted either, at least not on economic matters. Dmitry Orlov put it very well:

Some people are starting to loudly criticize Putin for his inaction; but what can he do? Ideologically, he is a statist, and has done a good job of shoring up Russian sovereignty, clawing back control of natural resources from foreign interests and curtailing foreign manipulation of Russian politics. But he is also an economic liberal who believes in market mechanisms and the free flow of capital. He can't go after the bankers on the basis of ideology alone, because what ideological differences are there? And so, once again, he is being patient, letting the bankers burn the old “wooden” ruble all the way to the ground, and their own career prospects in the process. And then he will step in and solve the ensuing political problem, as a political problem rather than as a financial one.

Orlov, as always, is spot on here. Let me explain, as this is crucial:

First, yes, Putin is an economic liberal. I hate to admit it, but I am convinced of it. So while he is "socialist" in a sense of supporting a social state, which helps the poor, needy, sick or old, he also is a "market capitalist" in the sense that he believes that market forces should be left free to maximize the competitivity of an economy. This might be a result of seeing a (pseudo-) socialist system fail or because he sincerely admires the competitivity of US and other (pseudo-) capitalist economies, I don't know. But there is no doubt in my mind that he is an economic liberal.

Second, it would be typical Putin to let the "Atlantic Integrationist" 5th column to fail so badly as to make their removal a political demand of the Russian people. The problem with that is that this strategic can take a huge toll on the Russian people and economy.

Right now the situation is so bad that the value of some high visibility Russian stocks has begun to plunge. As does the Ruble. As does the price of Brent.

I am not much of an economist, much less so a trader. But I have to agree with the markets here: the current Putin+Nabiulina combo is not one deserving trust and if I had to speculate, I would speculate against Russia right now.

Maybe I am naive or primitive but I see only one way to reverse this death spiral: not only to fire Nabiulina, but to fully nationalize the Central Bank, fire the totality of its current top management and to appoint a new team with Sergei Glaziev as it's director with a rank of Minister of Finance. Then Russia must take the strategic decision drop the current system of backing each printed Ruble with purchased US Dollar and instead back the Ruble with either energy or metals or a combo of real-word resources. My own vote would go for gold.

First, yes, Putin is an economic liberal. I hate to admit it, but I am convinced of it. So while he is "socialist" in a sense of supporting a social state, which helps the poor, needy, sick or old, he also is a "market capitalist" in the sense that he believes that market forces should be left free to maximize the competitivity of an economy. This might be a result of seeing a (pseudo-) socialist system fail or because he sincerely admires the competitivity of US and other (pseudo-) capitalist economies, I don't know. But there is no doubt in my mind that he is an economic liberal.

Second, it would be typical Putin to let the "Atlantic Integrationist" 5th column to fail so badly as to make their removal a political demand of the Russian people. The problem with that is that this strategic can take a huge toll on the Russian people and economy.

Right now the situation is so bad that the value of some high visibility Russian stocks has begun to plunge. As does the Ruble. As does the price of Brent.

I am not much of an economist, much less so a trader. But I have to agree with the markets here: the current Putin+Nabiulina combo is not one deserving trust and if I had to speculate, I would speculate against Russia right now.

Maybe I am naive or primitive but I see only one way to reverse this death spiral: not only to fire Nabiulina, but to fully nationalize the Central Bank, fire the totality of its current top management and to appoint a new team with Sergei Glaziev as it's director with a rank of Minister of Finance. Then Russia must take the strategic decision drop the current system of backing each printed Ruble with purchased US Dollar and instead back the Ruble with either energy or metals or a combo of real-word resources. My own vote would go for gold.

Russian Central Bank hikes key interest rate to 17% to halt ruble roil

Russian Central Bank hikes key interest rate to 17% to halt ruble roil

No comments:

Post a Comment

Note: only a member of this blog may post a comment.