Hong Kong Riots Reveal A

Looming Crisis At The

World's 6th Largest Bank

5 August, 2019

Earlier today, in addition to the chaos surrounding the escalation of the US-China trade and currency war, we also got news which slipped under the radar that the CEO of HSBC, one which with $2.6 trillion in assets is the largest UK bank and the 6th largest bank in the world by assets, was unexpectedly quitting and his departure would also lead to mass layoffs, with the bank set to fire 4,000 workers, or about 2% of its workforce.

And while today's market massacre succeeded in sweeping the HSBC news under the rug, one can't help but wonder: is HSBC, which has had almost as many run-ins with the law as one particular infamous German bank, going to be the next Deutsche Bank?

For the answer we went to one of our blogging friends who runs the Strategic Macro blog, and who conveniently took a look at some of the cockroaches in HSBC's basement. What he found was troubling, especially in light of the ongoing turmoil in Hong Kong which at any given moment is just a few minutes away and a false flag provocation away from a Chinese invasion.

Courtesy of the Strategic Macro blog, we present:

HSBC's exposure to Hong Kong real estate

So conventional wisdom is that post-Basel III the banks hold a lot of capital against loans and are run conservatively. And in a normalised market this is very true I think.

However when you are calculating LTVs and RWAs and PDs against bubble valuation levels, are they still appropriate? If you calculated it against replacement costs, the LTVs would go through the roof, and so would RWAs and the banks would be left with an CET tier 1 equity deficit to be covered by a rights issue. Any losses and higher RWAs on impaired loans would further cost equity.

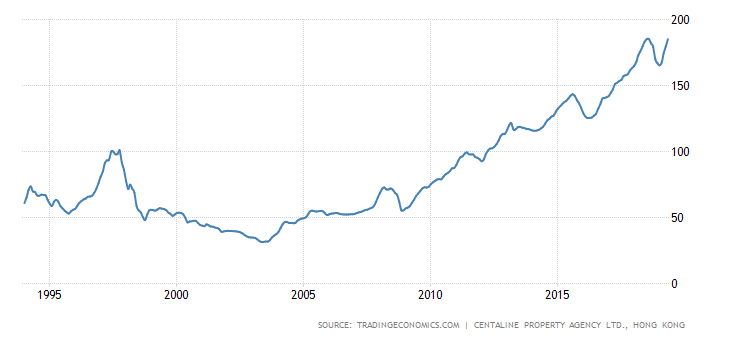

So Hong Kong real estate which yields 1-2% rental yields in many cases, vs a Prime lending rate which is 5.15% is an enormous, negatively carrying bubble, propped up by speculation and Chinese capital flows.

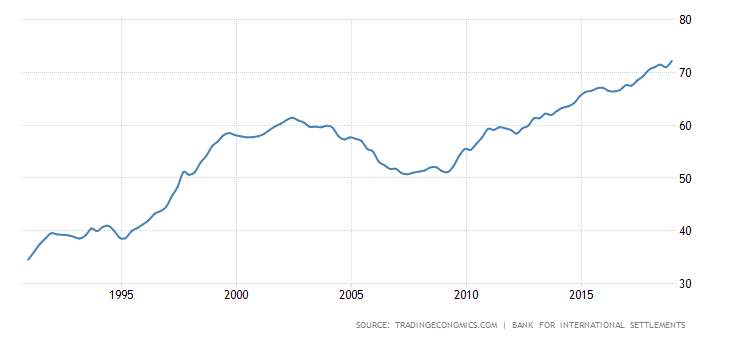

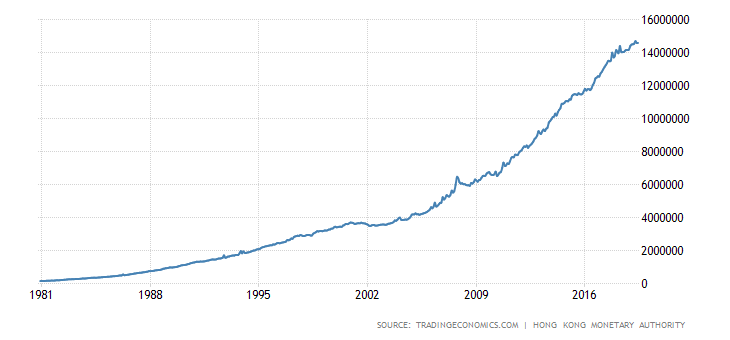

HSBC is the 800lb gorilla in a banking system where M£ is >5x GDP.

M3 and Household debt to GDP:

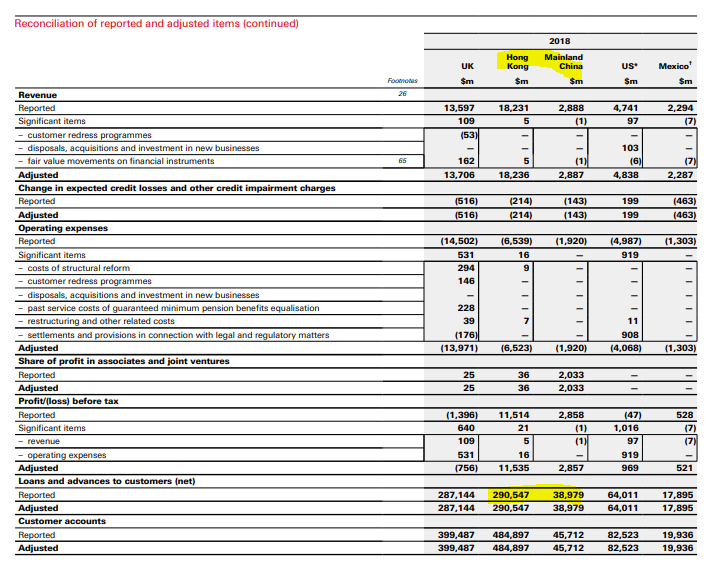

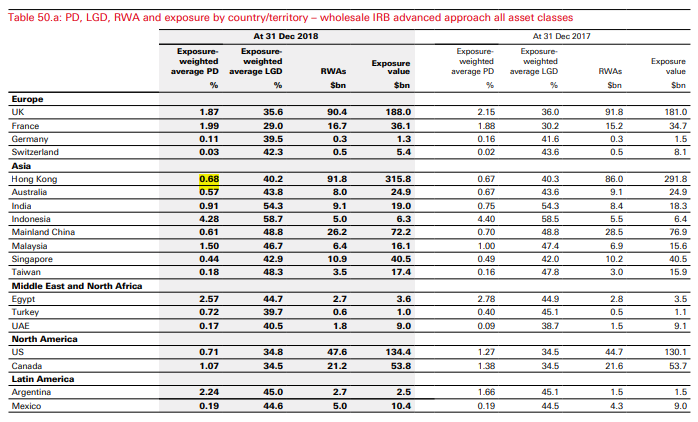

Here are some excerpts from HSBC's financials and Pillar 3 statements for Dec 18.

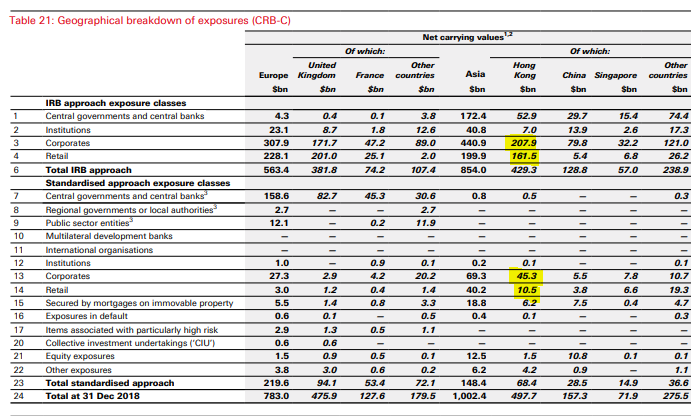

HSBCs 2018 AFS. $300bn plus exposure to HK and China.

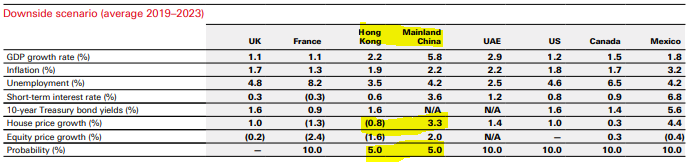

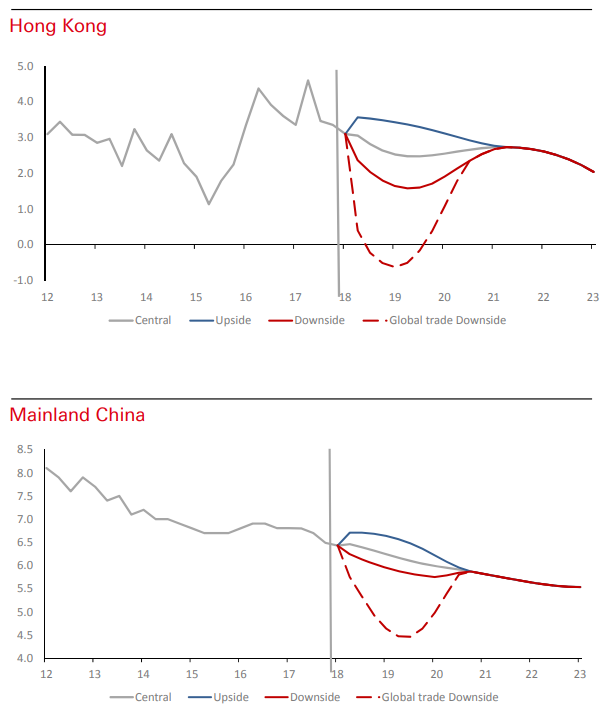

Downside risk scenario involves small house price drops and ongoing economic growth.

Trade exacerbated downside drives a greater slowdown in 2019 only with recovery in H2-20.

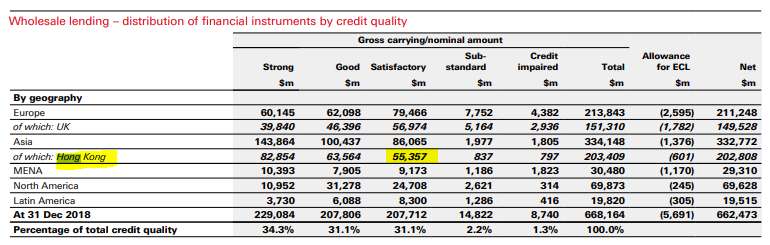

$55bn of Category 3 loans to wholesale borrowers. Category 3 typically has a 100% RWA under Basel III.

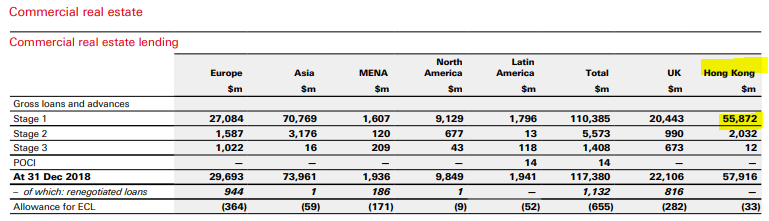

$58bn of CRE, $2bn impaired

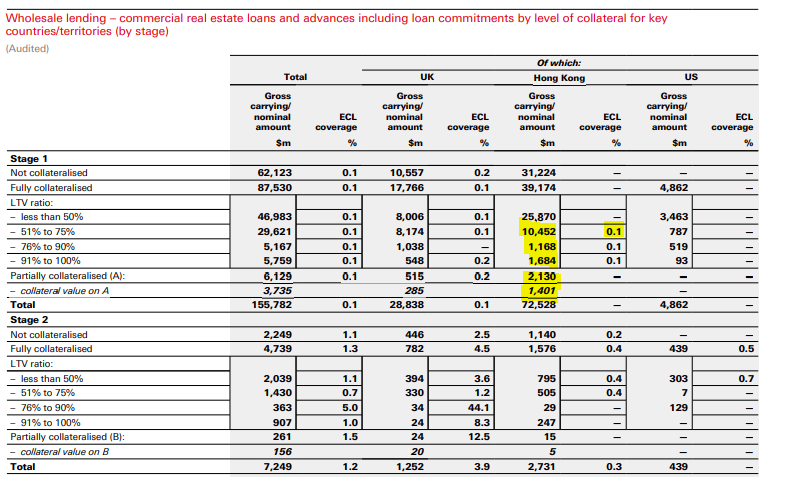

About $15bn in higher LTV wholesale loans:

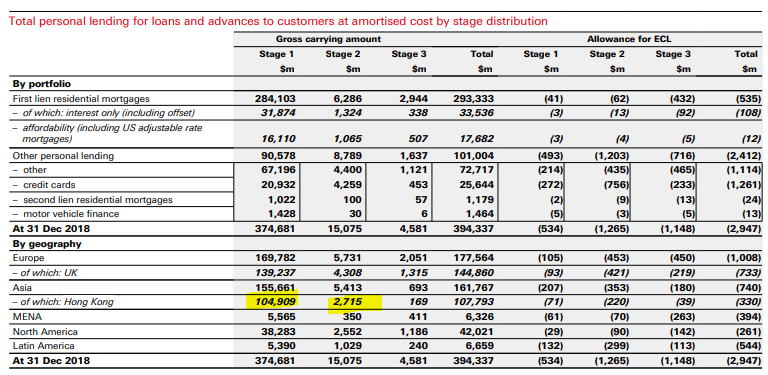

$108bn in personal loans, of which about $3bn are impaired

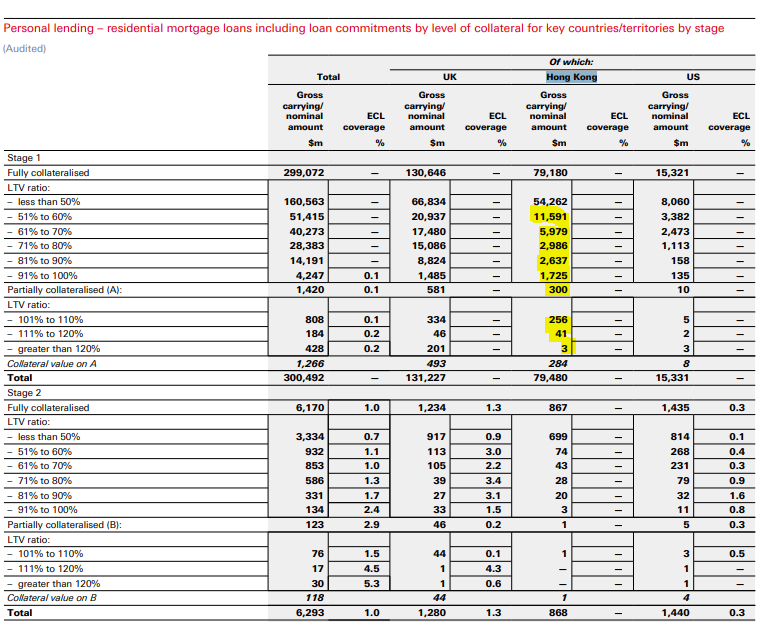

About $25bn in loans above 51% LTV

However most of their book has RWA charges determined by their Internal Ratings Based approach:

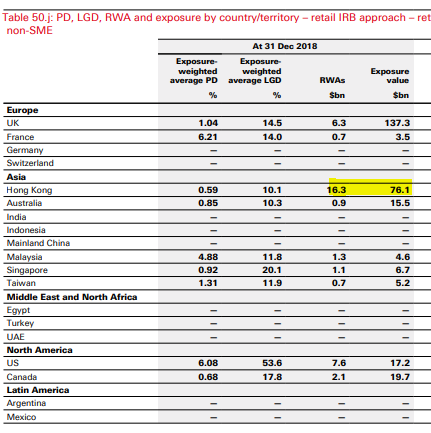

Using their IRB approach retail mortgages have only a 0.7% probability of default and a few percent of loss given default. They calculate a 20% RWA charge against this.

Wholesale loan PDs are also under 70bps and seem to be applying a 30% RWA charge.

Only by IRB derived models and applying low PDs and low LDG rates have they been able to book these loans at 20 or 30% RWA levels and as such 'Category 1 loans'. But Category 3, 4 or 5 loans carry 100% or 150% RWA charges. So any large falls in property prices and rise in PDs will absorb a lot of CET1.

As a reminder after the 1997 bubble imploded the Honk Kong residential index dropped from 172 to 59 between 1997 and June 03, a 66% drop in nominal terms and more in real.

And remember the prime lending rate is 5.15% and property yields 1-3%. Well they have 3 year interest deferred ARM mortgages to resolve for that.... I wonder if any of HSBC's wholesale loans book is against such loans?

No comments:

Post a Comment

Note: only a member of this blog may post a comment.