THIS

I trust

Kiwi

Craters After RBNZ Surprises Traders WIth 50bps Rate-Cut

The

New Zealand Dollar is tumbling following a surprise

50bps rate-cut by

RBNZ (economists had forecast 25bps) to 1.00%, citing

downside risks on inflation and jobs.

6 August, 2019

Mimiccing

The Fed's apparent lack of data-dependence,

this surprise rate-cut followed a strong 3.9% unemployment print; and

just like The Fed, RBNZ is clear that global trade issues are an

important factor:

"Heightened uncertainty and declining international trade have contributed to lower trading-partner growth."

Some

key quotes from the statement here:

“GDP growth has slowed over the past year and growth headwinds are rising,” the central bank said in a statement.

“In the absence of additional monetary stimulus, employment and inflation would likely ease relative to our targets.”

“Our actions today demonstrate our ongoing commitment to ensure inflation increases to the mid-point of the target range, and employment remains around its maximum sustainable level.”

Kiwi

has plunged...

Near

its weakest level against the dollar since Jan 2015...

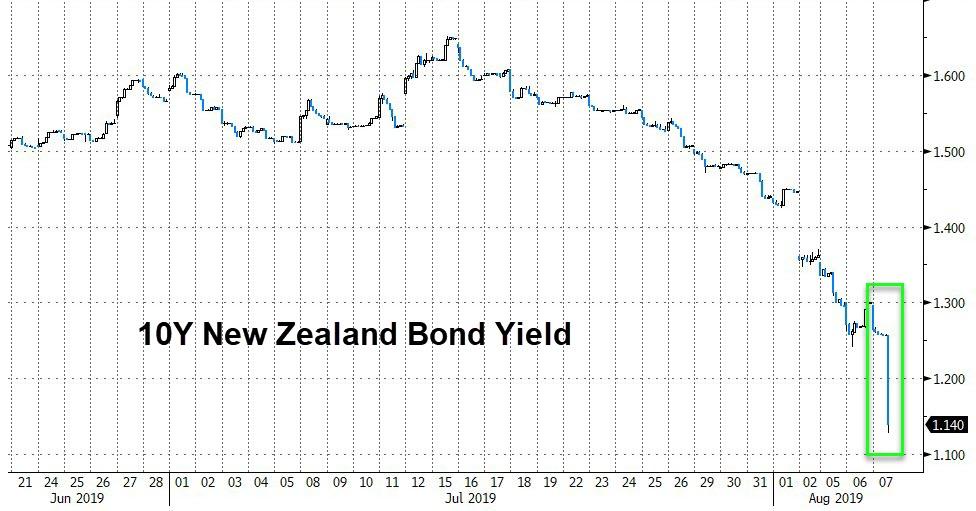

And

10Y Kiwi note yields plunged 17bps to a record low 1.128%!

Clearly

the central bank is trying to get ahead of the curve of global easing

and as Bloomberg's Garfield Reynolds notes, RBNZ

obviously decided they didn't dare risk any sort of bounce in the

kiwi if they followed the Fed's playbook and made a so-called hawkish

cut. The

currency had ticked up into the decision to offer the board a warning

about the perils of insufficient action.

Here's

the take from Kyle Rodda, analyst at IG Markets in Melbourne.

“This was not what the market was expecting at all, it’s a shock to many. Considering the data isn’t terrible for New Zealand at all, this is an example of a central bank that’s looking beyond current data and trying to get ahead of the global slowdown.”

They

also secured themselves a weaker currency even if the Fed finds

itself pushed toward further rate cuts.

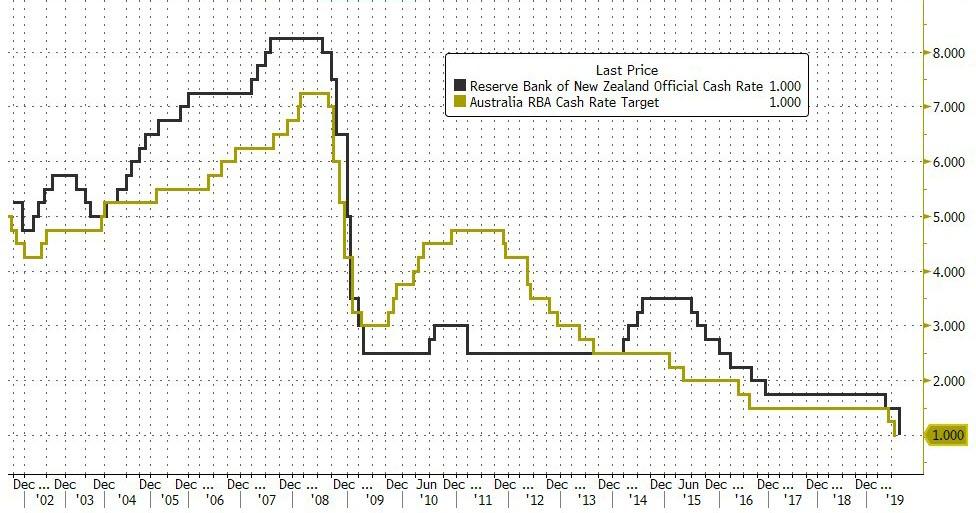

Additionally,

this brings RBNZ's policy rate in line with RBA's rate...

This I do NOT

Reserve

Bank cuts Official Cash Rate by 0.5 percent to sit at 1 percent

7

August, 2019

The

Reserve Bank (RBNZ) has slashed its benchmark interest rate by a

greater than expected half a percent in the face of significant

headwinds at home and abroad, sending the New Zealand dollar

plunging.

Reserve

Bank governor Adrian Orr Photo: RNZ / Dom Thomas

The

official cash rate (OCR) was reduced to a record low 1 percent, when

forecasters had been expecting a lesser quarter percent cut..

RBNZ

Governor Adrian Orr said the risks have risen and the economy needed

more stimulus to help counter the weaker outlook.

"In

the absence of additional monetary stimulus, employment and inflation

would likely ease relative to our targets."

The

RBNZ held

the rate steady in June after

cutting by a quarter of a percentage point in

May -

its first move in more than two years.

The

last time the RBNZ cut by such an amount was in March 2011 after the

Canterbury earthquakes.

But

Mr Orr said recent solid growth and employment numbers were positive,

but the worsening international outlook was hurting New Zealand.

"Global

economic activity continues to weaken, easing demand for New

Zealand's goods and services. Heightened uncertainty and declining

international trade have contributed to lower trading-partner

growth."

Economy should improve

Mr

Orr said low interest rates and increased government spending were

expected to lift the economy over the coming year. Inflation was

expected to reach its 2 percent target and employment should remain

strong, which are the RBNZ's overriding policy objectives.

Interest

rate decisions are now made by a committee of four RBNZ staff and

three outside members.

A

summary of the committee's deliberations showed discussion about the

effect of increased government spending, soft wage growth, and a

slowing housing market dampening consumer spending.

"They

agreed that the larger initial monetary stimulus would best ensure

the Committee continues to meet its inflation and employment

objectives," the statement said.

Neither

the statement nor the RBNZ's forward projections pointed to another

rate cut, and suggested the OCR might be held at current levels

through to 2022.

The

New Zealand dollar slumped a full cent against the US after the

decision, as investors were caught by surprise by the size of the

cut. The Kiwi settled at around 64.4 US cents.

ASB

Bank was quick to respond to the hefty cut, by reducing its floating

mortgage rate by half-a-percent, but it trimmed its short term fixed

rate by only a small amount.

An

economist said the RBNZ had clearly decided to 'front-load' the

support for the economy, and its commentary still had an easing bias.

"We

forecast a further 25 basis point (quarter-percent) cut in November,

but timing will be heavily influenced by global risks, which are

fluid at present," ASB chief economist Nick Tuffley said.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.