At the centre of America's developing crisis is its burgeoning debt, its declining imperial power, the demise of the petrodollar and the inability to issue sufficient bonds to feed its debt.

Printing

machine: US Treasury issuing more bonds to feed soaring debt but

there are no takers

RT,

13

October, 2018

The

US Treasury is selling $74 billion of debt this week to fund the

rising budget deficit stemming from the Trump administration’s

massive tax cut introduced last December and the country’s massive

overall debt.

The

new debt will be issued in a three-year, 10-year and 30-year bond

supply this week, Reuters reports, quoting US Treasury data. In late

September, the Treasury sold a combined $106 billion of debt amid

cooling demand from investors.

With

countries like Japan, China, Russia and Turkey buying less and

selling more US debt, foreign purchases at Treasury auctions have

slowed down. One of the reasons is the trade war between the US and

China, which has given a boost to the dollar. Bond dealers have been

buying more US debt, but they quickly resell it to make a profit.

Last

week’s data shows that the US budget deficit soared to an estimated

$782 billion in Donald Trump’s first full fiscal year as president.

This is the largest fiscal deficit for the US since 2012.

There

are concerns that US debt is growing out of control. America’s debt

currently stands at $21.5 trillion, while the Treasury said the US

government paid $523 billion in interest in fiscal 2018, the highest

on record.

Trump

will soon announce a plan to tackle the debt, according to the US

president’s chief economist Kevin Hassett. “The deficit is

absolutely higher than anyone would like. As you watch our next

budget come out – and you’ll start to see things in the next few

weeks – then you’ll see a much more aggressive stance” in

tackling it, he said, as quoted by Bloomberg.

Soaring

by $38,000 per second: US national debt now exceeds $21.5 trillion

RT,

3

October, 2018

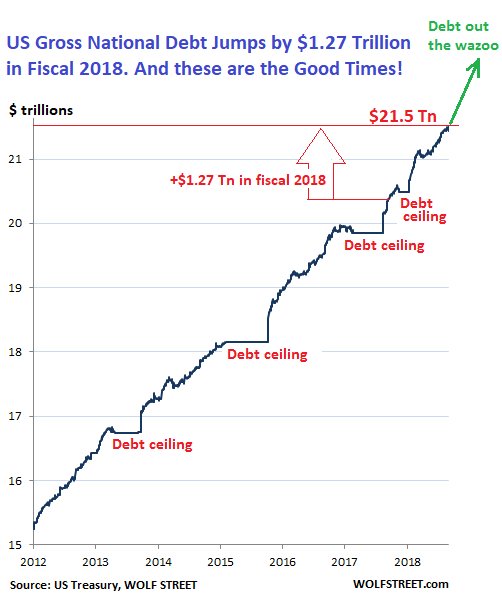

The latest data from the US Treasury Department shows America’s gross national debt ballooned by $1.2 trillion to a breathtaking $21.52 trillion on September 28, the last day of fiscal year 2018.

During that period, the US national debt increased by 6.3 percent and now amounts to 105.4 percent of the country’s current-dollar Gross Domestic Product (GDP).

According to the Treasury Department’s Bureau of the Fiscal Service, the national debt at the end of fiscal year 2017 was an estimated $20.25 trillion. The large deficit is a result of federal benefit payments pushed into August instead of September, the service said.

“Where the threshold is too high, we don’t know. But rising forever is definitely an unsustainable, big problem. And we’re the only advanced economy on an unsustainable course,” economist Jason Furman at Harvard’s Kennedy School of Government told the Public Radio International (PRI).

“We’re the only advanced economy where the debt is expected to rise as a share of GDP over the next five years. All the other advanced economies, it’s falling,” he added.

The budget deficit hit $214 billion in August, which is double the amount compared with the same period a year ago.

The Congressional Budget Office (CBO) estimates that the “deficit” will be $895 billion in fiscal 2018. It said that in just a few years the US will be paying more in interest to pay down the national debt than on the military or Medicare.

“The fact that we are in the 10th year of an economic expansion now and debt keeps rising is really extraordinary and very irresponsible. Unless Congress fundamentally changes its path, we are headed for a Greek-type crisis,” said Chris Edwards, director of tax policy studies at the Cato Institute, a think tank in Washington.

He explained: “A rising debt could create this crisis situation where interest rates spike, the government has to take drastic actions, perhaps cutting benefits, social security and other benefits radically, or hiking taxes dramatically, which will damage the economy.”

No comments:

Post a Comment

Note: only a member of this blog may post a comment.