I

think there might be a hint of irony in the headline below.

No irony, I'm afraid, in the following headlines from Radio New Zealand:

It

could be a good year to ask for a pay rise, with a recruitment

company survey showing the number of businesses intending to hire is

at a six-year high.

Stocks

Stumble Into Green As China Stimulus Headline Trumps Collapsing Crude

19

January,, 2016

Your

day in equity markets explained... China

crap data (sell), that's great news - moar stimulus (buy), but Iran

just cut prices of crude to Europe (sell), and now the Saudis have

threatened to use nukes against Iran (sell more)... but then -

spurious headline saved the world - CHINA SHOULD CUT RESERVE RATIO,

RAISE DEFICIT: SEC. JOURNAL

All

fundamentals...

The

China headline ramped S&P Futs perfectly to VWAP...

Cash

indices all gave up their post-China gains before the spurious China

headline appeared (just a reminder - the last few RRR cuts have been

utter failures)

FANGs

ramped the open - tumbled all the way into the red - then were

rescued by Chinese headlines...

Energy

stocks were hammered but the bounce rescued financials

It

appears concerns about energy loan transparency are weighing on

regional banks...

Tumbling

to the lowest since Oct 2013...

Energy

credit risk continues to surge to record highs...

Investment

Grade credit is still worrisome...

BUT

- ex-Energy credit risk is surging also and following a worrisom

contagion pattern...

Treasury

yields ended the day modestly higher whipsawing intraday... with 10Y

getting close to 2.00%

The

USD Index ended the day unchanged, holding yesterday's gains...

Crude

and Copper loved the crap China data and ripped higher on stimulus

dreams only to dump it all back once US equities opened. Gold was

flat whilke Silver rallied...

Charts:

Bloomberg

Bonus

Chart: BofA sees S&P 500 pricing in a 50% chance of recession

Bonus

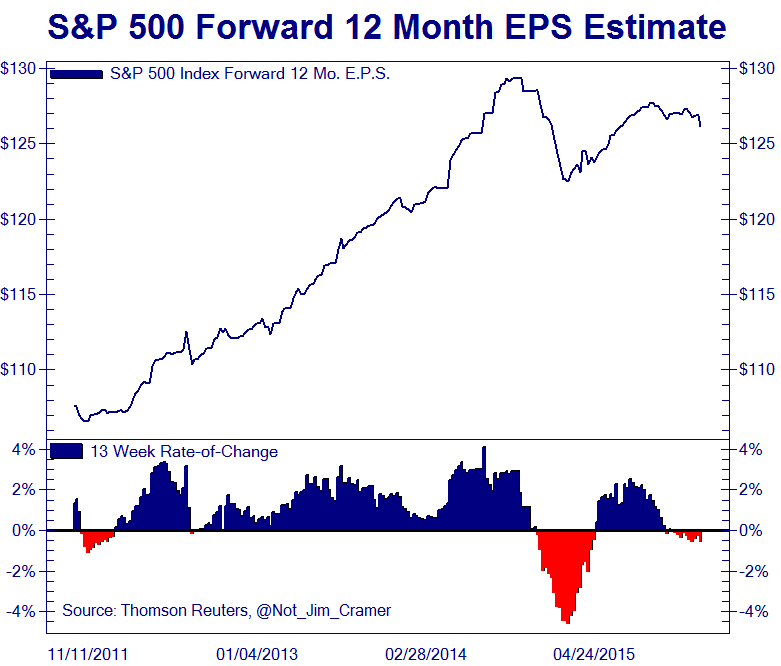

Bonus Chart: Earnings expectations are rolling over again!! (h/t

@Not_Jim_Cramer)

S&P Forward EPS Estimate Rolling Over. Again.

Overheard on CNBC this morning "now is the time to buy and believe."

Don't panic!

Hong Kong Dollar Plunges To Weakest Since Aug 2007

Modest

overnight weakness in the Hong Kong Dollar has accelerated notably as

the US session starts with USDHKD

down 150 pips in the last hour, plunging

to its weakest against the dollar since Aug 2007...

12

month forwards have been leading this collapse and still indicate HKD

dropping to 7.8650, once again testing the weak-end of the HKDUSD peg

band.

Wall St. In Free Fall! Gerald Celente Explains The Panic & Global Recession W/ Host Brian Engelman.

China's

economic growth slumps to 25-year low

China's

economy grew 6.9 percent in 2015, GDP figures released on Tuesday

showed, the lowest level of growth in 25 years.

Chinese

leaders are trying to reduce reliance on trade and investment by

nurturing slower, more self-sustaining growth based on domestic

consumption and services.

Bottom

of barrel: Crude oversupply makes producers cut oil output to

stabilize market

The

oil price dropped to a 13-year low on Monday trading below $28 per

barrel. Large oil producers are struggling to keep the economy

afloat, with the global crude prices at rock bottom. With the huge

crude oversupply - some oil producing countries have been

acknowledging the need to cut production.

Not Jim Cramer

Not Jim Cramer

No comments:

Post a Comment

Note: only a member of this blog may post a comment.