"Massive...

Huge... Largest

Ever": Fed Will Flood Market

With Gargantuan

$500

Billion In Liquidity To Avoid

Year-End Repo Crisis

12 December, 2019

In previewing today's Fed statement regarding repurchase operations, on Tuesday Curvature Securities repo expert Scott Skyrm said that he expects the Fed to announce a $50 billion (at least) term operation for Monday December 23 (double the current term ops) and a $50 billion (at least) term operation for Monday, December 30. This prediction was in response to Zoltan Pozsar's warning that reserve levels are too low and the result would be a market crash that could spark QE4.

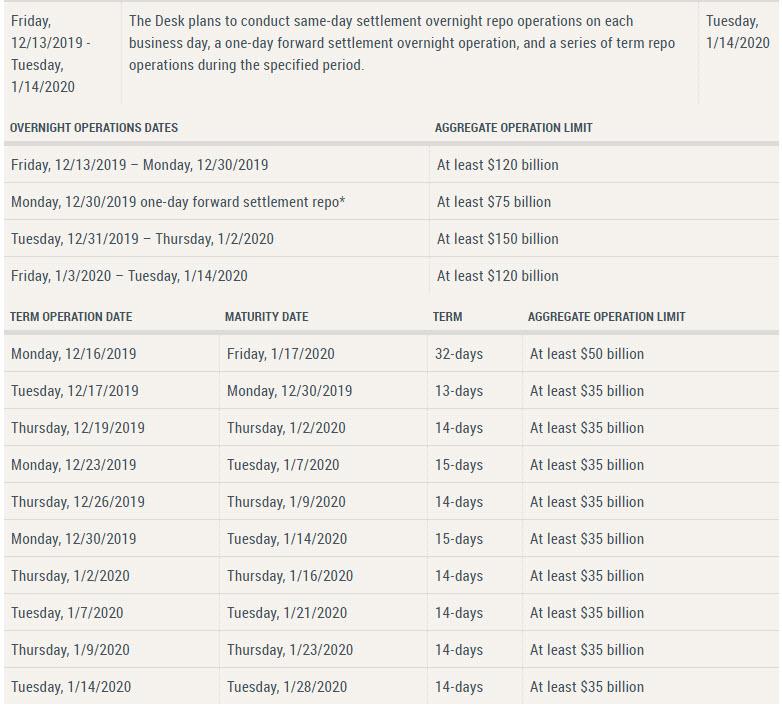

Well, moments ago the NY Fed did publish it latest weekly "Statement Regarding Repurchase Operations" as expected laying out the Fed's expected repo operations for the period December 13 - January 14... and it blew Skyrm's expectations out of the water

According to the statement, the NY Fed will continue to offer two-week term repo operations twice per week, four of which span year end. In addition, the Desk will also offer another longer-maturity term repo operation that spans year end. The amount offered in this operation will be at least $50 billion, just as Skyrm expected.

But there was more. Much more.

In addition, to prevent a cascading year-end liquidity squeeze, Fed overnight repo operations will continue to be held each day, and just to be safe, the Fed will go to town by substantially expanding their size: On December 31, 2019 and January 2, 2020, the overnight repo offering will increase to at least $150 billion to cover the "turn" in a flood of overnight liquidity. In addition, on December 30, 2019, the Desk will offer a $75 billion repo that settles on December 31, 2019 and matures on January 2, 2020.

And just in case that's not enough, the NY Fed's markets desk also added that it "intends to adjust the timing and amounts of repo operations as needed to mitigate the risk of money market pressures that could adversely affect policy implementation, consistent with the directive from the FOMC."

What the Fed means is that in addition to expanding the sizes of its "turn" overnight repos to $150 billion, the Fed will conduct a total of nine term repos covering the year-end turn from Dec 16 to Jan 14, 8 of which will amount to $35BN and the first will be $50BN, for a total injection of a whopping $365 billion in the coming month.

And visually:

In other words, instead of QE4 the Fed will flood the repo market with a firehose of liquidity.

Here is how Curvature's Skyrm summarized this:

One word: "Massive". A few more words: The largest series of RP operations ever! The Fed announced it's RP operations schedule for the next few weeks and it's huge!Here are my calculations:There are two existing $25 billion term operations over the Turn already in the market totaling $50 billionThe Fed committed to at least a $150 billion overnight operation on year-endA REG-start year-end operation on the day before year-end of $75 billionBetween now and year-end a total of 6 term RP operations totaling $225 billionAll total, I count the Fed committed to pump $500 billion in the Repo market over year-end. Naturally, the Turn (12/31-1/2) rallied a bit today. Trading from 4.25% yesterday to 3.80% today

There's more: add in the incremental liquidity from the expanded overnight repo of about $50 billion and another $60 billion in T-Bill purchases, and the Fed will inject a total of just shy of $500 billion in the next 30 days!

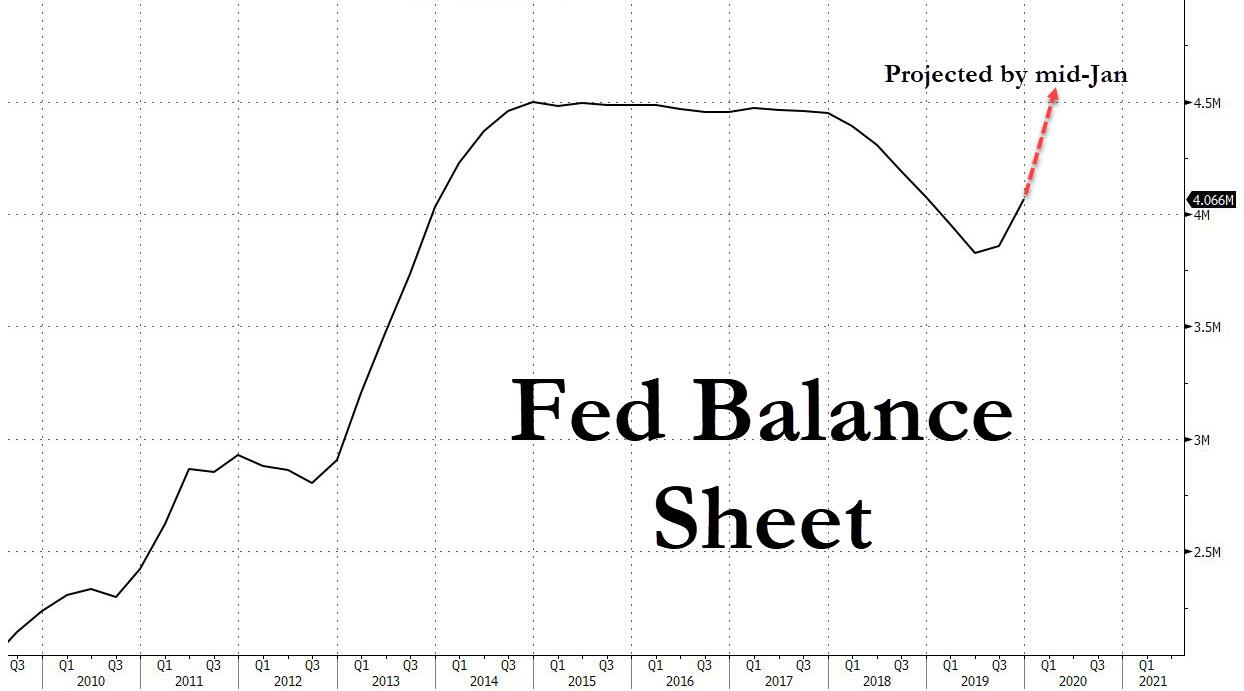

This also means that by Jan 14, the Fed's balance sheet would have grown by a cumulative $365BN in "temporary" repos, and together with the expanded overnight repos, and the $60BN in monthly TBill purchases, and by mid-January, the Fed's balance sheet, currently at $4.066 trillion, will surpass its all time high of $4.5 trillion!

The question then is whether this will be sufficient to refute the repo Doomsday predicted by Pozsar, one which was supposed to launch QE4, or will the Fed's gargantuan liquidity injection still not be enough and lead to a collapse in the repo market. We will find out in the next three weeks.

Zoltan

Pozsar "doomsday" report predicting that the Fed is about

to lose control over short-term interest rates due to a reserve

shortage, resulting in a repo market crisis, surging bond yields and

a stock market crash, managed to do something few others have

achieved: it caused a full-blown Fed panic.

The

result was not only the earlier announcement that the NY Fed would

inject over $500 billion in liquidity over the next month to avoid

said repo crisis, which as we calculated would blow out the Fed's

above $4.5 trillion to a new all time high...

https://www.zerohedge.com/markets/calm-markets-ny-fed-announces-new-heads-plunge-protection-team

No comments:

Post a Comment

Note: only a member of this blog may post a comment.