UK Government Plan To ‘Engineer Financial Crash’ To Scare MP’s Into Voting For Brexit Deal

20

November, 2018

Faced with the prospect of the Brexit deal being voted down, the British government will attempt to plunge the financial markets into chaos according to a report in the Sunday Times.

A source close to aides of British Prime Minister Theresa May claims that the UK government is planning to “engineer a financial crash” if parliament fails to back their Brexit deal, in a bid to frighten MPs into voting it through at a second vote.

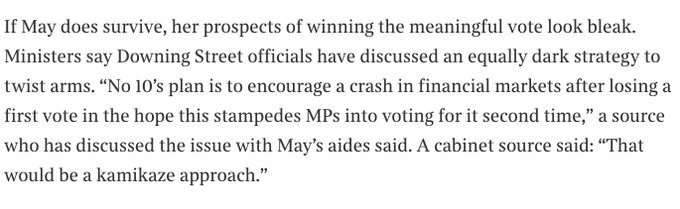

RT reports: A source, who has discussed the issue with May’s officials, has told the paper that No 10 has come up with a dark plan to twist the arms of MPs to force through their Brexit deal.

“No 10’s plan is to encourage a crash in financial markets after losing a first vote in the hope this stampedes MPs into voting for it second time,” the source claims.

On social media, there’s been a mixture of shock at the prospect of such a course of action and cynicism at whether the UK government have direct control over the financial markets to engineer a crash. On Twitter, Guardian columnist, Owen Jones asked how is this not a “national scandal?” John McTernan, ex-adviser to former Labour PM Tony Blair, suggests May’s Tory government is merely predicting the inevitable.

David Spencer, Professor of Economics and Political Economy at Leeds University, told RT it’s the uncertainty surrounding Brexit that causes volatility in financial markets – and any crash will not be the consequence of direct government action, but the symptom of their policies.

Professor Spencer said: “Financial investors hate uncertainty and while the uncertainty around Brexit drags on volatility in financial markets looks inevitable – the UK govt adds to this volatility so as long as it delays any resolution to the Brexit problem.

“But the volatility is not something they directly control, instead it is a symptom of their behaviour and policies.”

He argues British sterling and the markets will fall if May’s government fails to get their Brexit deal through parliament at the first attempt

#PeoplesVote #FBPE #stopBrexit

#PeoplesVote #FBPE #stopBrexit

No comments:

Post a Comment

Note: only a member of this blog may post a comment.