I will start off with the view from Zero Hedge.

Much of the rest is from what may be called the commentariat. While they have a fine broad-brush approach and well worked out opinions they do not have deep insight into the particulars of the Greek situation.

Having heard him for some time, Varoufakis has such a towering intellect and insight into the problems of his own country (and of Europe) that he can and should in my opinion be taken on its own basis.

Zero Hedge can be good (even very good) as a source, but I have been disappointed with some of the views that have been expressed very confidently of late.

I will finish with the words of Helena Sheehan, an old acquiantance, Marxist and supporter of Syriza:

Today I have been watching, listening, reflecting. I have been slow to begin speaking. I have been reading many accusations of capitulation and even betrayal, of snatching defeat from the jaws of victory.

I am not going to add my voice to them. I am not going to defend the current proposals either, although some are worse than others. I see this more as defeat than betrayal.

I see the enormous pressures and the brutal power being brought to bear on the Greek people and the Syriza government. I do not agree with this course of action, but I do not doubt their good faith.

I have been writing a paper for a conference in Athens next week entitled "Ghosts of alternatives past". I have been focusing on the weight of the wider world, on the power of the global system, bearing down on the whole history of our alternatives, transforming even our greatest victories into defeats. Win or lose, we still need to resist their power and to build our alternatives to it.

Tsipras

Sells Out Referendum 'No' Vote Ahead Of Weekend Deadline

10

July, 2015

"We

got a mandate to bring a better deal than the ultimatum that the

Eurogroup gave us, but certainly not given a mandate to take Greece

out of the eurozone,” Greek PM Alexis Tsipras reportedly told

Syriza lawmakers on Friday, underscoring the fact that his

government’s mandate is, for all intents and purposes, impossible

to achieve.

As detailed

Thursday evening,

the proposal (or, the “thorough piece of text” as Jeroen

Dijsselbloem called it) submitted by Tsipras looks quite a bit like

the proposal the Greek people rejected at Tsipras’ urging last

Sunday. Here are the basics:

The broad strokes: a 3 year, €53.5 billion bailout program, including €35 billion of growth measures, lasting through June 30, 2018 requesting funds from the ESM, seeking to finally put the IMF off to the side. The program is heavy on revenue promises and lite on actual spending cuts. Greece hopes to achieve a 1% primary budget surplus in 2015, rising to 2%, 3%, and 3.5% by 2018, all of which are now impossible due to the total collapse of the economy in the past week. Among the tax reform will be a modest increase in corporate tax from 26% to 28%. The changes to the VAT system are as noted previously, keeping the VAT on hotels at 13% but raising it to 23% for restaurants; Greece also promises to eliminate discounts on islands, starting with the islands with higher incomes and which are the most popular tourist destinations. Create strong disincentives to early retirement, incur penalties for early withdrawals, make all supplementary pension funds financed by own contributions; and so on. Greece will seek to "gradually phase out the solidarity grant (EKAS) for all pensioners by end-December 2019" - who will be impacted and when: "the top 20% of beneficiaries in March 2016." In other words another 9 months of non real action. Greece will also "freeze monthly guaranteed contributory pension limits in nominal terms until 2021."

Reactions

from Europe and from Syriza itself have been largely predictable. As

mentioned above, Dijsselbloem is lukewarm, French President Francois

Hollande called the proposal “serious and credible”, Italian PM

Matteo Renzi is “more optimistic than [he] was in the past,”

while Germany is, to use Bloomberg’s

words “reserving

judgement.”

On

person who is not “reserving judgement” however is Greek Energy

Minister and far-left leader Panagiotis Lafazanis. “The

proposals are not compatible with the Syriza programme," he told

Reuters on

Friday. On Thursday, in the course of detailing

Greece’s €2

billion energy partnership with Russia, Lafazanis said the

referendum “no vote “must not become a humiliating ‘yes’.”

While

the Eurogroup will convene on Saturday to consider whether to go

ahead with the deal, the first hurdle is the Greek parliament

where Tsipras

is set to use what Deutsche Bank calls an “unusual political

move” to

give the proposal a better chance of passing next week. Here’s

Deutsche Bank with more:

In the meantime, the Greek PM has initiated the domestic approval process as well. In an unusual political move, he has submitted a one-page legislative proposal requesting emergency parliamentary authorization to negotiate the final terms of the agreement. He has published the government's proposal at the same time, but is not calling for parliament to vote upon the actual measures. In principle such authority is not required. In practice, the strategy aims at consolidating the SYRIZA party's parliamentary base ahead of a likely vote to approve the measures next week. On the positive side, pre-emptive parliamentary support will make it more difficult for SYRIZA MPs to reject an agreement after it comes to parliament. On the negative side, the PM will also have an authority to reject an agreement if he so decides.

The opposition's stance to this strategy remains to be seen, but it will be the support of the government's parliamentary majority that will be the most important today. The PM will meet with SYRIZA parliamentarians at 6am London time. A full parliamentary vote will take place later in the evening. Approval will provide negotiating space to the PM, increasing credibility with the Europeans and the odds of passage in a subsequent parliamentary vote next week.

In

other words, it appears as though Tsipras is looking to back the

Syriza hardliners into a corner. The argument appears to go something

like this: voting on the actual proposals would be largely pointless

as Europe hasn’t approved them, so let’s vote on whether I have

the authority to negotiate the measures, but if you say “yes” to

that, and I agree to a deal this weekend, then I can then come back

to you and say “well, you gave me the authority to negotiate and I

decided to accept so now you pretty much have to approve this.”

This strategy has the added benefit of allowing Tsipras to tell

Europe that the Greek parliament voted “yes” even though in

reality they did not vote on the actual deal. You have to love

politics.

As

for “debt sustainability” (i.e. that small issue which the IMF

brought up three days before the referendum and effectively won the

vote for Tsipras and the “no” crowd), that will be considered

later apparently. From Bloomberg:

Debt sustainability is a central part of discussions in the Euro Working Group and the Eurogroup of euro-area finance ministers, EU official says.

Assessment of Greece’s financing requirements will also form part of analysis, official tells reporters in Brussels

First, prior actions will be discussed, then financing, then debt sustainability -- but they are all linked, official says.

They

may be “all linked” but Germany still isn’t biting — or at

least not on the idea of a “classic haircut.” Here’s the Irish

Times:

The Greek government received a boost on Thursday, after European Council President Donald Tusk said that a “realistic proposal from Athens” should be matched by “realistic proposal from creditors on debt sustainability”.

His unexpected comments - the first from a senior EU figure - followed a phone conversation with Greek prime minister Alexis Tsipras.

Senior officials representing the 19 euro zone member states will consider Greece’s new reform plan on Friday, ahead of a scheduled eurogroup meeting of finance ministers in Brussels on Saturday.

Mr Tusk’s intervention follows renewed calls from IMF managing director Christine Lagarde on Wednesday that Greece’s debt burden should be addressed.

US treasury secretary Jack Lew also intervened to call for debt relief for Greece.

In a sign that Berlin could be open to the idea of debt relief, German finance minister Wolfgang Schauble said the issue could be discussed over the coming days, though he hinted that the impact of any measures would be minimal. “The room for manoeuvre through debt reprofiling or restructuring is very small,” he said.

German chancellor Angela Merkel also explicitly ruled out a debt writedown for Greece. “I have said that a classic haircut is out of the question for me and that hasn’t changed between today and yesterday,” she said, echoing comments she made on Tuesday in Brussels.

Speaking within hours of Mr Tusk’s comments, she said that Greece’s debt sustainability had already been addressed under previous bailouts.

So,

just as we said: Germany and the US are now at odds over a Greek debt

writedown.

Ultimately,

Tspiras has submitted the same proposal that Greeks, at his behest,

voted against last weekend. The PM will use a shrewd political

maneuver to secure parliamentary support and new FinMin Euclid

Tsakalotos will attempt to close the deal on Saturday. And although

that would mean selling Greek "no" voters down the river,

it's once again a nearly impossible choice because as Bloomberg

reports, citing Dutch newspaper Het Financieele Dagblad, the

ECB "will

terminate emergency liquidity assistance (ELA) to Greece as of 6am on

Monday morning if Greek reform proposals are deemed too light and if

Greece is unwilling to cooperate with withdrawal from the euro one."

Here's

Commerzbank's Markus Koch summing things up: "The

'No' in the referendum appears to be turning into a 'Yes' from

Tsipras."

Sorry

Panagiotis Lafazanis. Maybe there's a cabinet position open in

Moscow.

*

* *

What

was the point of Tsipras referendum?

The

new Greek government proposals, published late last night are clearly

based on those submitted by Jean Claude Juncker last Thursday, before

the referendum.

It’s

left many Greeks frustrated, asking: what was the point of the

referendum? It’s left many foreign observers saying the same.

Here

are the most obvious answers:

First,

the Greek government’s hope that a referendum mandate would allow

swift negotiations with their creditors, and relaxation of terms, did

not materialise. Instead a renewed ultimatum materialised. If they

can’t meet it, the ECB and EU will collapse the Greek banking

system and throw them out of the Eurozone. Indeed, one of the main

“achievements” of the referendum was to flush out that clear

threat, from politicians who had never admitted it before.

The

Greek government has no mandate to leave the Euro, as the 61% vote No

last Sunday was clearly won as a “stay in and fight” mandate.

Secondly,

the deal makes no economic sense without debt relief. The referendum,

combined with US pressure, seems to have prompted key European

voices, including Angela Merkel and Donald Tusk, accede in principle

to the need for debt reprofiling – which is a sneaky way of writing

off debts.

Thirdly, it is still redistributive on balance. Syriza can still sell this as a very different programme from those previously designed by the conservative led coalition. 29% corporation tax is one example. However it does make concessions on pensions and on VAT on the islands, which currently enjoy a discount.

Fourth,

it is the work of Euclid Tsakalatos. Tsakalatos, as I’ve been

explaining since mid-January, is existentially committed to two

things: Euro membership and the use of government to foster

widespread modernisation and social change. He wants to stay in power

– not lose it to a government of “technocrats”.

Fifth,

the deal comes with a request for a loan to make Greece’s debt

repayments over the next three years. If someone else pays your debts

for three years, that is a very fiscally beneficial thing, and leaves

Greece with money to spend it did not have.

Most

importantly, this is not a done deal. If it gets through the Greek

parliament and is then thrown back into the Greeks’ faces it will

solidify and prepare Greek society for Grexit.

It

will most likely prompt a few resignations from Syriza, but I am told

the Left Platform in Syriza will mainly accept it. But getting it

through parliament is not the problem. Getting it through the EU is

the problem – and it’s left many Greeks still predicting this is

the last gamble before Grexit.

Here is a good interview of investigative journalist, Greg Palast with Thom Hartmann

Greece: We Voted No to Our Slavery &.Yes To Our Chains

And from Ilargi of Automatic Earth

Someone

Pull The Plug or This Will End in War

Raúl Ilargi Meijer

Unknown Petersburg, Virginia. Group of Company B, U.S. Engineer Battalion 1864

10

July, 2015

I

was going to write up on the uselessness of Angela Merkel, given that

she said on this week that “giving in to Greece could ‘blow

apart’ the euro”, and it’s the 180º other way around; it’s

the consistent refusal to allow any leniency towards the Greeks that

is blowing the currency union to smithereens.

Merkel’s

been such an abject failure, the fullblown lack of leadership, the

addiction to her right wing backbenchers, no opinion that seems to be

remotely her own. But I don’t think the topic by itself makes much

sense anymore for an article. It’s high time to take a step back

and oversee the entire failing euro and EU system.

Greece

is stuck in Germany’s own internal squabbles, and that more than

anything illustrates how broken the system is. It was never supposed

to be like that. No European leader in their right mind would ever

have signed up for that.

Reading

up on daily events, and perhaps on the verge of an actual Greece

deal, increasingly I’m thinking this has got to stop, guys, there

is no basis for this. It makes no sense and it is no use. The mold is

broken. The EU as a concept, as a model, has failed and is already a

thing of the past.

It’s

over. And anything that’s done from here on in will only serve to

make things worse. We should learn to recognize such transitions, and

act on them. Instead of clinging on to what we think might have been

long after it no longer is.

Whatever

anyone does now, it’ll all come back again. That’s guaranteed. So

just don’t do it. Or rather, do the one thing that still makes any

sense: Call a halt to the whole charade.

As

for Greece: Just stop playing the game. It’s the only way for you

not to lose it.

There’s

no reason why European countries couldn’t live together, work

together, but the EU structure makes it impossible for them to do

just that, to do the very thing it was supposed to be designed for.

Germany

runs insane surpluses with the rest of the EU, and it sees that as a

sign of how great a country it is. But in the present structure, if

one country runs such surpluses, others will need to run equally

insane deficits.

Cue

Greece. And Italy, Spain et al. William Hague for once was right

about something when he said this week that the euro could only

possibly have ended up as a burning building with no exits. This is

going to lead to war.

Simple

as that. It may take a while, and the present ‘leadership’ may be

gone by then, but it will. Unless more people wake up than just the

OXI voters here in Greece.

And

the only reason for it to happen is if the present flock of petty

little minds in Berlin, Paris, London and Brussels try to make it

last as long as they can, and call for even more integration and

centralization and all that stuff. The leaders are useless, the

structure is painfully faulty, and the outcome is fully predictable.

Europe

has no leadership, it has a varied but eerily similar bunch of people

who crave the power they’ve been given, but lack the moral

sturctures to deal with that power. Sociopaths. That’s what

Brussels selects for.

And

Brussels is by no means the only place in Europe that does that. What

about people like Schäuble and Dijsselbloem, who see the misery in

Greece and loudly bang the drum for more misery? What does that say

about a man? And what does it say about the structure that allows

them to do it? At times I feel like the Grapes of Wrath is being

replayed here.

It’s

nice and all to claim you’re right about something, but if your

being right produces utter misery for millions of others, you’re

still wrong.

Greece

is not an abstract exercise in some textbook, and it’s not a

computer game either. Greece is about real people getting hurt. And

if you refuse to act to alleviate that hurt, that defines you as a

sociopath.

Germany

now, and it took ‘only’ 5 months, says Greece needs debt relief

but it also says, through Schäuble: “There cannot be a haircut

because it would infringe the system of the European Union.” That’s

exactly my point. That’s silly. And looking around me here in

Athens for the past few weeks, it’s criminally silly. You

acknowledge what needs to be done, and at the same time you

acknowledge the system doesn’t allow for what needs to be done.

Time to change that system then. Or blow it up.

I

don’t care what people like Merkel and Schäuble think or say, once

people in a union go hungry and have no healthcare, you have to

change the system, not hammer it down their throats even more. If you

refuse to stand together, you can be sure you’ll fall apart.

Get

a life. Greece should just default on the whole thing, and let Merkel

and Hollande figure out the alleged Greek debt with their own

domestic banking sectors. They’re the ones who received all the

money that Greece is now trying to figure out a payback schedule for.

Problem

with that is of course that very banking sector. They call the shots.

The vested interests have far too much power on all levels. That’s

the crux. But that’s also the purpose for which a shoddy construct

like the EU exists in the first place.

The more centralized politics

are, the easier the whole thing is to manipulate and control. The

more loopholes and cracks in the system, the more power there is for

vested interests.

Steve

Keen just sent a link to an article at Australia’s MacroBusiness,

that goes through the entire list of new proposals from the Syriza

government, and ends like this:

This is basically the same proposal as that was just rejected by the Greek people in the referendum. There are some headlines floating around about proposed debt restructuring as well but I can’t find them. This makes absolutely no sense. The Tsipras Government has just:

• renegotiated itself into the same position it was in two months ago;

• set massively false expectations with the Greek public;

• destroyed the Greek banking system, and

• destroyed what was left of Greek political capital in EU.

If this deal gets through the Greek Parliament, and it could given everyone other than the ruling party and Golden Dawn are in favour of austerity, then Greece has just destroyed itself to no purpose. Markets are drawing comfort from the roll over but how Tsipras can return home without being lynched by a mob is beyond me. And that raises the prospect of any deal being held immediately hostage to violence.

Yes,

it’s still entirely possible that Tsipras submitted this last set

of proposals knowing full well they won’t be accepted. But he’s

already gone way too far in his concessions. This is an exercise in utility.

It’s

time to acknowledge this is a road to nowhere. From where I’m

sitting, Yanis Varoufakis has been the sole sane voice in this whole

5 month long B-movie. I think Yanis also conceded that it was no use

trying to negotiate anything with the troika, and that that’s to a

large extent why he left.

Yanis

will be badly, badly needed for Greece going forward. They need

someone to figure out where to go from here.

Just

like Europe needs someone to figure out how to deconstruct Brussels

without the use of heavy explosives. Because there are just two

options here: either the EU will -more or less- peacefully fall

apart, or it will violently blow apart.

And last (and possibly east) from liberal Green commentator, George Monbiot

Greece is the latest battleground in the financial elite’s war on democracy

From laissez-faire economics in 18th-century India to neoliberalism in today’s Europe the subordination of human welfare to power is a brutal tradition

George Monbiot

7 July, 2015

Greece may be financially bankrupt, but the troika is politically bankrupt. Those who persecute this nation wield illegitimate, undemocratic powers, powers of the kind now afflicting us all. Consider the International Monetary Fund. The distribution of power here was perfectly stitched up: IMF decisions require an 85% majority, and the US holds 17% of the votes.

The IMF is controlled by the rich, and governs the poor on their behalf. It’s now doing to Greece what it has done to one poor nation after another, from Argentina to Zambia. Its structural adjustment programmes have forced scores of elected governments to dismantle public spending, destroying health, education and all the means by which the wretched of the earth might improve their lives.

The same programme is imposed regardless of circumstance: every country the IMF colonises must place the control of inflation ahead of other economic objectives; immediately remove barriers to trade and the flow of capital; liberalise its banking system; reduce government spending on everything bar debt repayments; and privatise assets that can be sold to foreign investors.

Using the threat of its self-fulfilling prophecy (it warns the financial markets that countries that don’t submit to its demands are doomed), it has forced governments to abandon progressive policies. Almost single-handedly, it engineered the 1997 Asian financial crisis: by forcing governments to remove capital controls, it opened currencies to attack by financial speculators. Only countries such as Malaysia and China, which refused to cave in, escaped.

Consider the European Central Bank. Like most other central banks, it enjoys “political independence”. This does not mean that it is free from politics, only that it is free from democracy. It is ruled instead by the financial sector, whose interests it is constitutionally obliged to champion through its inflation target of around 2%. Ever mindful of where power lies, it has exceeded this mandate, inflicting deflation and epic unemployment on poorer members of the eurozone.

The Maastricht treaty, establishing the European Union and the euro, was built on a lethal delusion: a belief that the ECB could provide the only common economic governance that monetary union required. It arose from an extreme version of market fundamentalism: if inflation were kept low, its authors imagined, the magic of the markets would resolve all other social and economic problems, making politics redundant. Those sober, suited, serious people, who now pronounce themselves the only adults in the room, turn out to be demented utopian fantasists, votaries of a fanatical economic cult.

Those sober, suited, serious people turn out to be demented utopian fantasists, votaries of a fanatical economic cut

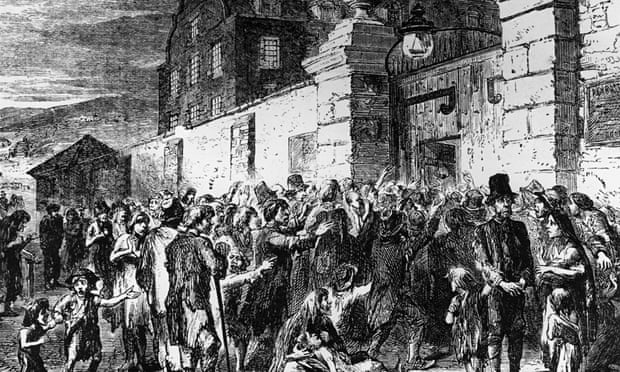

All this is but a recent chapter in the long tradition of subordinating human welfare to financial power. The brutal austerity imposed on Greece is mild compared with earlier versions. Take the 19th century Irish and Indian famines, both exacerbated (in the second case caused) by the doctrine of laissez-faire, which we now know as market fundamentalism or neoliberalism.

In Ireland’s case, one eighth of the population was killed – one could almost say murdered– in the late 1840s, partly by the British refusal to distribute food, to prohibit the export of grain or provide effective poor relief. Such policies offended the holy doctrine of laissez-faire economics that nothing should stay the market’s invisible hand.

When drought struck India in 1877 and 1878, the British imperial government insisted on exporting record amounts of grain, precipitating a famine that killed millions. The Anti-Charitable Contributions Act of 1877 prohibited “at the pain of imprisonment private relief donations that potentially interfered with the market fixing of grain prices”. The only relief permitted was forced work in labour camps, in which less food was provided than to the inmates of Buchenwald. Monthly mortality in these camps in 1877 was equivalent to an annual rate of 94%.

As Karl Polanyi argued in The Great Transformation, the gold standard – the self-regulating system at the heart of laissez-faire economics – prevented governments in the 19th and early 20th centuries from raising public spending or stimulating employment. It obliged them to keep the majority poor while the rich enjoyed a gilded age. Few means of containing public discontent were available, other than sucking wealth from the colonies and promoting aggressive nationalism. This was one of the factors that contributed to the first world war. The resumption of the gold standard by many nations after the war exacerbated the Great Depression, preventing central banks from increasing the money supply and funding deficits. You might have hoped that European governments would remember the results.

Today equivalents to the gold standard – inflexible commitments to austerity – abound. In December 2011 the European Council agreed a new fiscal compact, imposing on all members of the eurozone a rule that “government budgets shall be balanced or in surplus”. This rule, which had to be transcribed into national law, would “contain an automatic correction mechanism that shall be triggered in the event of deviation.” This helps to explain the seigneurial horror with which the troika’s unelected technocrats have greeted the resurgence of democracy in Greece. Hadn’t they ensured that choice was illegal? Such diktats mean the only possible democratic outcome in Europe is now the collapse of the euro: like it or not, all else is slow-burning tyranny.

It is hard for those of us on the left to admit, but Margaret Thatcher saved the UK from this despotism. European monetary union, she predicted, would ensure that the poorer countries must not be bailed out, “which would devastate their inefficient economies.”

But only, it seems, for her party to supplant it with a homegrown tyranny. George Osborne’s proposed legal commitment to a budgetary surplus exceeds that of the eurozone rule. Labour’s promised budget responsibility lock, though milder, had a similar intent. In all cases governments deny themselves the possibility of change. In other words, they pledge to thwart democracy. So it has been for the past two centuries, with the exception of the 30-year Keynesian respite.

The crushing of political choice is not a side-effect of this utopian belief system but a necessary component. Neoliberalism is inherently incompatible with democracy, as people will always rebel against the austerity and fiscal tyranny it prescribes. Something has to give, and it must be the people. This is the true road to serfdom: disinventing democracy on behalf of the elite.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.