Bit by Bit: Bitcoin sets another record reaches $18,000 per single token

Bitcoin’s

unstoppable bull run continues with the world’s most valuable

cryptocurrency beating its own records day after day.

The

crypto-currency has once again defied nay-sayers by spiking above

18,000 dollars at one point today.

Bitcoin’s Berserker Run Resumes After Exchange Breaks; Novogratz Says “Not Close To The End"

6 December, 2017

Bitcoin is extending its gains after the 25-minute shutdown on GDAX...

* * *

Mike Novogratz - self-described as the "Forrest Gump of Bitcoin" - is on the wires calling Bitcoin a "cultural revolution."

"The world is in blockchain speculative phase... not close to the end of the speculative phase"Novo added that Bitcoin futures will give rise to ETFs and even broader adoption and a "sell-off after the speculative phase is complete.""Cryptokitties will be a fad""It's hard to mitigate volatility risk in Bitcoin"Novogratz says "banks will be slow to move into the industry and doesn't see quick adoption of Bitcoin as a currency"For now he has 25% of his net worth invested in Bitcoin/Blockchain and warns investors to "be careful" in non-Bitcoin tokens.

GDAX is back up after a 25 minute 'glitch'... and Bitcoin is rebounding

* * *

GDAX just broke...

Additionally, Bitfinex says it is under a significant denial of service attack.

As Bitcoin tumbled $4,500 from its highs...

And now the giveback...Bitcoin is down $3000 from its $19,600 highs...but is still up 30% on the day

Bwuahahaha... $19k...on GDAX

After tagging $19,697, Bitcoin prices tumbled to $17,900...

Prices are varying dramatically across exchanges with $2000 differences.

For those keeping track, this is how long it has taken the cryptocurrency to cross the key psychological levels:

- $0000 - $1000: 1789 days

- $1000- $2000: 1271 days

- $2000- $3000: 23 days

- $3000- $4000: 62 days

- $4000- $5000: 61 days

- $5000- $6000: 8 days

- $6000- $7000: 13 days

- $7000- $8000: 14 days

- $8000- $9000: 9 days

- $9000-$10000: 2 days

- $10000-$11000: 1 day

- $11000-$12000: 6 days

- $12000-$13000: 17 hours

- $13000-$14000: 4 hours

- $14000-$15000: 10 hours

- $15000-$16000: 5 hours

- $16000-$17000: 2 hours

- $17000-$18000: 10 minutes

- $18000-$19000: 3 minutes

Coinbase is struggling to keep up...

* * *

Update: $18,000, that is all!

* * *

Update: WTF! $17,000...

We do note that GDAX pricing appears to be at a significant premium to several other exchanges.

* * *

Update: Bitcoin just surpased $16,000... speechless...

* * *

In the last 36 hours, Bitcoin has blasted through $12,000, $13,000, $14,000, and now $15,000 levels in an unprecedented 28% surge...

With a market cap of around $250 billion, Bitcoin is bigger than Proctor & Gamble and approaching the size of Wal-Mart as the 12 biggest 'company' in the S&P 500.

As CoinTelegraqph reports, the price is likely being driven by news of the imminent launch of Bitcoin futures trading. CBOE will be launching their futures market this coming Sunday, December 10, with CME Group following on December 18. Nasdaq plans to launch futures trading in the summer of 2018 and Japan’s Tokyo Financial Exchange is preparing to launch futures trading as well.

Bloomberg has announced that brokerage firms TD Ameritrade and Ally Invest will be offering Bitcoin futures trades to their clients. Even J.P. Morgan Chase may follow suit, despite CEO Jamie Dimon’s infamous views on the digital currency.

GDAX, Coinbase’s digital currency exchange, has been leading the rally all day. The price on GDAX is currently about $500 ahead of other Western Bitcoin exchanges. The likeliest - and most bullish - explanation is that Coinbase is the easiest way for new Bitcoin investors to get involved. Consequently, when GDAX leads the charge as it has today, it probably means new “retail” investors are fueling the rally.

Meanwhile, as CoinDesk reports, Ron Paul wants to know: would you take $10,000 in bitcoin, cash or something else?

The former U.S. Congressman from Texas is currently holding a poll on his official Twitter account that asks in which form they would take $10,000 from a "wealthy person". The catch: you can't get rid of it for 10 years.

Paul – who earlier this year called for the U.S. government to "stay out" of bitcoin – put the question to his more than 650,000 followers, asking if they would take $10,000 in the form of bitcoin, dollars, gold or 10-year U.S. Treasury Bonds. The result thus far – one hour remains in the poll at press time – indicate that of the more than 70,000 responses, 54 percent expressed support for bitcoin.

Gold took the second-highest amount with 36 percent, followed by a mere 8 percent for the 10-year bonds. Just 2 percent indicated that they would take the Federal Reserve Notes if offered.

Speaking with TheStreet in October, Paul conceded that he's no expert on cryptocurrencies (back in 2014, he argued that bitcoin wasn't "true money"). That said, he voiced his support for cryptocurrency in the most recent interview, arguing that it lends credence to the emergence of alternative currencies against the U.S. dollar.

And while Bitcoin's eye-popping price movements have some observers saying the market is in bubble territory, Naval Ravikant, the co-founder of AngelList, while he's not ruling it out entirely, holds a less alarmist view.

"Money is a bubble that never pops," he said at yesterday's Token Summit II in San Francisco.

He told attendees:

"It's a consensus hallucination."

And speaking to the newfound attention to bitcoin, Ravikant said people are interested in growing the wealth that they have. With most savings accounts returning zero these days – as central banks conduct what Ravikant called their "grand money printing experiment" – the general public is looking for alternative places to store their money and watch it grow.

Bitcoin and other protocols seem to offer that, as even the less-developed cryptocurrencies are showing substantial returns.

"I think people are looking to solve their money problems," he said.

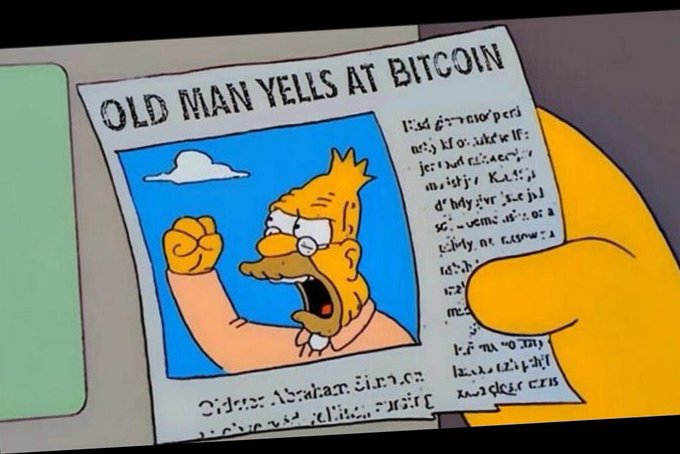

Additionally, Coindesk notes that the former chairman of the U.S. Federal Reserve, Alan Greenspan, has joined the many financial luminaries to recently criticize bitcoin's value.

Speaking to CNBC, Greenspan compared bitcoin to that of an early American form of money called "Continental currency" that came into use in 1775 and had become worthless by 1782. The paper-based legal tender was used at the time of the American Revolution and was not backed by a commodity such as gold.

Noting that bitcoin will likely suffer similar fate, Greenspan said that a "significant share" of Continental currency was still used to create "real goods and services," even though it had no ultimate worth.

He continued:

"Bitcoin is really a fascinating example of how human beings create value, and is not always rational ... It is not a rational currency in that case."

Greenspan's comments come as the value of a bitcoin is soaring beyond most expectations, having gained thousands of dollars in value in the last two days.

And in response to that...

And finally, for those calling this a "bubble" - we would humbly suggest you ain't seen nothing yet...

Steve Keen and Max Keiser debate bitcoin and whether it is a store of value or a bubble

The Bitcoin debate: Max Keiser vs. Steve Keen

Max Keiser and Alex Jones on bitcoin

Austin/We Have A Problem. Alex Come Back/The Great Deception is Strong.

The Beast System is like a Casino. It must have many winners at first to draw in the multitudes. The Black Hole.

Eric Holthaus discusses the ecological costs of the bitcoin revolution

Bitcoin could cost us our clean-energy future

By

Eric Holthaus

5 December,2017

If

you’re like me, you’ve probably been ignoring the bitcoin

phenomenon for years — because it seemed too complex, far-fetched,

or maybe even too libertarian. But if you have any interest in a

future where the world moves beyond fossil fuels, you and I should

both start paying attention now.

Last

week, the value of a single bitcoin broke the $10,000 barrier for the

first time. Over the weekend, the price nearly hit $12,000. At the

beginning of this year, it was less than $1,000.

If

you had bought $100 in bitcoin back in 2011, your investment would be

worth nearly $4 million today. All over the internet there are

stories of people who treated their friends to lunch a few years ago

and, as a novelty, paid with bitcoin. Those same people are now

realizing that if they’d just paid in cash and held onto their

digital currency, they’d now have enough money to buy a house.

That

sort of precipitous rise is stunning, of course, but bitcoin wasn’t

intended to be an investment instrument. Its creators envisioned it

as a replacement for money itself — a decentralized, secure,

anonymous method for transferring value between people.

But

what they might not have accounted for is how much of an energy suck

the computer network behind bitcoin could one day become. Simply put,

bitcoin is slowing the effort to achieve a rapid transition away from

fossil fuels. What’s more, this is just the beginning. Given its

rapidly growing climate footprint, bitcoin is a malignant

development, and it’s getting worse.

Cryptocurrencies

like bitcoin provide a unique service: Financial transactions that

don’t require governments to issue currency or banks to process

payments. Writing in the Atlantic, Derek Thompson calls bitcoin an

“ingenious and potentially transformative technology” that the

entire economy could be built on — the currency equivalent of the

internet. Some are even speculating that bitcoin could someday make

the U.S. dollar obsolete.

But

the rise of bitcoin is also happening at a specific moment in

history: Humanity is decades behind schedule on counteracting climate

change, and every action in this era should be evaluated on its net

impact on the climate. Increasingly, bitcoin is failing the test.

Digital

financial transactions come with a real-world price: The tremendous

growth of cryptocurrencies has created an exponential demand for

computing power. As bitcoin grows, the math problems computers must

solve to make more bitcoin (a process called “mining”) get more

and more difficult — a wrinkle designed to control the currency’s

supply.

Today,

each bitcoin transaction requires the same amount of energy used to

power nine homes in the U.S. for one day. And miners are constantly

installing more and faster computers. Already, the aggregate

computing power of the bitcoin network is nearly 100,000 times larger

than the world’s 500 fastest supercomputers combined.

The

total energy use of this web of hardware is huge — an estimated 31

terawatt-hours per year. More than 150 individual countries in the

world consume less energy annually. And that power-hungry network is

currently increasing its energy use every day by about 450

gigawatt-hours, roughly the same amount of electricity the entire

country of Haiti uses in a year.

That

sort of electricity use is pulling energy from grids all over the

world, where it could be charging electric vehicles and powering

homes, to bitcoin-mining farms. In Venezuela, where rampant

hyperinflation and subsidized electricity has led to a boom in

bitcoin mining, rogue operations are now occasionally causing

blackouts across the country. The world’s largest bitcoin mines are

in China, where they siphon energy from huge hydroelectric dams, some

of the cheapest sources of carbon-free energy in the world. One

enterprising Tesla owner even attempted to rig up a mining operation

in his car, to make use of free electricity at a public charging

station.

In

just a few months from now, at bitcoin’s current growth rate, the

electricity demanded by the cryptocurrency network will start to

outstrip what’s available, requiring new energy-generating plants.

And with the climate conscious racing to replace fossil fuel-base

plants with renewable energy sources, new stress on the grid means

more facilities using dirty technologies. By July 2019, the bitcoin

network will require more electricity than the entire United States

currently uses. By February 2020, it will use as much electricity as

the entire world does today.

This

is an unsustainable trajectory. It simply can’t continue.

There

are already several efforts underway to reform how the bitcoin

network processes transactions, with the hope that it’ll one day

require less electricity to make new coins. But as with other

technological advances like irrigation in agriculture and outdoor LED

lighting, more efficient systems for mining bitcoin could have the

effect of attracting thousands of new miners.

It’s certain that the increasing energy burden of bitcoin transactions will divert progress from electrifying the world and reducing global carbon emissions. In fact, I’d guess it probably already has. The only question at this point is: by how much?

it crashed 12% just today!

ReplyDeleteRecording success in cryptocurrency Bitcoin is not just buying and holding till when bitcoin sky-rocks, this has been longed abolished by intelligent traders ,mostly now that bitcoin bull is still controlling the market after successfully defended the $19,000 support level once again ad this is likely to trigger a possible move towards $20,000 resistance area However , it's is best advice you find a working strategy/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Carlos daily signals and strategy, on his platform, and his guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to easily increase my portfolio in just 3weeks of trading with his daily signals, growing my 0.9 BTC to 2.9BTC. Mr Carlos daily signals are very accurate and yields a great positive return on investment. I really enjoy trading with him and I'm still trading with him, He is available to give assistance to anyone who love crypto trading and beginners in bitcoin investment , I would suggest you contact him on WhatsApp: +14242850682 , telegram : @IEBINARYFX or through Gmail : (investandearnbinaryfx@gmail.com) for inquires and profitable trading systems. Bitcoin is taking over the world.

ReplyDelete