“The

Dow Jones industrial average plunged more than 1,100 points Monday as

stocks took their worst loss in six and a half years. Two days of

steep losses have erased the market's gains from the start of this

year and ended a period of record-setting calm for stocks.”

U.S.

Stocks Sink Most Since 2011 as Rout Deepens: Markets Wrap

- S&P sectors decline across the board; Treasuries, gold rally

- Equity plunge follows declines in Asia, Europe markets

5

February, 2018

U.S.

stocks plunged the most in 6 1/2 years, with the Dow Jones Industrial

Average sinking more than 1,100 points, as the equity selloff reached

a fever pitch amid rising concern that inflation will force interest

rates higher. Treasuries rallied and gold rose on haven demand.

Volatility

roared back into American equity markets, as the S&P 500 Index

sank 4.1 percent to wipe out its January gain and turn lower on the

year. The index capped its worst day since the U.S. lost its pristine

credit rating, topping the rout that followed China’s shock

devaluation of the yuan, the Brexit selloff and jitters heading into

the presidential election. Trading volume was almost double the

30-day average. All but two stocks in the broad gauge declined.

“This

is classic risk off that may not end any time soon,” says Win Thin,

head of emerging-market currency strategy at Brown Brothers Harriman.

Selling

accelerated shortly after 3 p.m. in New York, with the Dow sinking

more than 800 points in a matter of 15 minutes only to snap back. The

blue-chip index ended lower by 4.6 percent -- its steepest drop since

August 2011, and is also lower for the year. The Cboe Volatility

Index more than doubled to its highest level in 2 1/2 years.

Treasuries

popped, sending the 10-year yield down more than 10 basis points, and

gold future pushed higher. The dollar stabilized while the yen

advanced.

While

Friday’s market rout came amid U.S. wage data on Friday that

pointed to quickening inflation, which would lead to higher rates

and, in turn, rising borrowing costs for companies, the selling

Monday came amid few major data points.

“I

think sentiment was a little too optimistic,” said Brad McMillan,

chief investment officer for Commonwealth Financial Network. “What

was driving the market up in January? It wasn’t the fundamentals,

as good as they were, it was excessive confidence.”

Elsewhere,

oil extended declines after U.S. explorers raised the number of rigs

drilling for crude to the most since August. Copper climbed the most

in a week. Bitcoin slid below $7,000

Terminal

users can read more in our markets blog.

- Monetary policy decisions are due in Australia, Russia, India, Brazil, Poland, Romania, the U.K., New Zealand, Serbia, Peru and the Philippines.

- Earnings season continues with reports from Bristol-Myers Squibb, Ryanair, Toyota Motor Corp., BNP Paribas, BP, General Motors, Walt Disney, SoftBank, Sanofi, Philip Morris, Total, Tesla, Rio Tinto, L’Oreal and Twitter.

- Dallas Fed President Robert Kaplan and New York Fed President William Dudley are among policy officials due to speak in Frankfurt and New York.

These

are the main moves in markets:

Stocks

- The S&P 500 fell 4.1 percent as of 4 p.m. New York time.

- The Dow fell 1,178 points, or 4.6 percent, while the Nasdaq averages were off by more than 3.7 percent.

- The Stoxx Europe 600 Index declined 1.6 percent , hitting the lowest in almost 12 weeks with its sixth consecutive decline.

- The MSCI Emerging Markets Index lost 1.9 percent.

Currencies

- The Bloomberg Dollar Spot Index gained 0.3 percent.

- The euro decreased 0.5 percent to $1.2405.

- The British pound declined 0.8 percent to $1.4001, the weakest in almost two weeks.

- The Japanese yen gained 0.3 percent to 109.79 per dollar.

Bonds

- The yield on 10-year Treasuries fell four basis points to 2.81 percent.

- Germany’s 10-year yield declined three basis points to 0.74 percent, the largest decrease in almost six weeks.

- Britain’s 10-year yield declined two basis points to 1.558 percent.

Commodities

- West Texas Intermediate crude dipped 2.2 percent to $64.01 a barrel.

- Gold advanced 0.1 percent to $1,334.76 an ounce.

- Copper gained 1.8 percent to $7,169 per metric ton.

Bitcoin

Tumbles Almost 20% as Crypto Backlash Accelerates

- Lloyds joins U.S. banks in prohibiting purchases with cards

- Value of the biggest cryptocurrency drops by as much as $1,990

5

February, 2018

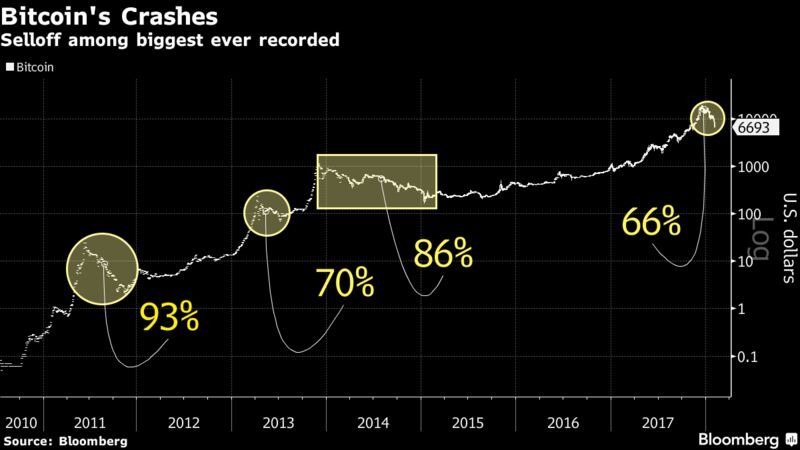

Bitcoin

tumbled for a fifth day, dropping below $7,000 for the first time

since November and leading other digital tokens lower, as a backlash

by banks and government regulators against the speculative frenzy

that drove cryptocurrencies to dizzying heights last year picks up

steam.

The

biggest digital currency sank as much as 22 percent to $6,579, before

trading at $7,054 as of 4:08 p.m. in New York, according to composite

Bloomberg pricing. It has erased about 65 percent of its value from a

record high $19,511 in December. Rival coins also retreated on

Monday, with Ripple losing as much as 21 percent and Ethereum and

Litecoin also weaker.

“Although

no fundamental change triggered this crash, the parabolic growth this

market has experienced had to slow down at some point,” Lucas

Nuzzi, a senior analyst at Digital Asset Research, wrote in an email.

“All that it took this time was a large lot of sell orders.”

Weeks

of negative news and commercial setbacks have buffeted digital

tokens. Lloyds Banking Group Plc joined a growing number of big

credit-card issuers have said they’re halting purchases of

cryptocurrencies on their cards, including JPMorgan Chase & Co.

and Bank of America Corp. Several cited risk aversion and a desire to

protect their customers.

SEC

Chairman Jay Clayton said he supports efforts to bring clarity to

cryptocurrency issues and that existing rules weren’t designed with

such trading in mind, according to prepared remarks for

a Senate Banking Committee hearing Tuesday on virtual currencies.

Bitcoin’s

longest run of losses since Christmas day has coincided with

investors exiting risky assets across the board, with

stocks retreating globally.

Bitcoin so far seems to be struggling to live up to any comparison

with gold as a store of value, which is an argument made by some of

its supporters. Bullion edged higher as other safe havens -- the yen,

Swiss franc and bonds -- also gained.

Regulators

in what have been some of the hottest market overseas are also

seeking to gain more control of trading. China will block all

websites, including foreign platforms, related to cryptocurrency

trading and initial coin offerings in an attempt to finally stamp out

speculation in the market, according to a South China Morning Post

report.

Meanwhile,

North Korea is trying to

hack South

Korea’s cryptocurrency-related programs to steal digital currencies

and has already stolen tens of billions of won worth, Yonhap News

reported. And authorities in digital-coin powerhouse South Korea and

other countries are weighing increased regulatory scrutiny of the

industry, news which helped spark the ongoing selloff.

Yet

some Bitcoin stalwarts remain unconcerned.

“There

are a few catalysts: people paying taxes, and general mean

reversion,” Kyle Samani, managing partner at crypto hedge fund

Multicoin Capital, said in an email. “Overall, this is probably

healthy given the run up in November-January.”

The

Market Just Erased All Of 2018 Gains, Distraction?, Watch Gold &

Cryptos!

No comments:

Post a Comment

Note: only a member of this blog may post a comment.