The

Problem Of Debt As We Reach Oil Limits

Gail

Tverberg

11

February, 2015

(This

is Part 3 of my series – A New Theory of Energy and the Economy.

These are links to Part

1 and Part

2.)

Many

readers have asked me to explain debt. They also wonder, “Why

can’t we just cancel debt and start over?”

if we are reaching oil limits, and these limits threaten to

destabilize the system. To answer these questions, I need to talk

about the subject of promises in general, not just what we would call

debt.

In

some sense, debt and other promises are what hold together our

networked economy. Debt

and other promises allow division of labor, because each person can

“pay” the others in the group for their labor with a promise of

some sort, rather than with an immediate payment in goods. The

existence of debt allows us to have many convenient forms of payment,

such as dollar bills, credit cards, and checks. Indirectly, the many

convenient forms of payment allow trade and even international trade.

Each

debt, and in fact each promise of any sort, involves two parties.

From the point of view of one party, the commitment is to

pay a certain amount (or

certain amount plus interest). From the point of view of the other

party, it

is a future benefit–an

amount available in a bank account, or a paycheck, or a commitment

from a government to pay unemployment benefits. The two parties are

in a sense bound together by these commitments, in a way similar to

the way atoms are bound together into molecules. We can’t get rid

of debt without getting rid of the benefits that debt

provides–something that is a huge problem.

There

has been much written about past debt bubbles and collapses. The

situation we are facing today is different. In the past, the world

economy was growing, even if a particular area was reaching limits,

such as too much population relative to agricultural land. Even if a

local area collapsed, the rest of the world could go on without them.

Now, the world economy is much more networked, so a collapse in one

area affects other areas as well. There is much more danger of a

widespread collapse.

Our

economy is built on economic growth. If the amount of goods and

services produced each year starts falling, then we have a huge

problem. Repaying loans becomes much more difficult.

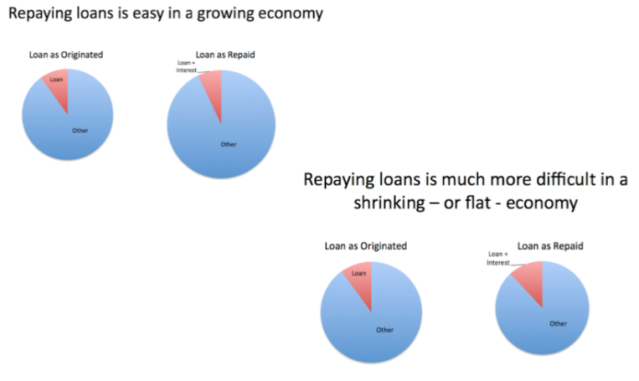

Figure

2. Repaying loans is easy in a growing economy, but much more

difficult in a shrinking economy.

In

fact, in an economic contraction, promises that aren’t debt, such

as promises to pay pensions and medical costs of the elderly as part

of our taxes, become harder to pay as well. The amount we have left

over for discretionary expenditures becomes much less. These

pressures tend to push an economy further toward contraction, and

make new promises even harder to repay.

The

Nature of Debt

In

a broad sense, debt is a promise of something of value in the future.

With this broad definition, it is clear that a $10 bill is a form of

debt, because it is a promise that at some point in the future you,

or the person you pass the $10 bill on to, will be able to exchange

the $10 bill for something of value. In a sense, even gold coins

are a promise of value in the future. This is not necessarily a

promise we can count on though. At times in the past, gold

coins have been confiscated.

Derivatives and other financial products have characteristics of debt

as well.

To

understand how important debt is, we need to think about an economy

without debt.Such

an economy might have a central market where everyone brings goods to

exchange. But even in such an economy, there will be a problem if

there is not a precise matching of needs. If I bring apples and you

bring potatoes, we could exchange with each other (“barter”). But

what if I don’t have a need for potatoes?

Then we might need to

bring a third person into the ring, so each of us can receive what we

want. Because barter is so cumbersome, barter

was never widely used for everyday transactions within communities.

An

approach that seemed to work better is one mentioned in David

Graeber’s book, Debt:

The First 5,000 Years.

With this system, a temple would operate a market. The operator of

the market would provide a “price” for each object, in terms of a

common unit, such as “bushels of wheat.” Each person could bring

goods to the market (and perhaps even services–I will work for a

day in your vineyard), and have them exchanged with others based on

value. No “money” was really needed because the operator would

take a clay tablet and on it make a calculation of the value in

“bushels of wheat” of what a person brought in goods, The

operator would also calculate the value in “bushels of wheat”

that the same person was receiving in return, and make certain that

the two matched.

Of

course, as soon as we start allowing “a day’s worth of labor ”

to be exchanged in this way, we get back to the problem of future

promises, and making certain that they really happen. Also, if we

allow a person to carry over a balance from one day to another–for

example, bringing in a large quantity of goods that cannot be sold in

one day–then we get into the area of future promises. Or if we

allow a farmer to buy seed on credit, with a promise to pay it back

when harvest comes in a few months, we again get into the area of

future promises. So even in this simple situation, we need to be able

to handle the issue of future promises.

Future

Promises Even Before Debt

Whenever

there is division of labor, there needs to be some agreement as to

how that division will take place–what are the responsibilities of

each participant. In the simplest case, we have hunters and

gatherers. If there is a decision that the men will do the hunting

and the women will do the gathering and care for children, then there

needs to be an agreement as to how the arrangement will work. The

usual approach seems to have been some sort of “gift

economy.”

In such an economy, everyone would share whatever they were able to

obtain with others, and would gain status by the amount they could

offer to share.

Instead

of a formal debt being involved, there was an understanding that if

people were to participate in the group, they had to follow the rules

that the particular culture dictated, including, very often, sharing

everything. People who didn’t follow the rules would be thrown out.

Because of the difficulty in living in such an environment alone,

such people would likely die. Thus, participants were in some sense

bound together by the customs that underlay gift economies.

At

some point, as more of an economy was built up, there would be a need

for one or more leaders, as well as some way of financially

supporting those leaders. Thus, there would need to be some sort of

taxation. While taxation to support the leader would not be

considered debt, it has many of the same characteristics as debt. It

is an ongoing payment obligation. The leader and the other members of

the group plan their lives as if this situation is going to continue.

In a way, the governmental services and the resulting taxation help

bind the economy together.

Benefits

of Debt

The

benefits of debt are truly great, including the following:

- Debt allows transactions to take place that are not precisely at the same time and place. I can order goods and have them delivered to my home. An employer can pay me for a month’s work with a check, rather than needing to give me food or some other barter item corresponding to each hour I work. There is no need to have billions of gold coins (or other agreed up metal currency) to facilitate each and every transaction, and to transport around. We can each have bank accounts. From the bank’s perspective, the amount in a bank account is a liability (debt) owed to the depositor.

- Additional debt gives additional purchasing power to individuals, governments or businesses. The additional funds available can be spent immediately. Very often, repayment (with interest) is spread over several years, making goods that would not be affordable, affordable. Thus debt raises “demand” for goods and also for the commodities used to create these goods.

- Because debt makes goods more affordable, additional debt tends to “pump up” the price of commodities. These higher prices make it worthwhile for businesses to extract more minerals (including fossil fuels) from the earth, and make it worthwhile to plant more acres of food. Debt, particularly cheap debt, makes building new factories and opening new mines more affordable for businesses.

- Debt allows a steep step-up in standard of living, such as that obtained by adding coal or oil to an economy. Debt allows goods to be purchased that will substantially change a person’s future, such as transit to a new country, or purchase of a college education, or purchase of a delivery vehicle that can be used to start a business. Without debt, it is unlikely that fossil fuels could ever have been extracted; consumers would never have been able to afford the goods provided by fossil fuels, and businesses would have had difficulty financing the many new factories required to make goods using these fuels.

- Adding debt is self-reinforcing. Suppose a considerable amount of debt is added for what is deemed a good purpose, such as extracting oil in North Dakota. Oil companies will use the debt they receive for many different purposes–including paying employees, paying royalties to land owners, and paying taxes to the state. Employees will buy new houses and cars, taking out loans in the process. North Dakota residents who receive royalty payments may decide to take out home improvement loans to fix up their homes, expecting that the royalties will continue. The state may fix its roads with its revenue, giving additional income (which may lead to more debt) to road workers. A grocery chain may decide to build a new store (borrowing money to do so), further pushing the chain along. What happens is that indirectly, the new oil company debt makes a lot of people at least temporarily wealthier. These temporarily wealthier individuals can then “qualify” for more in loans than would otherwise be the case, giving them more to spend, and allowing yet others to qualify for loans.

- Arrangements that are not debt, but more of the nature of contingent debt, make people feel more confident of the current system. There are insurance programs for pension programs and for bank accounts, up to a selected balance per account. These insurance programs generally don’t have very much money in them, relative to what they are insuring. But they make people feel good, especially if there is a government that might come in and take over, beyond the actual funding of the insurance program.

What

Goes Wrong with Debt and Other Financial Promises

1.

As mentioned at the beginning of the post, debt works very badly if

the economy is contracting.

It

becomes impossible to repay debt with interest, without reducing

discretionary income. Government programs, such as health care for

the elderly, become more expensive relative to current incomes as

well.

2.

Interest payments on debt tend to transfer wealth from the

poorer members of society to the richer members of society.

Economists

have tended to ignore debt, because it represents a more or less

balanced transaction between two individuals. The fact remains,

though, that the poorer members of society find themselves especially

in need of debt, and many pay very high interest rates. The ones

lending money tend to be richer. Because of this arrangement, over

time, interest payments tend to increase wealth disparities.

3.

All too often, the payment stream upon which debt depends proves

unsustainable.

In

the example given above, everyone thinks the North Dakota oil will

continue for a while, so takes out loans as if this is the case. If

it doesn’t, then this is an “Oops” situation.

In

the case of US student loans, many students are never able to get

jobs with high enough wages to pay back the loans they were given.

4.

Governments tend to put programs into place that are more

expensive than they really can afford, for the long term.

As

an economy gets wealthier (because of more fossil fuel use), there is

a tendency to add more programs. Representative government is used

instead of a monarch. Medical care and pensions for the elderly are

added, as are unemployment benefits, and more advanced levels of

schools.

Unfortunately,

it is hard to properly estimate what long-run cost of these programs

will be. Also, even if the programs were affordable with a high level

of fossil fuels, they almost certainly will not be affordable if

energy availability declines. It is virtually impossible to roll

programs back, even if they are not guaranteed, once people plan

their lives on the new programs.

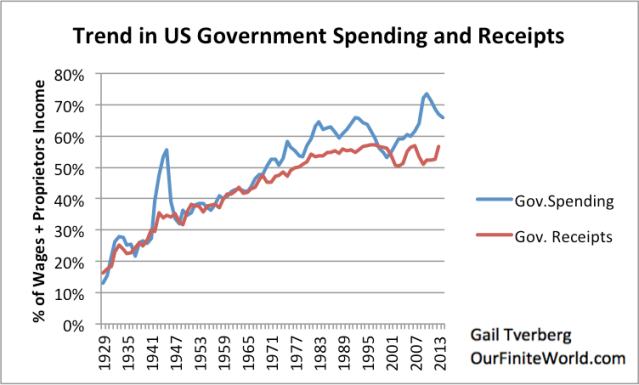

Figure

3 shows a graph of US government spending (all levels) compared to

wages (including amounts paid to proprietors, including farmers). I

use this base, rather than GDP, because wages have not been keeping

up with GDP in recent years. The amounts shown include programs such

as Social Security and Medicare for the elderly, in addition to

spending on things such as schools, roads, and unemployment

insurance.

Figure

3. Comparison of US Government spending and receipts (all levels

combined) based on US Bureau of Economic Research Data.

Clearly,

government spending has been rising much faster than wages. I would

expect this to be true in many countries.

5.

There is no real tie between amounts of debt issued and what

will actually be produced in the future.

We

are told that money

is a store of value,

and that it transfers purchasing power from the present to the

future. In other words, we can count on balances in our bank

accounts, and in fact, in all of the paper securities that are

outstanding.

This

story is only true if the economy can continue to create an

increasing amount of goods and services forever. If, in fact, the

production of goods and services drops off dramatically (most likely

because prices cannot rise high enough to encourage enough extraction

of commodities), then we have a major problem.

In

any year, all we have available is the actual amount of resources

that can be pulled out of the ground, plus the actual amount of food

that can be grown.

Together, these amounts determine how many goods

and services are available. Money acts to distribute the goods that

are available. Presumably, the people who work at extraction and

production of these goods and services need to be paid first, or the

whole process will stop. This basically leaves the “leftovers” to

be shared among those who are now being supported by tax revenue and

by those who hold paper securities of some sort or other. It is hard

to see that anyone other than the workers producing the goods and

services will get very much, if we lose the use of fossil fuels.

Workers will become less efficient, and production will drop by too

much.

6.

Derivatives and other financial products expose the financial system

to significant risks.

Certain

large banks have found that they can earn considerable revenue by

selling derivatives and other financial products, allowing people or

businesses to essentially gamble on certain outcomes–such as the

price of oil falling below a certain price, or interest rates rising

very rapidly, or a certain company failing. As long as everything

goes well, there is not a huge problem. The concern now is that with

rapidly changing commodity prices, and rapidly changing levels of

currencies, companies may fail and there may be major payouts

triggered.

In

theory, some of these payments may be offsetting–money owed by one

client may offset money owed to another client. But even if this is

the case, these defaults can sometimes take years to settle. There

may also be issues with one of the parties’ ability to pay.

One

particular problem with many of the products is the use of

the Black-Scholes

Pricing Model.

This model is applicable when events are independent and normally

distributed. This is not the case, when we are approaching oil limits

and other limits of a finite world.

7.

Governments tend to be badly affected by a shrinking economy, so may

be of little assistance when we need them most.

As

noted previously, payments to governments act very much like debt. As

an economy shrinks, programs that seemed affordable in the past

become less affordable and badly need to be cut. Thus, governments

tend to have problems at the exactly same time that banks and other

lenders do.

Governments

of “advanced” countries now

have debt levels that are high by historical standards. If

there is another major financial crisis, the plan seems to be to

use Cyprus-like

bail-ins of

banks, instead of bailing out banks using government debt. In a

bail-in, bank deposits are exchanged for equity in the failing

bank. For

example,

in Cyprus, 37.5% of deposits in excess of 100,000 euros were

converted to Class A shares in the bank.

This

approach has a lot of difficulties. Businesses have a need for their

funds, for purposes such as paying employees and building new

factories. If their funds are taken in a bail-in, the ability of the

business to continue may be damaged. Individual consumers depend on

their bank balances as well. As noted above, deposit insurance is

theoretically available, but the actual amount of funds for this

purpose is very low relative to the amount potentially at risk. So we

get back to the issue of whether governments can and will be able to

bail out banks and other failing financial institutions.

If

wages are rising fast enough, wages by themselves might be used to

pump demand for commodities, and thus raise their prices. Our wages

are close to flat–median

wages have been falling in

the US. If wages aren’t rising sufficiently, increasing debt must

be used to raise demand. Debt is growing slowly in the household

sector, according to figures compiled by McKinsey

Global Institute.

Household debt has grown by only 2.8% per year between Q4 2007 and Q4

2014, compared to 8.5% per year in the period between Q4 2000 and Q4

2007.

Even

with business demand included, debt isn’t rising rapidly enough to

keep commodity prices up. This lack of sufficient growth in debt (and

lack of growth in demand apart from growing debt) seems to be a major

reason for the drop

in prices since 2011 in many commodity prices.

9.

Differing policies with respect to interest rates and quantitative

easing seem to have the possibility of tearing the world financial

system apart.

In

a networked economy, not moving too far from the status quo is a

definite advantage. If the US’s policies have the effect of raising

the value of the dollar, and the policies of other countries have the

tendency to lower their currencies, the net effect is to make debt

held in other countries but denominated in US dollars unpayable. It

also makes goods sold by American companies unaffordable.

The

economy, as it exists today, has been made possible by countries

working together. With sanctions against Iran and Russia, we are

already moving away from this situation. Low oil prices are now

putting the economies of oil exporters at risk. As countries try

different approaches on interest rates, this adds yet another force,

pulling economies apart.

10.

The economy begins to act very strangely when too much of current

income is locked up in debt and debt-like instruments.

Economic

models suggest that if oil prices drop, demand for oil will grow

robustly and supply will drop off quickly. If oil producers are

protected by futures contracts that lock in a high price, they may

not respond in the manner expected. In fact, if they are obligated to

make debt payments, they may continue drilling even when it may not

otherwise make financial sense to do so.

Likewise,

consumers are also affected by prior commitments. If much of

consumers’ income is tied up with condominium payments, auto

payments, and payment of taxes, they may not have much ability to

respond to lower oil prices. Instead of increasing discretionary

spending, consumers may pay off some of their debt with their

newfound income.

Conclusion

If

the current economic system crashes and it becomes necessary to

create a new one, the new system will have to deal with having an

ever-smaller amount of goods and services available for a fairly long

transition time. Because

of this, the new system will have to be very different from the

current one. Most promises will need to be of short

duration. Transfers among people living in a particular

area might still be facilitated by a financial system, but it would

be hard to have long-term or long-distance contracts. As a

result, the new economy will likely need to be much simpler than our

current economy. It is doubtful it could include fossil fuels.

Many

people ask why we can’t just cancel all debt, and start over again.

To do so would probably mean canceling all bank accounts as well.

Most of our current jobs would probably disappear. We would probably

be without grid electricity and without oil for cars. It would be

very difficult to start over from such a situation. We would truly

have to start over from scratch.

I

have not talked about a distinction between “borrowed funds” and

“accumulated equity”. Such a distinction is important in terms of

the rate of return investors expect, but it is not as important in a

crash situation. Similarly, the difference between stocks, bonds,

pension plans, and insurance contracts becomes less important as

well. If there are real problems, anything that is not physical ends

up in the general category of “paper wealth”.

We

cannot count on paper wealth (or for that matter, any wealth) for the

long term. Each

year, the amount of goods and services the economy can produce is

limited by how the economy is performing, given limits we are

reaching. If the quantity of these goods and services starts falling

rapidly, governments may fail in addition to our problems with debts

defaulting. Those

holding paper wealth can’t count on getting very much. Workers

producing whatever goods and services are actually being produced

will likely need to be paid first.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.