Mother, who is 83 years old can't remember a *spontaneous* AND *pro-government* rally in her lifetime. In Greece, the barricades, the riot police -and the fear, are one

Eurogroup

Gives Greece 10 Day Ultimatum: Apply For Bailout Or Grexit

6

February, 2015

Update:

And now this:

- MOODY'S PLACES GREECE'S Caa1 GOVT. BOND RATING ON REVIEW FOR DOWNGRADE REVIEW

- GREECE CREDITOR TALKS UNCERTAINTY KEY DRIVER FOR MOODY'S REVIEW

- GREECE TALKS OUTCOME COULD BE NEGATIVE FOR FUNDING: MOODY'S

Surely

Greece must be delighted to be part of the European "Union"

at this point.

* *

*

Europe

has an unpleasant habit of dropping tape bombs at the most

inopportune of times, like at 3pm or later a Friday. And while on

Wednesday it was the ECB yanking repoable Greek collateral for local

banks, today it was first S&P, which downgraded Greece 5 months

after upgrading it, and moments ago it was none other than the Cyprus

bail-in man himself, the Eurogroup's Dijsselbloem, aka Diesel

"Blueprint" BOOM,

who just have Greece a 10 day ultimatum to fall into place or risk a

terminal bank run and capital controls (both hinted at earlier by the

post-DOJ settlement political "rating agency')

- GREECE MUST APPLY FOR BAILOUT EXTENSION ON FEB 16 AT THE LATEST TO KEEP EURO ZONE FINANCIAL BACKING -EUROGROUP CHAIRMAN DIJSSELBLOEM

This

means that Greece now has 10 days, or until the Monday after next to

decide whether it will stay in the Eurozone or Grexit. More

from Reuters:

[Yanis Varoufakis] made clear that the new government, which came to power on a wave of anti-austerity anger in elections last month, now wanted to forego remaining bailout money that had austerity strings attached:

"Greece is not asking for the remaining tranches of the current bailout programme - except the 1.9 billion euros that the ECB and the EU member states' central banks must return."

Euro zone finance ministers will discuss how to proceed with financial support for Athens at a special session next Wednesday ahead of the first summit of EU leaders with the new Greek prime minister, Alexis Tsipras, the following day.

However, the chairman of the finance ministers said the following meeting of theEurogroup on Feb. 16 would be Greece's last chance to apply for a bailout extension because some euro zone countries would need to consult their parliaments.

"Time will become very short if they (Greece) don't ask for an extension (by then)," said Jeroen Dijsselbloem.

The current bailout for Greece expires on Feb 28. Without it the country will not get financing or debt relief from its lenders and has little hope of financing itself in the markets.

* * *

Participants said no progress was made at a preparatory meeting of senior finance officials in Brussels on Thursday because Greece and its euro zone partners were so far apart.

"It was Greece against all others, basically one versus 18," one official said.

Almost

sounds like a reverse veto out of the European "Union".

At

the end of the day what D-Boom has effectively said is this:

Which

is precisely the thing Greece, whose negotiating position already has

been crushed with the threat of a wholesale bank run, did not want to

hear especially now that the government really has no choice: either

it complies with European demands, and can sign its resignation

right after having flopped epically, or it pushes on to find out just

how badly Europe is bluffing.

Suddenly

next week's emergency Eurogroup meeting on Wednesday is looking quite

fascinating. We hope the caterers have bulletproof jackets.

And

with that we give you... EUROPE!

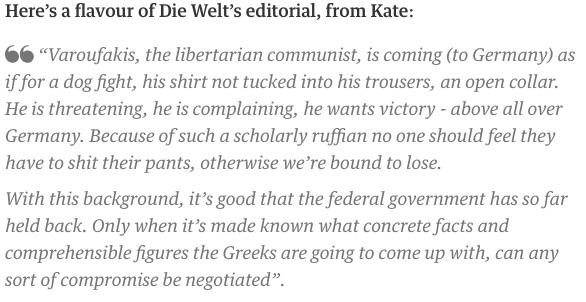

Yanis Varoufakis retweeted

Having dealt personally with both #Schauble & #Varoufakis - if anyone’s a bully, its #Schauble Nasty Op-Ed from @welt

Greece’s Syriza government vows to fight pressure to stick to bailout terms

Eurozone

ministers to hold special debt talks next week as new Greek

government rules out accepting a plan based on old bailout

6

February, 2015

Greece’s

radical Syriza government has vowed to keep fighting pressure from

its eurozone neighbours to stick to the strict terms of its bailout

package as battle lines were drawn ahead of crunch debt talks next

week.

Eurozone

finance ministers have called an emergency meeting for Wednesday

night in Brussels to discuss the Greek crisis after a whistlestop

tour of Europe by Yanis Varoufakis, Greece’s finance minister, made

little headway.

Germany

wants Greece to arrive with a plan on the repayment of €240bn

(£180bn) in bailout loans it received from the international

community. The special debt meeting will be followed on Friday by a

summit of European leaders, the first with Alexis Tsipras, the Greek

prime minister.

But

a government official ruled out accepting a plan based on the old

bailout and said Varoufakis would ask for a bridge agreement to tide

Athens over until it can present a new debt and reform programme. “We

will not accept any deal which is not related to a new programme,”

an official told Reuters news agency.

The

Syriza party swept to power on a promise to ditch the strict

austerity cuts tied to Greece’s bailout from the troika of lenders

– the European Union, European Central Bank and International

Monetary Fund. Now they are in government, Varoufakis and Tspiras

have spent the past week meeting their counterparts around Europe,

including the British chancellor, George Osborne, to push that same

message and argue that ending austerity would do more for economic

recovery than relentless cuts.

But

they got few concessions and a meeting in Germany with finance

minister Wolfgang Schäuble ended with a tense press conference as

Greece’s paymasters appeared as determined as ever to make Athens

stick to the deficit-cutting agenda and pay back the bailout money.

Greek

stock markets fell on Friday ending a volatile week of trading. Bank

shares were under pressure amid fears of a fresh run on Greek bank

deposits. Concerns were intensified this week by a decision from the

European Central Bank to tighten the rules on the collateral that

Greek banks can post in exchange for loans.

Standard

and Poor’s, the credit ratings agency, highlighted the tight

timeframe for Athens to reach a deal as it cut the credit rating on

Greek sovereign debt to “B-” from “B”.

The

ratings agency said: “The downgrade reflects our view that the

liquidity constraints weighing on Greece’s banks and its economy

have narrowed the timeframe during which the new government can reach

an agreement on a financing programme with its official creditors.

It

also raised the prospect of a Greek exit from the single currency

bloc.

“Although

the newly elected Greek government has been in power for less than

two weeks, we believe its limited cash buffers and approaching debt

redemptions to official preferred creditors constrain its negotiating

flexibility. In our view, a prolongation of talks with official

creditors could also lead to further pressure on financial stability

in the form of deposit withdrawals and, in a worst-case scenario, the

imposition of capital controls and a loss of access to

lender-of-last-resort financing, potentially resulting in Greece’s

exclusion from the Economic and Monetary Union.”

The

Athens FTSE banks index lost almost 10% while Greece’s broader ATG

shares index lost 2% from Thursday.

The

bailout from the troika – which came with stringent conditions,

including big spending cuts – is due to expire at the end of this

month. But for now many analysts appear hopeful a deal will be done

that avoids a Greek exit, or “Grexit”.

“We

still think that the Greek government and its creditors, including,

importantly, the ECB, will eventually come to an agreement on a

follow-up bailout that avoids Grexit and a default by the Greek

government,” economists at Citigroup saidon Friday

They

outlined two agreements that will be needed soon: “An interim

agreement (probably by end-February) to keep the Greek government and

Greek banks funded for up to four months, with the ECB playing a key

role during this period, and ... a more substantial and durable

agreement on a follow-up bailout to be struck during that period.”

“We

continue to expect an agreement on both fronts, but it would require

both sides to substantially narrow their differences and we see

material risks that either one of these negotiations will fail,”

the note said.

With

time tight and worries that the prospect of the Greek exit from the

eurozone will have repercussions around the world, the US again

intervened in the standoff on Friday.

After

a meeting with Tsipras, the US ambassador to Greece, David Pearce,

urged the new government to work cooperatively with its European

colleagues and the IMF and to keep on with reforms.

“Greece

should continue to make administrative and structural reforms and

exercise fiscal prudence,” the embassy said in a statement.

Yanis is a rock star in Athens

Thousands

Organize First Pro-Govt Rally in Athens

5

February, 2015

A

demonstration largely different from those Athens has seen in recent

years took place today in downtown Athens’ Syntagma Square. The

rally was called for 6.00 pm and was organized through social media.

It was the first pro-government demonstration organized in

Greece in recent years. Four years ago, in summer 2011 the

Spanish-inspired movement of the “Indignados” attracted thousands

of protestors rallying against austerity measures in the same square.

Once

again, the protestors’ request was the abolition of the austerity

policies imposed upon Greece. The crowds gathered in front of the

Greek Parliament in support of the new anti-austerity SYRIZA-led

government’s efforts to renegotiate the country’s international

debt. The chants were mostly against German Chancellor Angela Merkel

and Finance

Minister Wolfgang Schaeuble, who earlier today met with his Greek

counterpart in Berlin.

Apparently, the two Ministers did not come to an agreement regarding

the Greek bailout program’s future.

On

the opposite, Greek Finance Minister Yanis Varoufakis, emerging

lately as Greece’s new “super star,” was the protestor’s

favorite along with Prime Minister Alexis Tsipras.

“European

Central Bank (ECB) President Draghi chose to play Merkel’s game

again and blackmail the Greek people and the new Greek government,”

was, among others, declared in the demonstration’s declaration,

calling people to hold a peaceful protest in Syntagma Square against

ECB’s decision not to accept Greek bonds as loan collateral.

It

should be noted that police presence was null and it was the first

time protestors could even reach the Tomb of the Unknown Soldier and

the stairs

leading to the Greek Parliament, as

the iron fence that was installed there for years has been

removed by the new government.

Similar peaceful demonstrations were held in other major Greek

cities.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.