Tech

Wreck Trumps Bullard Bounce; Dollar Dumps As Bonds & Bullion Jump

3 June, 2019

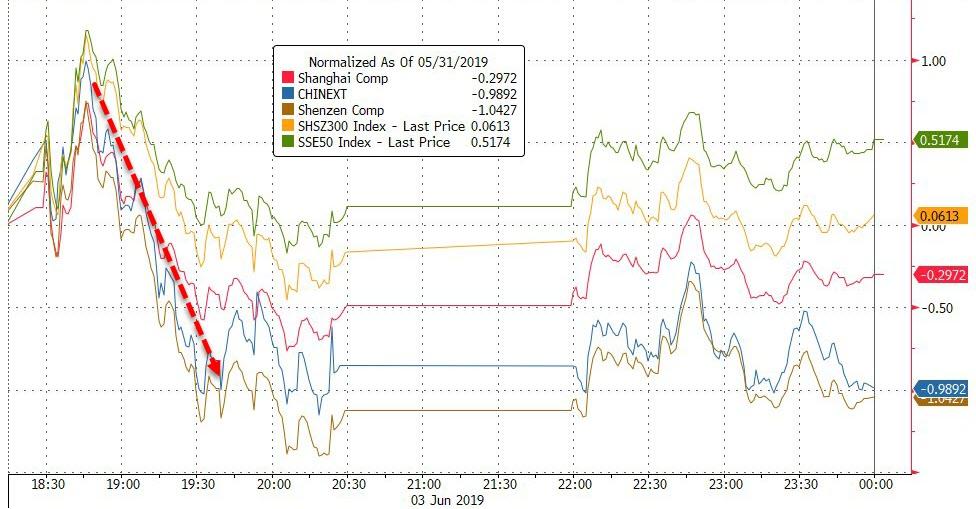

China opened optimistically, but faded soon after the open, only to flatline during the afternoon session...

European markets were the opposite, opening down hard then ramping all day long..

A double-whammy from Bullard boosted stocks briefly (but battered bond yields and the dollar)

1325ET FED'S BULLARD: RATE CUT MAY BE WARRANTED SOON TO LIFT INFLATION1505ET FED'S BULLARD: INFLATION BELOW TARGET IS ANOTHER RATE-CUT ARGUMENT

But tech-probe trouble trumped the Fed Put today...(Dow ended unch, S&P red and Nasdaq clubbed like a baby seal)

The reaction to the news that the DoJ is considering an antitrust investigation into Google parent Alphabet and an FTC probe of Facebook has been dramatic and justifiable in tech shares, with the Nasdaq 100 down hard today. But the reality is FAANG stocks have been in trouble for a while...

Today's bloodbath sent the Nasdaq back into correction territory (down 10.8% from highs)...

Credit markets are starting to crack more systemically...

Flashing very bright warning lights to stocks...

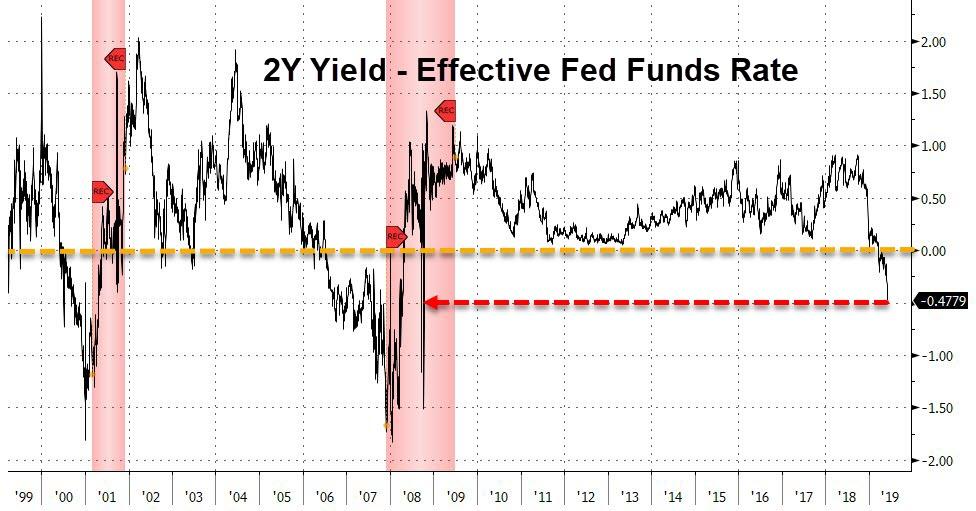

Bond yields continued to collapse, this time led by the short-end...

Yields are utterly collapsing...

Dramatically inverting the front-end of the curve...

And 3M-2Y is at 2007 crisis lows...

Which won't end well...

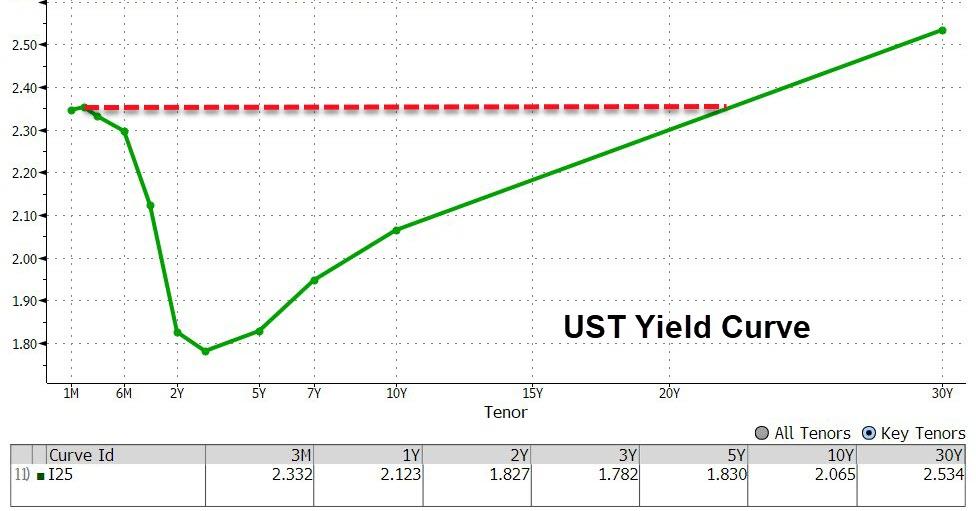

The entire curve is underwater now out to beyond the 20Y...

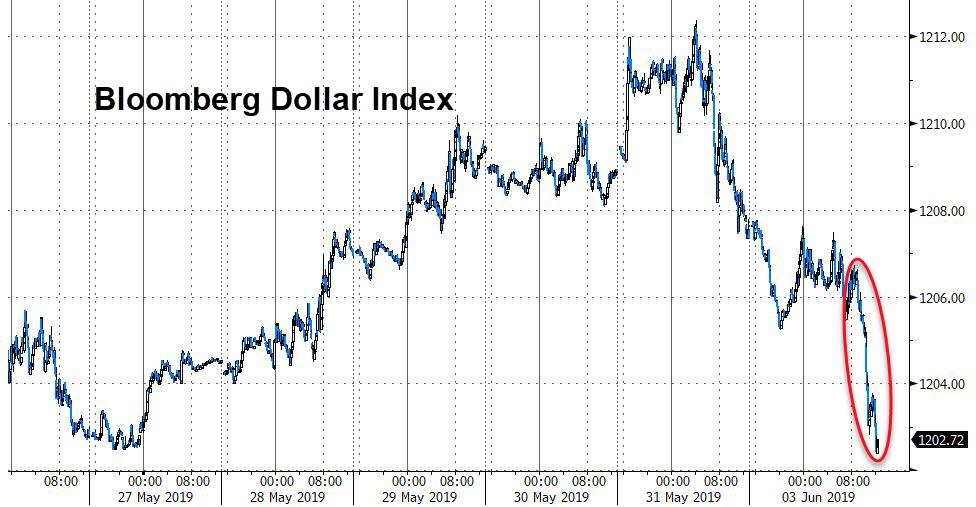

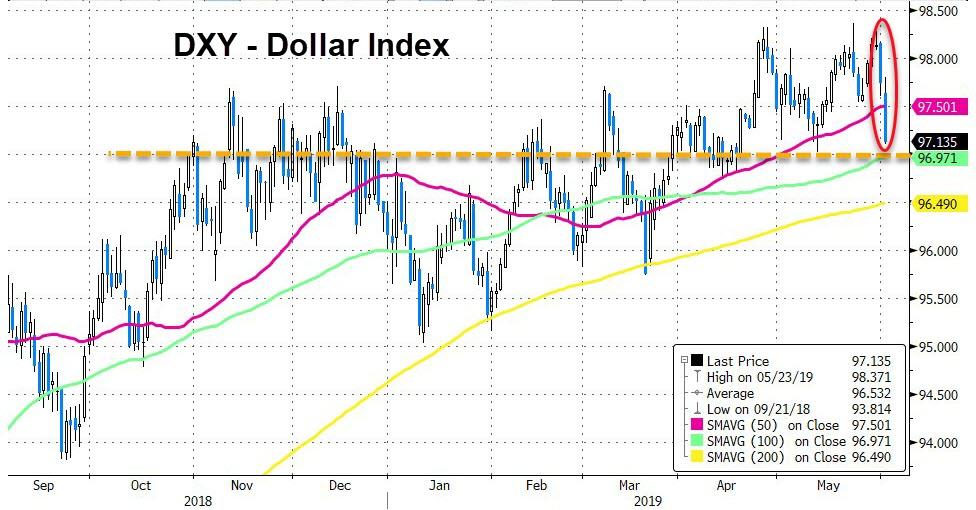

The Dollar tumbled on the day, accelerating lower after Bullard hinted at rate-cuts soon...

With DXY breaking down to the 97.00 Maginot Line...

Bitcoin is unchanged, Ripple higher...

PMs and copper gained as the dollar dropped but early gains for oil were eviscerated...

Despite dollar weakness, oil tumbled once again - now down almost 22% from April highs...

Gold extended its recent surge...

Pushing to almost 90.0x ratio with Silver...

And notably gold is dramatically outperforming Yuan reaching near 6-year highs...

Finally, the market is pricing in 3 rate-cuts by the end of 2020...

Is that really a good reason to buy stocks?

No comments:

Post a Comment

Note: only a member of this blog may post a comment.