From the former Assistant Secretary of the Treasury, Paul Craig Roberts

For

example, it

is normal in a recovering or expanding economy for the labor force

participation rate to rise as people enter the work force to take

advantage of the job opportunities. During

the decade of the long recovery, from June 2009 through May 2019, the

labor force participation rate consistently fell from 65.7 to 62.8

percent.

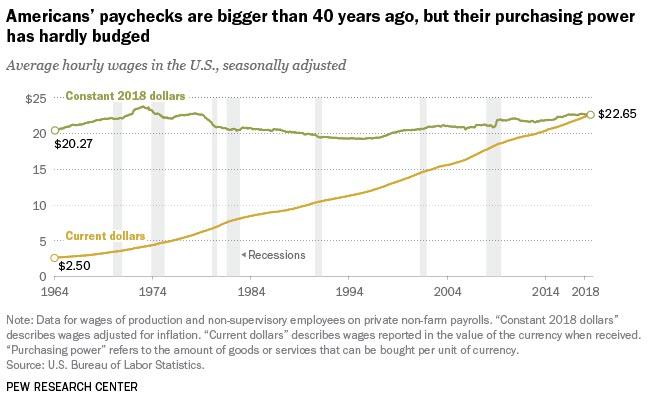

Real

retail sales cannot grow when “for

most U.S. workers, real wages have barely budged in decades.”

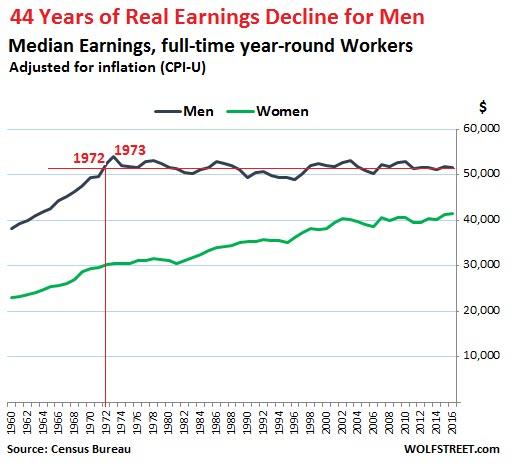

For

full-time employed men real wages have fallen 4.4% since 1973.

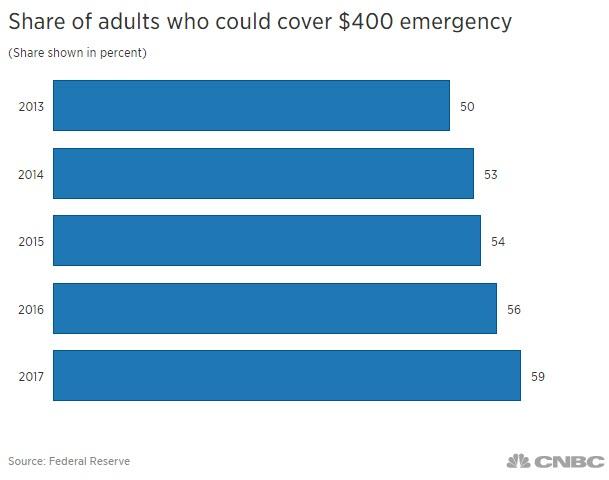

According

to Federal Reserve reports, 40

% of American households cannot raise $400 cash.

Paul

Craig Roberts Exposes The Diminishing American Economy

25

June, 2019

Since

June 2009 Americans have lived in the false reality of a recovered

economy. Various fake news and manipulated statistics have

been used to create this false impression.

However,

indicators that really count have not supported the false picture and

were ignored.

Another

characteristic of a long expansion is high and rising business

investment. However, American corporations have used their profits

not for expansion,

but to reduce their market capitalization by buying back their

stock. Moreover,

many have gone further and borrowed money in order to repurchase

their shares, thus indebting their companies as they reduced their

capitalization! That boards, executives, and shareholders

chose to loot their own companies indicates that the executives and

owners do not perceive an economy that warrants new investment.

How

is the alleged 10-year boom reconcilled with an economy in which

corporations see no investment opportunities?

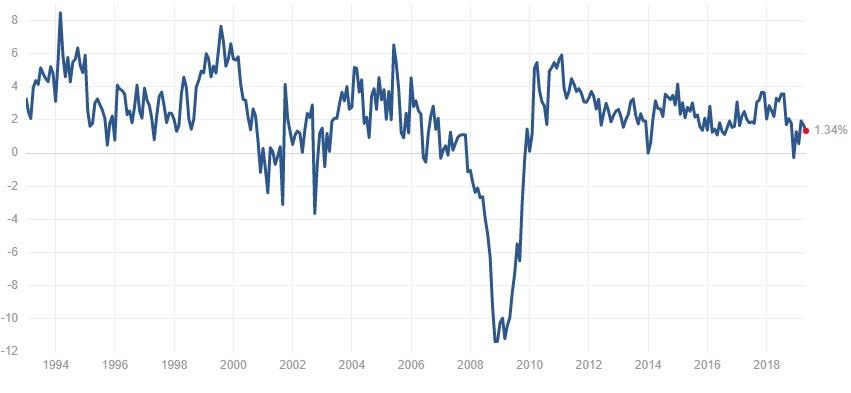

Over

the course of the alleged recovery, real

retail sales growth has declined,

standing today at 1.3%.

This

figure is an overstatement, because the measurement of inflation

has been

revised in ways that understate inflation. As

an example, the consumer price index, which formerly measured the

cost of a constant standard of living, now measures the cost of

a variable standard of living. If the cost of

an item in the index rises, the item is replaced by a lower cost

alternative, thus reducing the measured rate of inflation. Other

price increases are redefined as quality improvements, and their

impact on inflation is neutralized.

Economic

shills explain away the facts. For

example, they argue that people are working more hours, so their real

earnings are up although their real wages are not.

Others

argue that the declining labor force participation rate reflects baby

boomer retirements. Of course, if you look around in Home

Depot and Walmart, you will see many retirees working to supplement

their Social Security pensions that have been denied cost of living

adjustments by the undermeasurement of inflation.

Other

economic shills say that the low unemployment rate means there is a

labor shortage and that everyone who wants a job has one. They

don’t tell you that unemployment has been defined so as

to exclude millions of discouraged workers who could not find jobs

and gave up looking.

If

you have not looked for a job in the past 4 weeks, you are no longer

considered to be in the work force. Thus, your

unemployment does not count.

It

is expensive to look for employment. Scarce money has to

be spent on appearance and transportation, and after awhile the money

runs out. It is emotionally expensive as well. Constant

rejections hardly build confidence or hope. People turn to

cash odd jobs in order to survive. It turns out that many

of the homeless have jobs, but do not earn enough to cover

rent. Therefore, they live on the streets.

The

propagandistic 3.5% unemployment rate (U3) does not include any of

the millions of discouraged workers who cannot find jobs. The

government does have a seldom reported U6 measure of unemployment

that includes short-term discouraged workers. As of last

month this rate stood at 7.1%, more than double the 3.5% rate. John

Williams of shadowstats.com continues

to estimate the long-term discouraged workers, as the government

formerly did. He finds the actual US rate of unemployment

to be 21%.

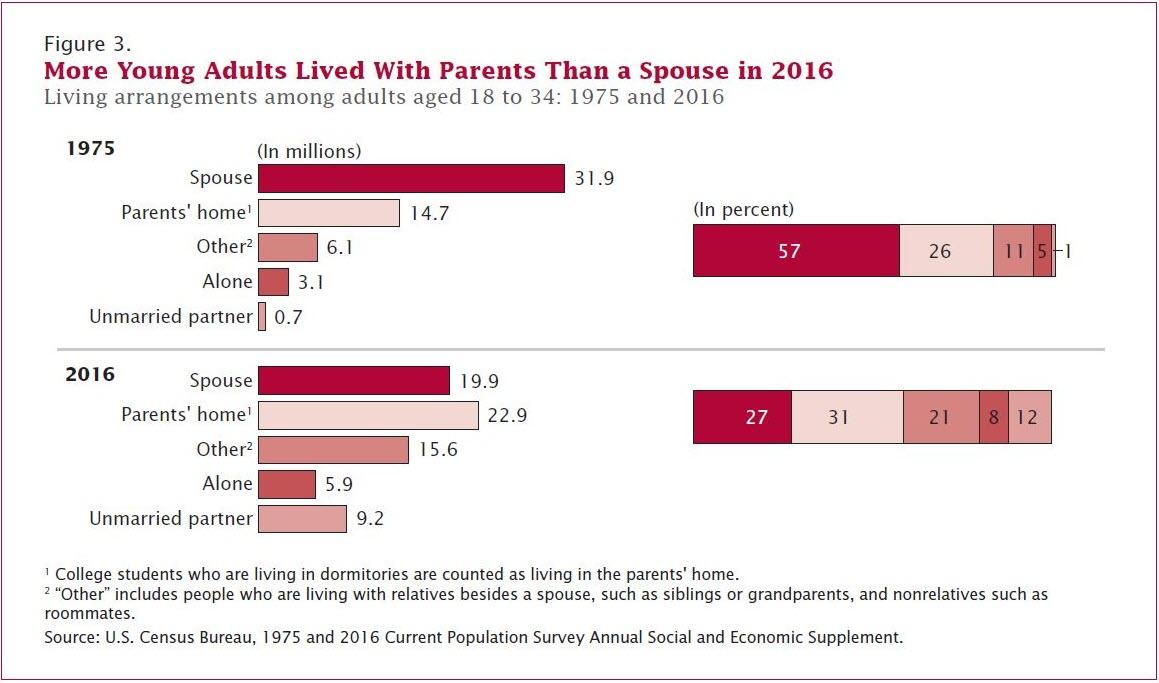

The

21% rate makes sense in light of Census Bureau reports that one-third

of Americans age 18-34 live at home with parents because

they can’t earn enough to support an independent existence

The

US economy was put into decline by short-sighted capitalist

greed. When the Soviet Union collapsed in the last decade

of the 20th century, India and China opened their economies to the

Western countries. Corporations saw in the low cost of

Chinese and Indian labor opportunities to increase their profits and

share prices by producing offshore the goods and services for their

domestic markets. Those hesitant to desert their home

towns and work forces were pushed offshore by Wall Street’s threats

to finance takeovers unless they increased their profits.

The

shift of millions of high productivity, high value-added American

jobs to Asia wrecked the careers and prospects of millions of

Americans and severely impacted state and local budgets and pension

funds.

The

external costs of jobs offshoring were extremely high. The cost to

the economy far exceeded the profits gained by jobs

offshoring.

The

“trade war” with China is an orchestration to cover up the fact

that America’s economic problems are the result of its own

corporations and Wall Street moving American jobs offshore and

because the US government did nothing to stop the deconstruction of

the economy.

The

Reagan administration’s supply-side economic policy, always

misrepresented and wrongly described, cured stagflation, the malaise

of rising inflation and unemployment described at the time as

worsening “Phillips curve” trade-offs between inflation and

unemployment. No one has seen a Phillips curve since the

Reagan administration got rid of it. The Federal Reserve

hasn’t even been able to resurrect it with years of money

printing. The Reagan administration had the economy poised

for long-run non-inflationary growth, a prospect that was foiled by

the rise of jobs offshoring.

Normally

a government would be protective of jobs as the government wants to

take in tax revenues rather than to pay out unemployment and social

welfare benefits. Politicians want economic success, not

economic failure. But greed overcame judgment, and the

economy’s prospects were sacrificed to short-term corporate and

Wall Street greed.

The

profits from jobs offshoring are short-term, because jobs offshoring

is based on the fallacy of composition—the assumption that what is

true for a part is true for the whole. An individual

corporation, indeed a number of corporations, can benefit by

abandoning its domestic work force and producing abroad for its

domestic market. But when many firms do the same, the impact on

domestic consumer income is severe. As Walmart jobs don’t pay

manufacturing wages, aggregate consumer demand takes a hit from

declining incomes, and there is less demand for the offshoring firms’

products. Economic growth falters. When this happened, the

solution of Alan Greenspan, the Federal Reserve Chairman at the time,

was to substitute an expansion of consumer debt for the missing

growth in consumer income.

The

problem with his solution is that the growth of consumer debt is

limited by consumer income. When the debt can’t be

serviced, it can’t grow. Moreover, debt service drains income

into interest and fee charges, further reducing consumer purchasing

power.

Thus,

the offshoring of jobs has limited the expansion of aggregate

consumer demand. As corporations are buying back their

stock instead of investing, there is nothing to drive the

economy. The economic growth figures we have been seeing

are illusions produced by the understatement of inflation.

Much

of America’s post-World War II prosperity and most of its power are

due to the US dollar’s role as world reserve currency.

This

role guarantees a worldwide demand for dollars, and this demand for

dollars means that the world finances US budget and trade deficits by

purchasing US debt. The world gives us goods and services

in exchange for our paper money. In other words, being the

reserve currency allows a country to pay its bills by printing money.

A

person would think that a government would be protective of such an

advantage and not encourage foreigners to abandon dollars. But

the US government, reckless in its arrogance, hubris, and utter

ignorance, has done all in its power to cause flight from the

dollar.

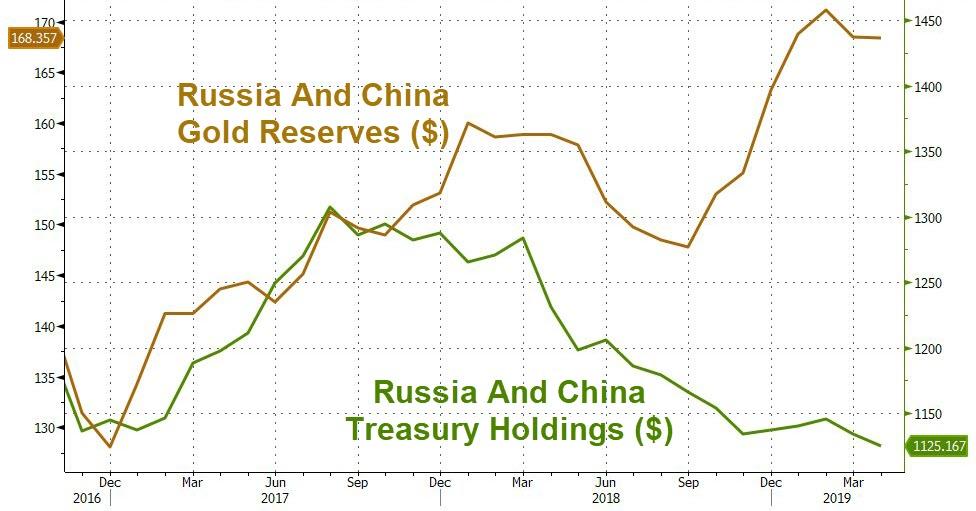

The

US government uses the dollar-based financial system to coerce other

countries to accommodate American interests at their

expense. Sanctions on other countries, threats of

sanctions, asset freezes and confiscations, and so forth have driven

large chunks of the world—Russia, China, India, Iran—into

non-dollar transactions that reduce the demand for dollars. Threats

against Europeans for purchasing Russian energy and Chinese

technology products are alienating elements of Washington’s

European empire.

A

country with the massive indebtedness of the US government would

quickly be reduced to Third World status if the value of the dollar

collapsed from lack of demand.

There

are many countries in the world that have bad leadership, but US

leadership is the worst of all. Never very good, US

leadership went into precipitous and continuous decline with the

advent of the Clintons, continuing through Bush, Obama, and

Trump. American credibility is at a low point. Fools like

John Bolton and Pompeo think they can restore credibility by blowing

up countries. Unless the dangerous fools are fired, we

will all have to experience how wrong they are.

Formerly

the Federal Reserve conducted monetary policy with the purpose of

minimizing inflation and unemployment, but today and for the past

decade the Federal Reserve conducts monetary policy for the purpose

of protecting the balance sheets of the banks that are “too big to

fail” and other favored financial institutions. Therefore, it

is problematic to expect the same results.

-

Today it is possible to have a recession and to maintain high prices of financial instruments due to Fed support of the instruments.

-

Today it is possible for the Fed to prevent a stock market decline by purchasing S&P futures,...

-

...and to prevent a gold price rise by having its agents dump naked gold shorts in the gold futures market.

Such

things as these were not done when I was in the Treasury. This

type of intervention originated in the plunge protection team created

by the Bush people in the last year of the Reagan administration.

Once the Fed learned how to use these instruments, it has done so

more aggressively.

Market

watchers who go by past trends overlook that today market

manipulation by central authorities plays a larger role than in the

past.

They

mistakenly expect trends established by market forces to hold in a

manipulated economic environment.

*

* *

No comments:

Post a Comment

Note: only a member of this blog may post a comment.