Is Europe developing some balls?

Meanwhile the G20 has given a chance to pretend the world is not headed to wall.

Western, corporate media does nothing but pretend.

This is EXTREMELY serious unless someone backs down.

Trump To Unleash Hell On

Europe: EU Announces

Channel To Circumvent

SWIFT And Iran Sanctions Is

Now Operational

28

June, 2019

With

the world waiting for the first headlines from the Trump-Xi meeting,

the most important and unexpected news of the day hit moments ago,

when Europe announced that the special trade channel, Instex,

that will allow European firms to avoid SWIFT and bypass American

sanctions on Iran, is now operational.

Following

a meeting between the countries who singed the Iran nuclear deal,

also known as the Joint Comprehensive Plan of Action (JCPOA), which

was ditched by US, French, British and German officials said the

trade mechanism which was proposed last summer and called Instex, is

now operational.

As

a reminder, last September, in order to maintain a financial

relationship with Iran that can not be vetoed by the US, Europe

unveiled a "Special Purpose Vehicle" to bypass SWIFT. The

mechanism would facilitate transactions between European and Iranian

companies, while preventing the US from vetoing the transactions and

pursuing punitive measures on those companies and states that defied

Trump. The payment balancing system will allow companies in Europe to

buy Iranian goods, and vice-versa, without actual money-transfers

between European and Iranian banks.

The

statement came after the remaining signatures of JCPOA gathered in

Vienna for a meeting that Iranian ministry spokesman Abbas Mousavi

called "the

last chance for the remaining parties...to gather and see how they

can meet their commitments towards Iran."

Until

today, Tehran was skeptical about EU's commitment to the deal and

threatened to exceed the maximum amount of enriched uranium allowed

it by the deal after US had imposed a series of sanctions on the

country.

Meanwhile,

opponents of Instex - almost exclusively the US - have argued that

the mechanism is flawed because the Iranian institution designated to

work with Instex, the Special Trade and Finance Instrument, has

shareholders with links to entities already facing sanctions from the

U.S.

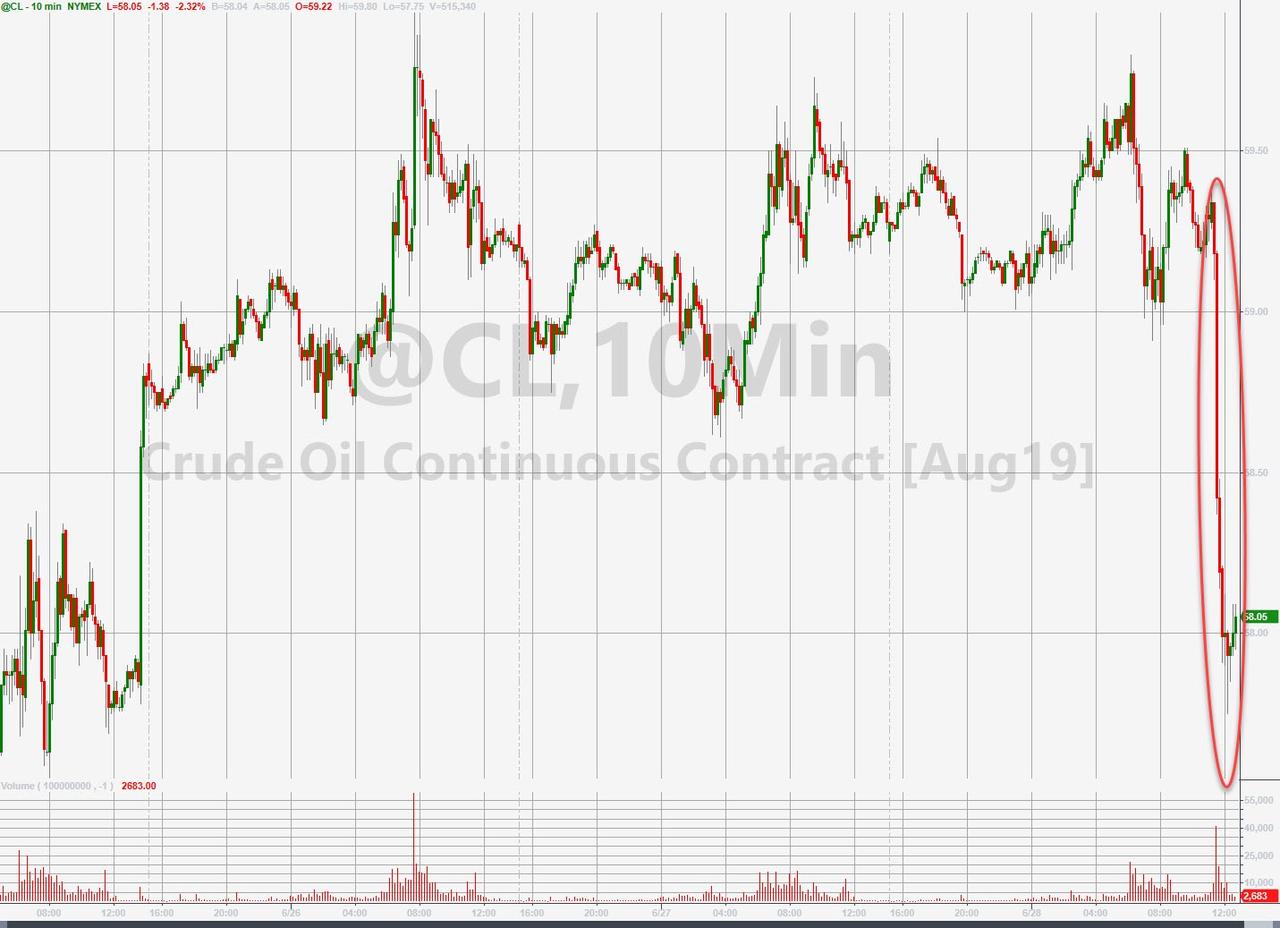

The

announcement sent oil sharply lower, with crude futures falling about

$1/bbl in closing minutes before settlement, extending daily loss, as

it means Iran now has a fully functioning pathway to receive payment

for oil it exports to anyone it chooses.

The

announcement will likely send president Trump off the rails, because

in late May Bloomberg reported that as part of Trump's escalating

battle with "European allies" over the fate of the Iran

nuclear accord, he was "threatening penalties against the

financial body created by Germany, the U.K. and France to shield

trade with the Islamic Republic from U.S. sanctions" including

the loss of access to the US financial system.

Germany,

France and the U.K. finalized the Instex system in January, allowing

companies to trade with Iran without the use of U.S. dollars or

American banks, allowing them to get around wide-ranging U.S.

sanctions that were imposed after the Trump administration abandoned

the 2015 Iran nuclear deal last year.

“This

is a shot across the bow of a European political establishment

committed to using Instex and its sanctions-connected Iranian

counterpart to circumvent U.S. measures,” said Mark Dubowitz, the

chief executive officer of the Foundation for Defense of Democracies

in Washington.

*

* *

When

asked to comment on the letter, the Treasury Department issued a

statement saying “entities that transact in trade with the Iranian

regime through any means may expose themselves to considerable

sanctions risk, and Treasury intends to aggressively enforce our

authorities.”

The

US ire was sparked by the realization - and alarm - that cracks are

appearing in the dollar's reserve status, opponents of Instex argue -

at least for public consumption purposes - that the mechanism is

flawed because

the Iranian institution designated to work with Instex, the Special

Trade and Finance Instrument, has shareholders with links to entities

already facing sanctions from the U.S

.

Separately,

during a visit to London on May 8, Mike Pompeo also warned that

there was no need for Instex because the U.S. allows for humanitarian

and medical products to get into Iran without sanction.

“When

transactions move beyond that, it doesn’t matter what vehicle’s

out there, if the transaction is sanctionable, we will evaluate it,

review it, and if appropriate, levy sanctions against those that were

involved in that transaction,” Pompeo said. “It’s very

straightforward.”

In

conclusion, one month ago we said that "In 2018, Europe made a

huge stink about not being bound by Trump's unilateral breach of the

Iranian deal, and said it would continue regardless of US threats.

But now that the threats have clearly escalated, and Washington has

made it clear it won't take no for an answer, it will be interesting

to see if Europe's resolve to take on Trump - especially in light of

the trade war with China - has fizzled. "

The

answer, it appears is that Europe felt unexpectedly emboldened, just

hours before Trump's meeting with Xi, and that it is ready and

willing to call Trump's bluff; it goes without saying, that if the US

does indeed retaliate and proceed with sanctions against European

banks, than the global trade war is about to turn far, far uglier.

Europe Activates "INSTEX" to Trade with Iran; US Threatens Sanctions - EUROPE THREATENS TO PULL ALL FUNDS FROM U.S. BANKS!

Hal Turner,

28 June, 2019

With the world waiting for the first headlines from the Trump-Xi meeting, the most important and unexpected news of the day hit moments ago, when Europe announced that the special trade channel, Instex, that will allow European firms to avoid SWIFT and bypass American sanctions on Iran, is now operational.

Following a meeting between the countries who singed the Iran nuclear deal, also known as the Joint Comprehensive Plan of Action (JCPOA), which was ditched by US, French, British and German officials said the trade mechanism which was proposed last summer and called Instex, is now operational.

As

a reminder, last September, in order to maintain a financial

relationship with Iran that can not be vetoed by the US, Europe

unveiled a "Special Purpose Vehicle" to bypass SWIFT. The

mechanism would facilitate transactions between European and Iranian

companies, while preventing the US from vetoing the transactions and

pursuing punitive measures on those companies and states that defied

Trump. The payment balancing system will allow companies in Europe to

buy Iranian goods, and vice-versa, without actual money-transfers

between European and Iranian banks.

The

statement came after the remaining signatures of JCPOA gathered in

Vienna for a meeting that Iranian ministry spokesman Abbas Mousavi

called "the last chance for the remaining parties...to

gather and see how they can meet their commitments towards Iran."

Until

today, Tehran was skeptical about EU's commitment to the deal and

threatened to exceed the maximum amount of enriched uranium allowed

it by the deal after US had imposed a series of sanctions on the

country.

Meanwhile,

opponents of Instex - almost exclusively the US - have argued that

the mechanism is flawed because the Iranian institution designated to

work with Instex, the Special Trade and Finance Instrument, has

shareholders with links to entities already facing sanctions from the

U.S.

The

announcement will likely send president Trump off the rails, because

in late May Bloomberg reported that as part of Trump's escalating

battle with "European allies" over the fate of the Iran

nuclear accord, he was "threatening penalties against the

financial body created by Germany, the U.K. and France to shield

trade with the Islamic Republic from U.S. sanctions" including

the loss of access to the US financial system.

According

to Bloomberg, the Treasury Department’s undersecretary for

terrorism and financial intelligence, Sigal Mandelker, sent a letter

on May 7 warning that Instex, the European SPV to sustain trade with

Tehran, and

anyone associated with it could be barred from the U.S. financial

system if it goes into effect.

“I

urge you to carefully consider the potential sanctions exposure of

Instex,” Mandelker

wrote in an ominous letter to Instex President Per Fischer. "Engaging

in activities that run afoul of U.S. sanctions can result in severe

consequences, including a loss of access to the U.S. financial

system."

Germany,

France and the U.K. finalized the Instex system in January, allowing

companies to trade with Iran without the use of U.S. dollars or

American banks, allowing them to get around wide-ranging U.S.

sanctions that were imposed after the Trump administration abandoned

the 2015 Iran nuclear deal last year.

“This

is a shot across the bow of a European political establishment

committed to using Instex and its sanctions-connected Iranian

counterpart to circumvent U.S. measures,” said Mark Dubowitz, the

chief executive officer of the Foundation for Defense of Democracies

in Washington.

Here

is a simpler summary of what just happened: this

was the first official shot across the bow of the USD status as a

global reserve currency, and not by America's adversaries but by its

closest allies.

And once those who benefit the most from the status quo openly revolt

against it, the countdown to the end of the USD reserve status

officially begins.

When

asked to comment on the letter, the Treasury Department issued a

statement saying “entities that transact in trade with the Iranian

regime through any means may expose themselves to considerable

sanctions risk, and Treasury intends to aggressively enforce our

authorities.”

The

US ire was sparked by the realization - and alarm - that cracks are

appearing in the dollar's reserve status, opponents of Instex argue -

at least for public consumption purposes - that the mechanism is

flawed because

the Iranian institution designated to work with Instex, the Special

Trade and Finance Instrument, has shareholders with links to entities

already facing sanctions from the U.S.

Separately,

during a visit to London on May 8, Mike Pompeo also warned that

there was no need for Instex because the U.S. allows for humanitarian

and medical products to get into Iran without sanction.

“When

transactions move beyond that, it doesn’t matter what vehicle’s

out there, if the transaction is sanctionable, we will evaluate it,

review it, and if appropriate, levy sanctions against those that were

involved in that transaction,” Pompeo said. “It’s very

straightforward.”

In

conclusion, one month ago we said that "In 2018, Europe made a

huge stink about not being bound by Trump's unilateral breach of the

Iranian deal, and said it would continue regardless of US threats.

But now that the threats have clearly escalated, and Washington has

made it clear it won't take no for an answer, it will be interesting

to see if Europe's resolve to take on Trump - especially in light of

the trade war with China - has fizzled. "

The

answer, it appears is that Europe felt unexpectedly emboldened, just

hours before Trump's meeting with Xi, and that it is ready and

willing to call Trump's bluff; it goes without saying, that if the US

does indeed retaliate and proceed with sanctions against European

banks, than the global trade war is about to turn far, far uglier.

LATE

BREAKING UPDATE 6:26 PM EDT -- Europe

has told the US Treasury that if the United States begins sanctioning

any European country or company over Iran trade, European entities

will WITHDRAW their funds from US Banks and Financial Markets,

sending certain banks into collapse immediately

And from Iran's Press TV

Iran's

deputy foreign minister says progress has been made in Vienna talks

aimed at saving the 2015 nuclear deal with world powers but the

demands of the Islamic Republic are yet to be met.

"It

was a step forward, but it is still not enough and not meeting Iran’s

expectations," Abbas Araqchi told reporters on Friday after

almost four hours of talks with senior diplomats from Britain, China,

France, Germany and Russia.

On

Friday, the remaining signatories of the nuclear agreement met in the

Austrian capital as a last-ditch effort to save the accord after the

US withdrew last year.

US

President Donald Trump withdrew Washington in May 2018 from the

multilateral nuclear accord, officially known as the Joint

Comprehensive Plan of Action (JCPOA), which was reached between Iran

and six world powers in 2015.

Afterwards,

Washington re-imposed unilateral sanctions on Iran that had been

lifted under the deal.

European

signatories to the nuclear deal are facing a two-month ultimatum to

help Iran navigate US sanctions or see Tehran take the second step of

reducing its commitments on July 7.

In

early May, Tehran suspended limits on its production of enriched

uranium and heavy water, moves that did not technically violate the

deal but signaled that its patience was wearing thin.

Referring

to Iran's decision to go over the deal's core atomic restrictions,

Araqchi said, "The decision to reduce our commitments has

already been made in Iran and we continue on that process unless our

expectations are met."

"I

don’t think the progress made today will be enough to stop our

process but the decision will be made in Tehran," he added.

Iran

says it will take the second step in reducing its commitments under

the 2015 nuclear deal more “firmly” if a European payment system

designed to bypass sanctions proves to be "superficial".

'INSTEX

operational'

Araqchi

said the Europeans have confirmed that the planned INSTEX trade

mechanism is now “operational” and the first transactions are

already processed.

However,

the Iranian official added that this was still insufficient because

European countries were not buying Iranian oil.

"For

INSTEX to be useful for Iran, Europeans need to buy oil or consider

credit lines for this mechanism otherwise INSTEX is not like they or

us expect," he said.

The

European Union also issued a statement, saying the special trade

channel was up and running

"France,

Germany and the United Kingdom informed participants that INSTEX had

been made operational and available to all EU member states and that

the first transactions are being processed," sad the statement.

The

trade mechanism was established last year after the US' withdrawal

from the JCPOA.

France,

Germany and Britain had been tinkering with INSTEX for months without

making it operational, leaving Iran wondering whether they are

serious about the idea.

In

a joint statement earlier on Friday, Austria, Belgium, Finland, the

Netherlands, Slovenia, Spain and Sweden, said they were working with

the E3 to develop trade mechanisms.

Araqchi

said all the parties in Vienna had agreed to hold a ministerial

meeting "very soon."

China

to continue to import Iranian oil

China

has rejected the imposition of unilateral US sanctions on Iran,

saying it would import Iranian oil in defiance of Washington’s bans

on Tehran.

"We

reject the unilateral imposition of sanctions," said Fu Cong,

the director general of the Chinese Foreign Ministry's Department of

Arms Control, on Friday.

Cong

made the remarks a day before US and Chinese leaders are to meet on

the sidelines of the G20 summit in Japan in an attempt to resolve

trade disputes.

"For

us energy security is important and the importation of oil is

important to Chinese energy security and also to the livelihood of

the people," said Cong.

American

special envoy for Iran Brian Hook has said the US will sanction any

country that imports oil from the Islamic Republic and there are no

exemptions in this regard

The

Trump administration said on April 22 that, in a bid to reduce Iran's

oil exports to zero, buyers of Iranian oil must stop purchases by May

1 or face sanctions. The move ended six months of waivers, which

allowed Iran’s eight biggest buyers -- Turkey, China, Greece,

India, Italy, Japan, South Korea and Taiwan -- to continue importing

limited volumes.

"We

do not accept this so-called zero policy of the United States,"

said Cong, who was speaking on the sidelines of a meeting on the

implementation of the Iranian nuclear deal.

The

United States' insistence on zeroing out Iran's oil exports has

caused many problems in the global market, keeping confused both

experts and buyers as they look straight into what is shaping up to

be a chaotic chapter for the petroleum industry.

China and several other major purchasers of Iranian oil have already complained to the US about the decision.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.