Fed Disaster: S&P Futures

Crash, Halted Limit Down;

Gold, Treasuries Soar After

Historic Fed Panic

15 March, 2020

The Fed may have a very big problem on its hands.

After firing the biggest emergency "shock and awe" bazooka in Fed history, one which was meant to restore not just partial but full normalcy to asset and funding markets, Emini futures are not only not higher, but tumbling by the -5% limit down at the start of trading...

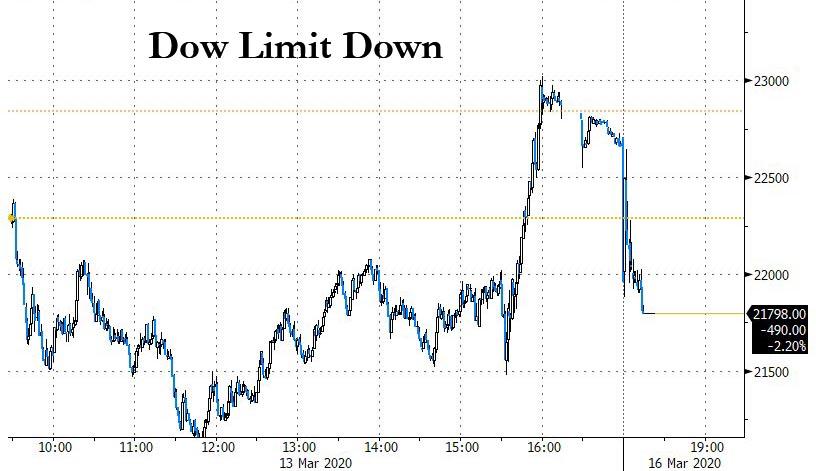

... Dow futures down 1,000 and also limit down...

... the VIX surging 14%....

... perhaps because the Fed has not only tipped its hand that something is very wrong by simply waiting an additional three days until the March 18 FOMC, but that it can do nothing more to fix the underlying problem, while gold is surging over 3% following today's dollar devastation (if only until risk parity funds resume their wholesale liquidation at some point this evening)...

... as US Treasury futures soar (which will also likely be puked shortly once macro funds are hit again on their basis trades), as it now appears that the Fed's emergency rate cut to 0% coupled with a $700BN QE is seen as note enough by a market which is now openly freaking out that the Fed is out of ammo and has not done enough.

In short, with the ES plunging limit down, this has been an absolutely catastrophic response to the Fed's bazooka; expect negative interest rates across the curve momentarily.

As FX strategist Viraj Patel puts it, "the Fed has thrown a kitchen sink of policy measures that should in theory weaken the US dollar. Problem is the global backdrop due to Covid-19 isn't conducive to putting money to work in other countries/FX. Fed making US risky assets relatively more attractive may support $USD"

No comments:

Post a Comment

Note: only a member of this blog may post a comment.