Fear

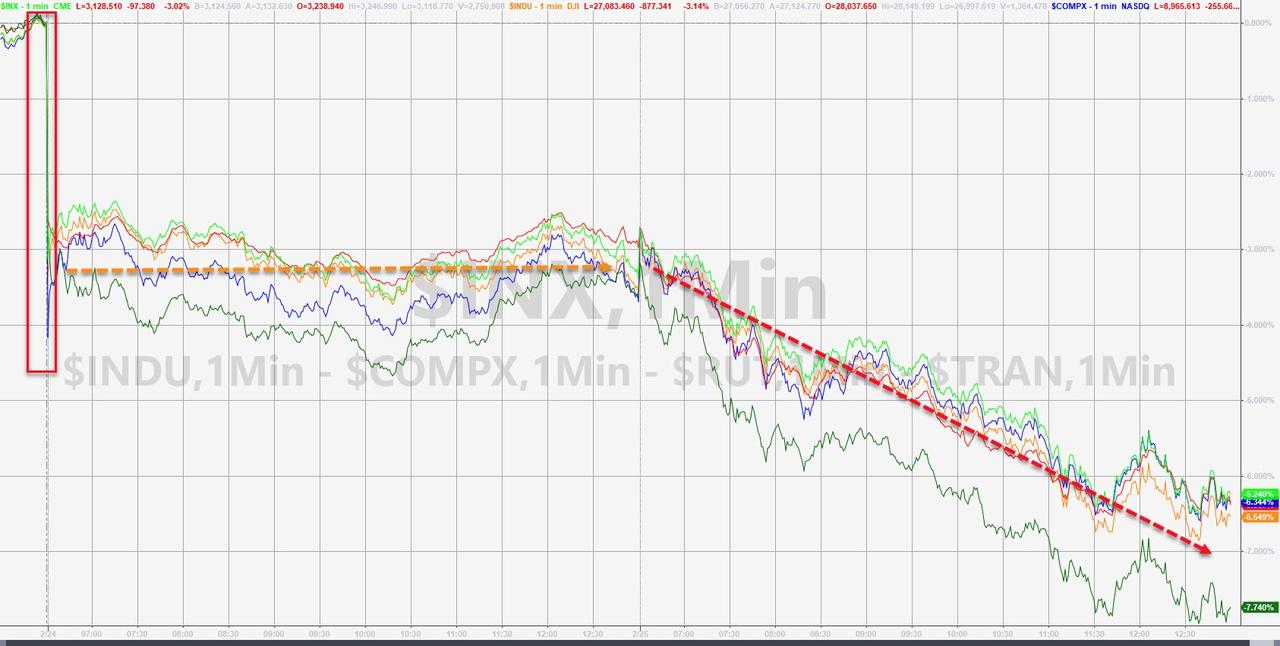

of COVID-19 coronavirus spreading globally is driving down US stock

markets, with the Dow Jones Industrial Average sliding by almost 900

points before recovering slightly to close at 27,081.36.

Nasdaq

composite dropped by 255 points (2.77 percent) by Tuesday closing,

while the S&P 500 was down 97 points (3 percent).

Tuesday’s

downturn follows Monday’s numbers, when the Dow lost more than

1,000 points and both S&P 500 and Nasdaq were down by more than 3

percent – wiping out most of the gains since the beginning of the

year.

Lows

As Stocks Suffer Worst

Breadth Since DotCom

Collapse

25 February, 2020

WHO,

CDC, and HSS all dropped the honesty hammer today:

-

WHO SAYS REST OF WORLD IS NOT YET READY FOR VIRUS SPREAD

-

CDC OFFICIAL SAYS CORONAVIRUS PANDEMIC IS LIKELY

-

AZAR SAYS U.S. MAY NEED UP TO 300M MASKS FOR HEALTHCARE WORKERS

And

just like that 'complacency' gone...

From "Extreme Greed" to "Extreme Fear" in a week...

So, rates, FX, and commodities were right after all...

Source: Bloomberg

Year-to-date, gold and bonds are up around 7.5%, stocks are down around 5%

Source: Bloomberg

Nasdaq briefly touched unchanged on the year, all the other majors are now red for the year...

All European majors are now red for the year...

Will stock investors ever learn? As Morgan Stanley's Chris Metli warned, sentiment hasn't shifted... yet:

"...in conversations with clients yesterday and today it feels like most discretionary traders want to look through the systematic supply and any economic disruptions, and still don’t see a reason to deviate from the secular growth trade. While the market will naturally follow the macro newsflow, the fact that investors haven’t become materially more bearish and there was not a full flush of positioning makes QDS concerned about further downside moves and would be a seller of rallies more than a buyer of dips."

Nasdaq broke below 9,000 and The Dow tested down to almost a 26k handle.

All major US equity indices tumbled through critical technical support levels. Dow and Russell 2000 broke below their 200DMA, Nasdaq well below its 50DMA, and S&P below its 100DMA...

“Those tech lines should matter -- it tells you the psychology is changing,” said Mark McCormick, global head of FX strategy at TD Securities.“When markets are not trading on growth or fundamentals, a turn in sentiment nearly always leads to a drawdown in the things that are overbought and trading at a premium.”

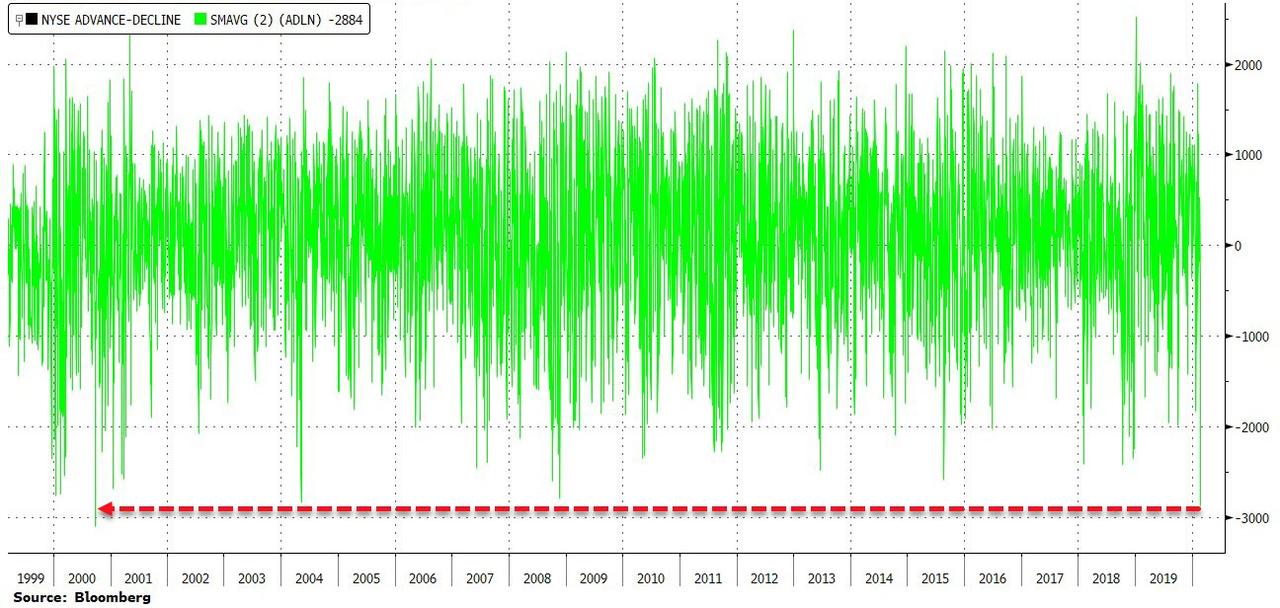

The number of NYSE-traded stocks that retreated in the past two days has been the highest of the almost 12-year bull market... and worst breadth since Sept 2000...

Source: Bloomberg

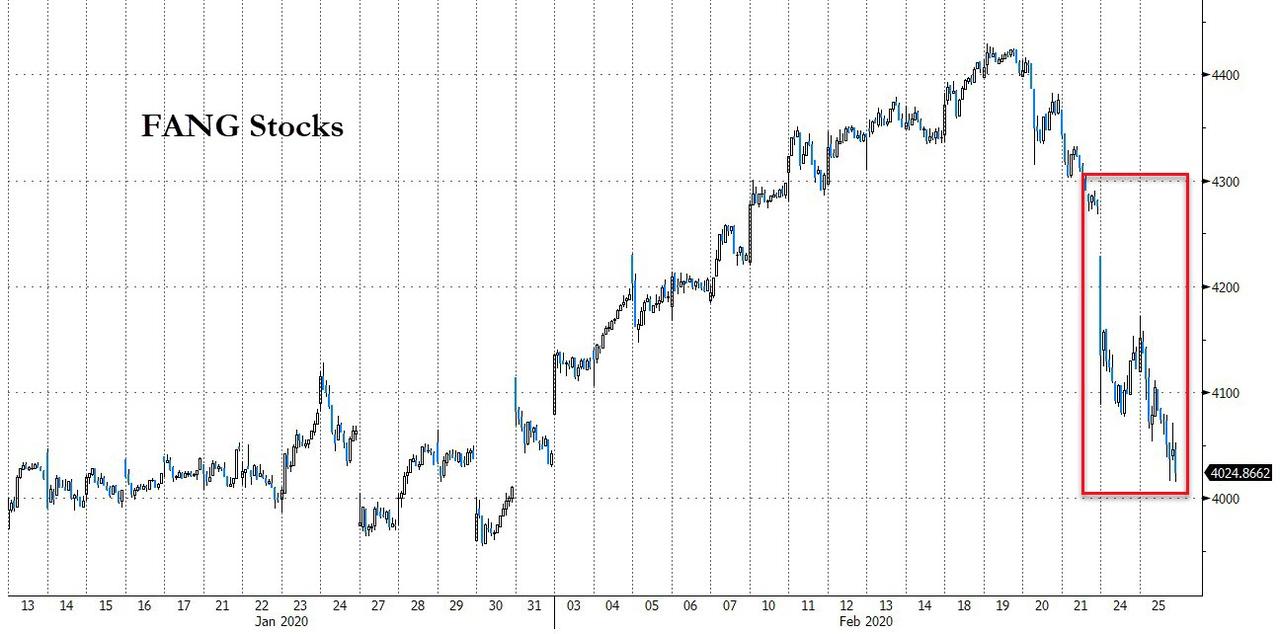

FANG Stocks crashed almost 10% from last week's highs...

Source: Bloomberg

This was The Dow's biggest 2-day drop since VIXmageddon in Feb 2018

Source: Bloomberg

Nasdaq broke below 9,000, and suffered the biggest 2-day drop since June 2016's Brexit vote...

Source: Bloomberg

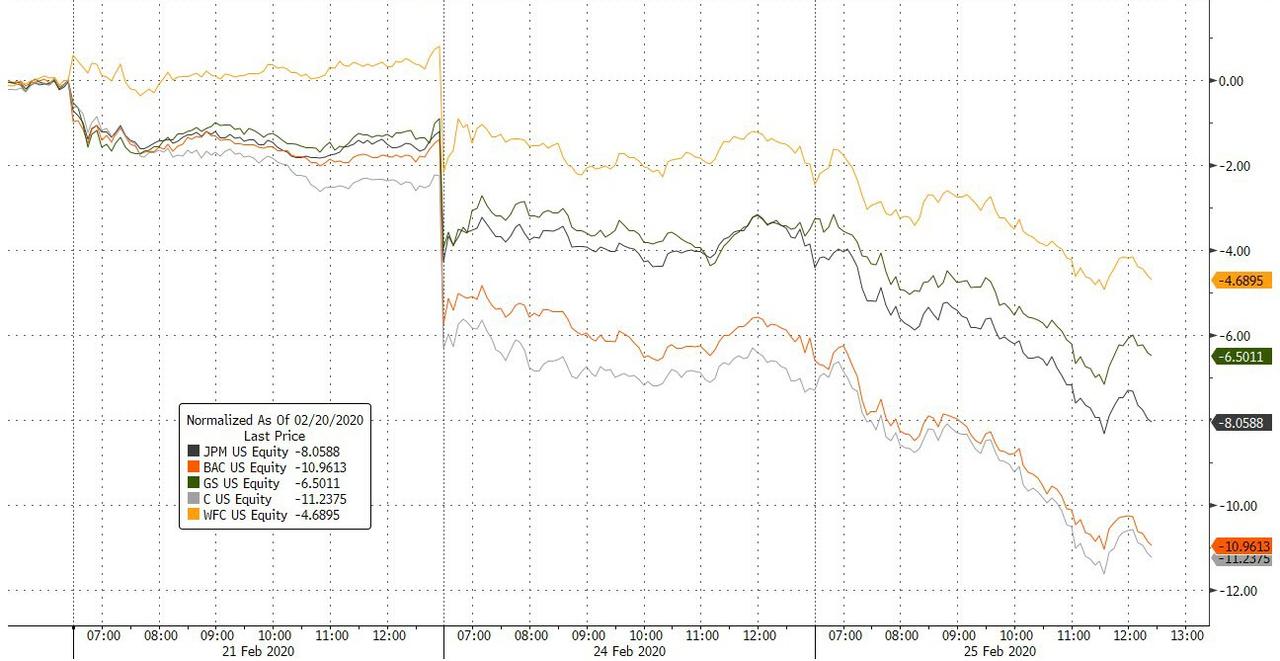

The big banks have been clubbed like baby seals, crashing over 10% in the last 3 days...

Source: Bloomberg

Airline stocks collapsed again - the worst 3 day drop for Airlines since Oct 2011...

Source: Bloomberg

VIX exploded higher again, pushing above 30 for the first time since Dec 2018...

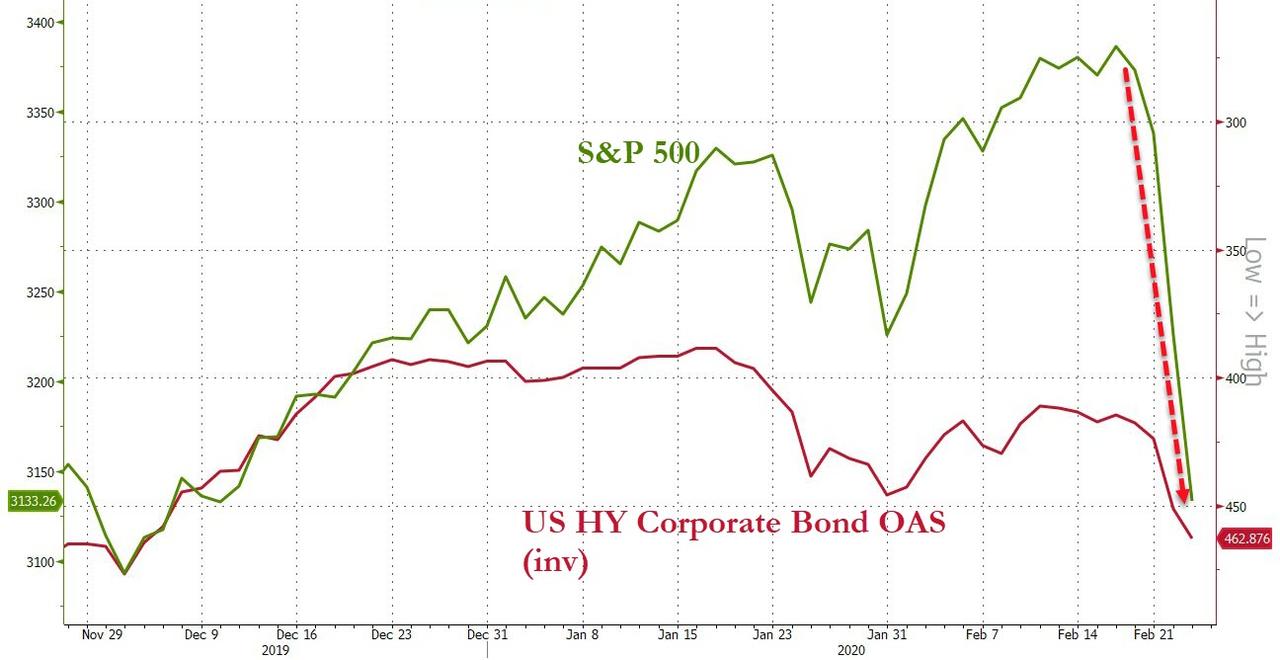

HY credit extended its losses as stocks caught down to their reality...

Source: Bloomberg

Credit spreads blew out in cash and CDS markets...

Source: Bloomberg

Treasury yields were down around 5bps across the curve...

Source: Bloomberg

30Y Yields extended the decline at record lows, trading with a 1.78% handle!!!

Source: Bloomberg

And the 10Y Yield just broke to a new record low at 1.3055%...

Source: Bloomberg

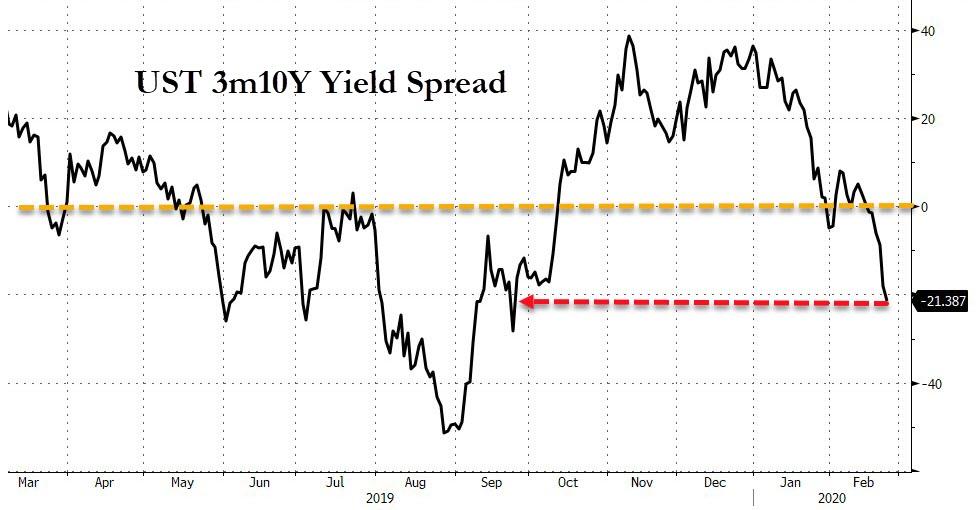

The yield curve continued to flatten dramatically...

Source: Bloomberg

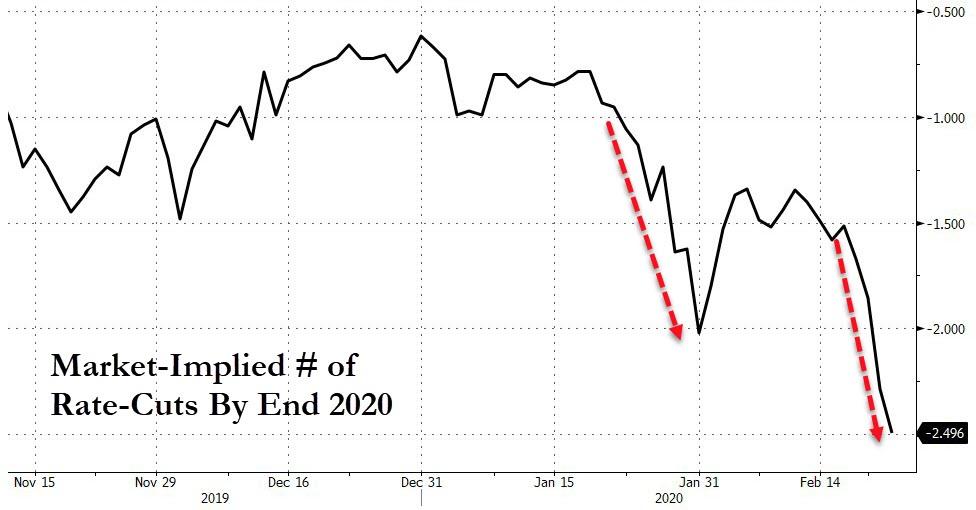

The short-end is now pricing in 2.5 rate-cuts by the end of 2020...

Source: Bloomberg

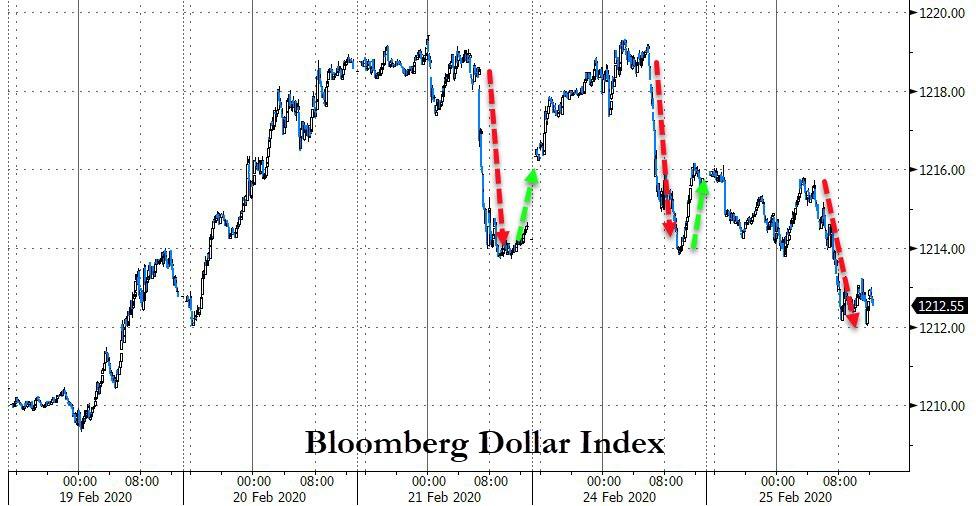

The dollar drifted lower today after two strange days...

Source: Bloomberg

Cryptos have also been sold as stocks have tumbled

Source: Bloomberg

Commodities were all lower today (gold outperformed, but still fell), despite a weaker dollar...

Source: Bloomberg

Gold managed to get back above the Friday close but was lower on the day...

And WTI tumbled below $50

Finally, we note that stocks have played catch down to the retreat in global liquidity...

Source: Bloomberg

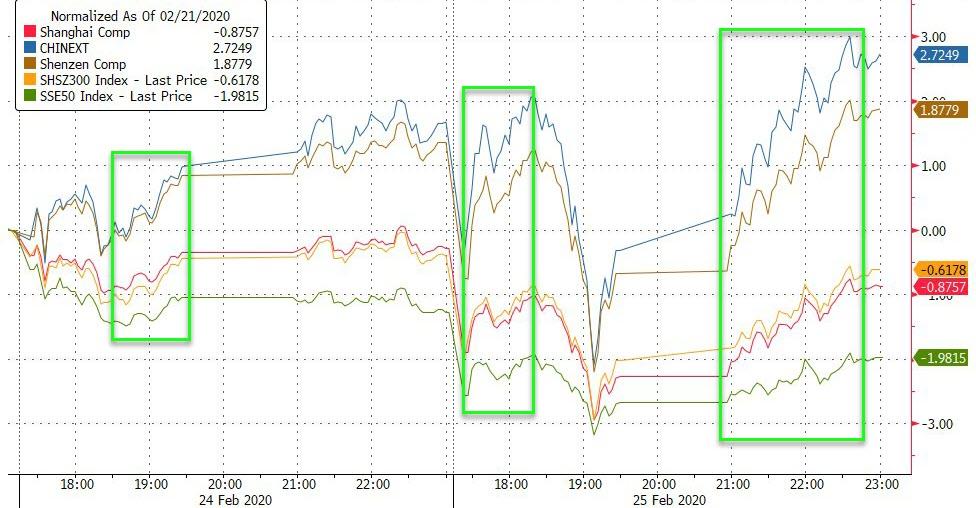

We also note that Europe and US are notably underperforming China since the Covid-19 crisis began to make headlines...

Source: Bloomberg

It is clear someone - cough, Xi, cough - doesn't want their stock market going down...

Source: Bloomberg

And China's resurgence is all about leverage - outstanding margin debt rose to a four-year high of 1.1 trillion yuan ($157 billion), according to data compiled by Bloomberg... that won't end well!

Source: Bloomberg

So, what happens next?

Source: Bloomberg

No comments:

Post a Comment

Note: only a member of this blog may post a comment.