Stocks Puke Into Bear

Market As US Financial

Conditions Crash Most

'Since Lehman'

https://sputniknews.com/business/202003111078541534-us-stocks-close-with-1400-plus-plunge-after-coronavirus-pandemic-declared/

'Since Lehman'

https://sputniknews.com/business/202003111078541534-us-stocks-close-with-1400-plus-plunge-after-coronavirus-pandemic-declared/

11 March, 2020

Today the stench of a desperate liquidity scramble as The Dollar rallied while Stocks, Bonds, Bitcoin, Crude, and Gold were all dumped.

The Dow and S&P crash into a bear market...erasing most of the Trump rally...

This is the fastest drawdown from a peak into bear market in history, and worst start to a year since 2009...

Source: Bloomberg

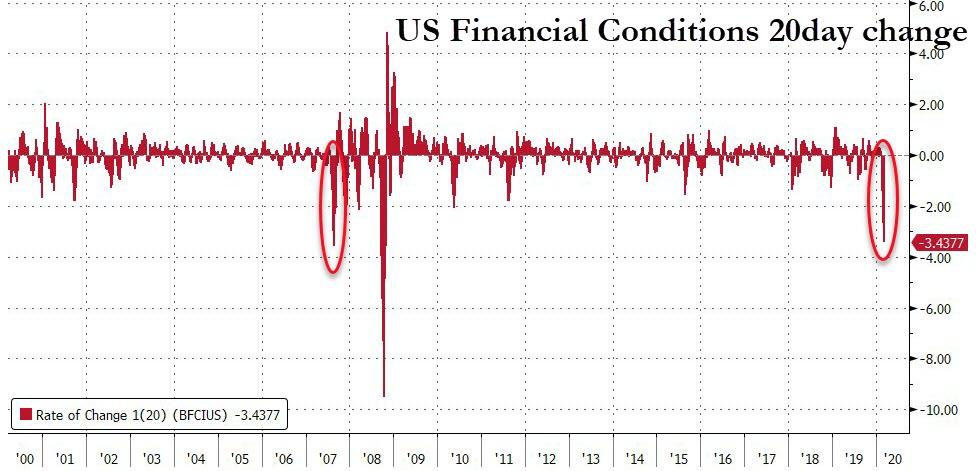

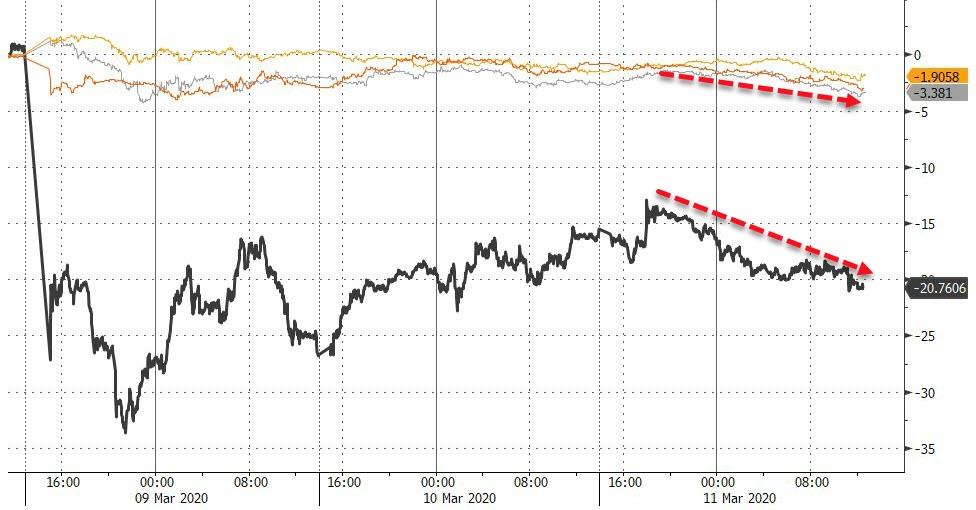

US Financial Conditions are tightening massively...

Source: Bloomberg

Crashing at the fastest pace since Lehman... (NOTE - the sudden drop is reminiscent of the first moments of crisis in August 2007)

Source: Bloomberg

With a massive dollar shortage evident...

Source: Bloomberg

Forcing The Fed to puke liquidity into the markets...

Source: Bloomberg

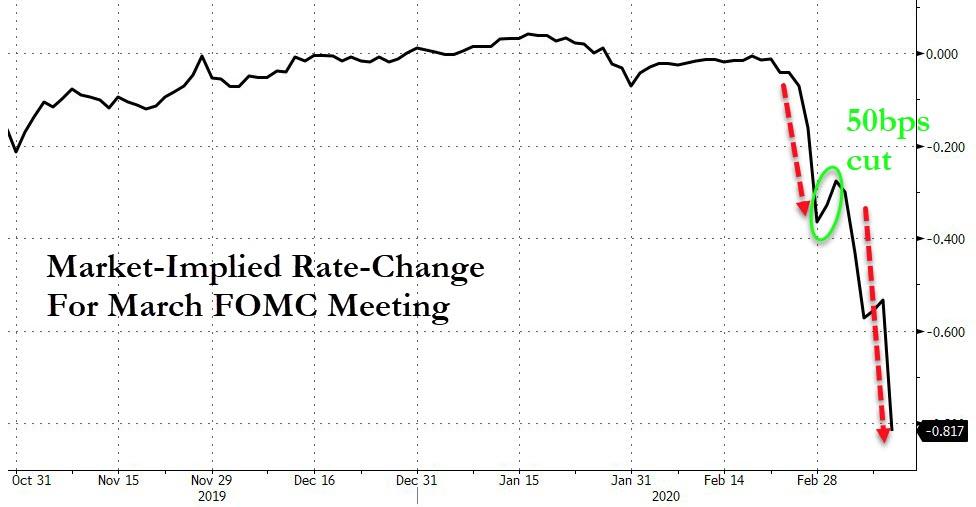

Which is perhaps why the market is now demanding 82bps of rate-cuts next week by The Fed...

Source: Bloomberg

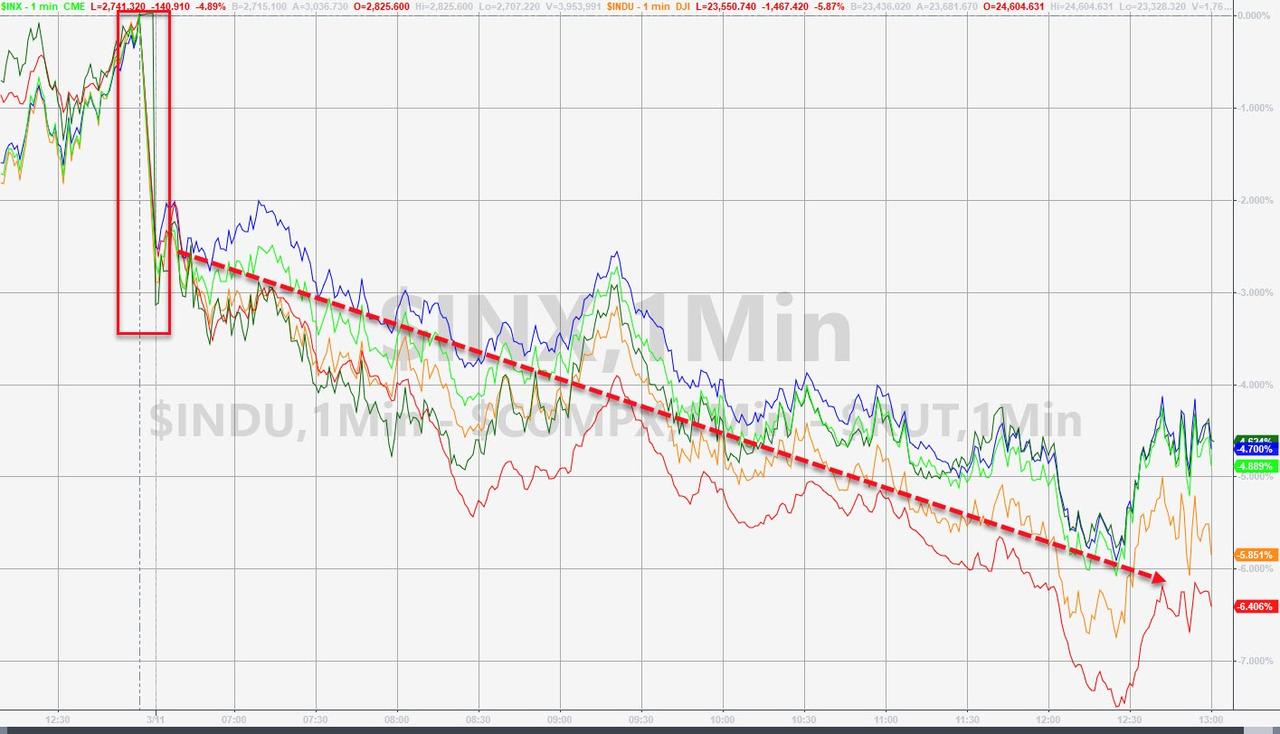

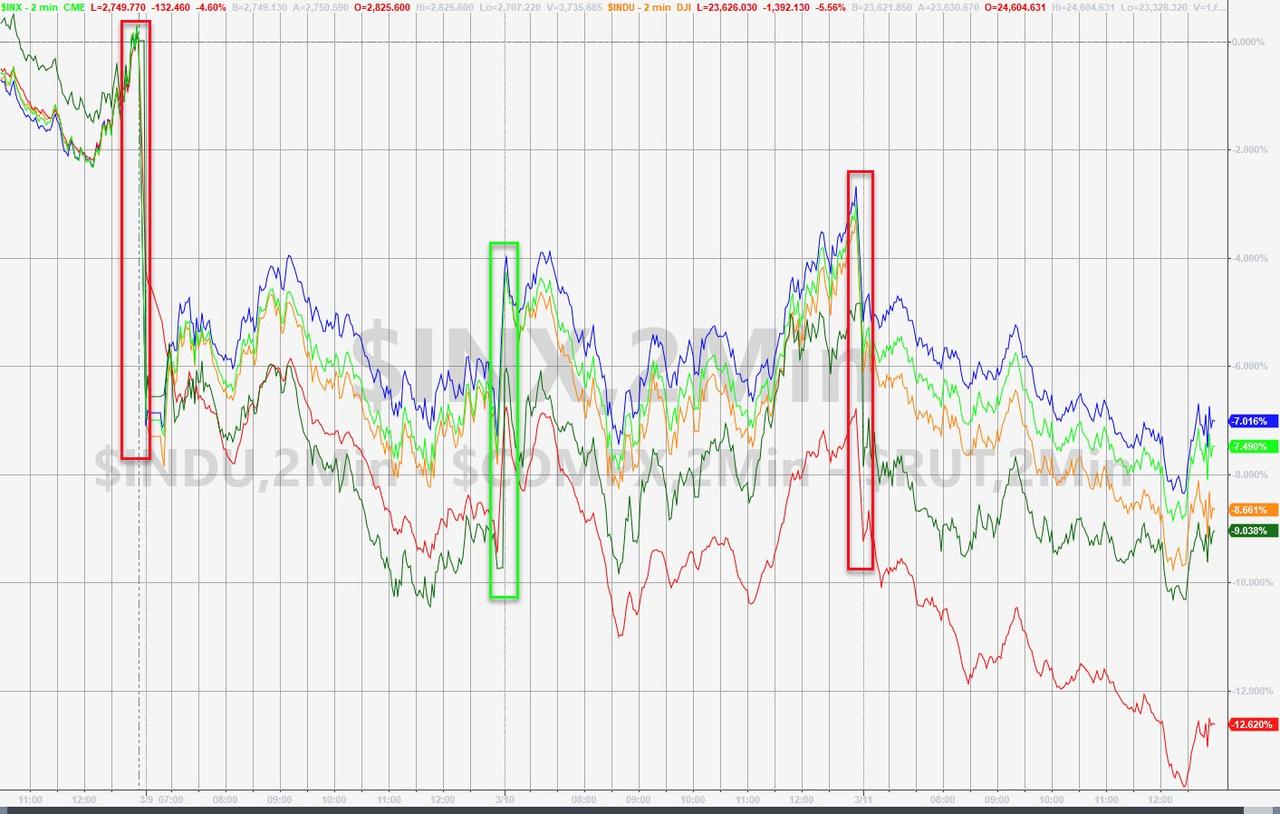

Today was a bloodbath in US equities with Small Caps and The Dow hammered hardest...

Dow Futures show the week's carnage best - just make sure to check the scale, these are simply massive swings...

And on the week, Small Caps are down almost 13%...

The Dow was the biggest underperformer because Boeing stock crashed today, but it was the CDS that is more worrying...

Source: Bloomberg

Virus-related travel and leisure sectors were hammered...

Source: Bloomberg

Bank stocks were clubbed like a baby seal today, now down a stunning 10-16% on the week alone!

Source: Bloomberg

VIX surged back above 50 today...

As Bloomberg details, the historic oil-market collapse that’s dragging down shares of the biggest Western explorers is swelling yields on investor payouts. The elite cohort of large international drillers known as the supermajors - Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., Total SA and BP Plc - now are churning out bloated yields that dwarf those paid by the broader S&P 500 Index.

Source: Bloomberg

Credit markets are collapsing with HY spreads smashing wider...

Source: Bloomberg

And IG spreads are exploding in the US...

Source: Bloomberg

Treasuries were very mixed today with the short-end rallying (2Y -5bps) and long-end selling off (30Y +5bps)...

Source: Bloomberg

10Y Yields pushed back above the pre-weekend plunge levels...

Source: Bloomberg

The Dollar rallied today as everything as was sold - suggesting a massive scramble for liquidity...

Source: Bloomberg

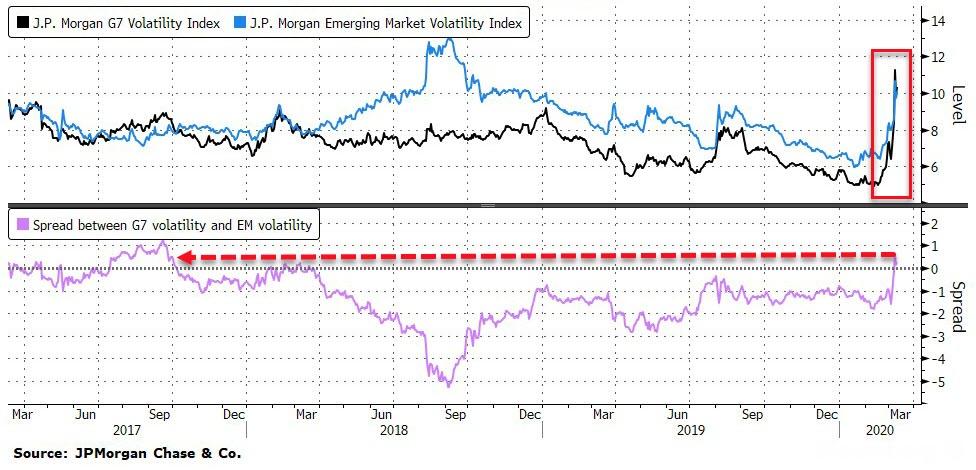

Rather notably, Developed Market FX is now trading with a higher vol than Emerging Market FX...

Source: Bloomberg

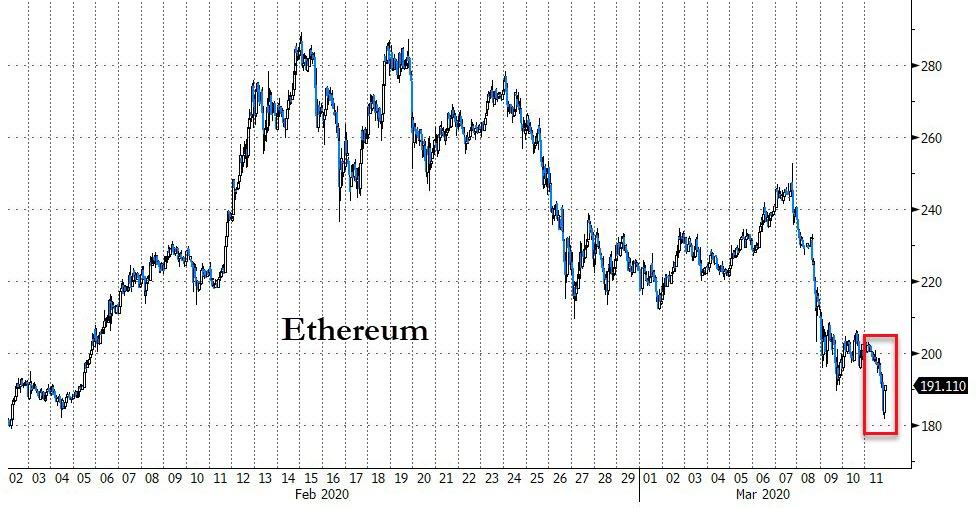

Cryptos continued to slide lower, with Ethereum hammered today...

Source: Bloomberg

Bitcoin was battered back below $8000...

Source: Bloomberg

Ethereum plunged back below $200...

Source: Bloomberg

Commodities were all lower today...

Source: Bloomberg

WTI's hopeful rally ended today with prices back to a $32 handle...

Gold was sold today too alongside bonds, bitcoin, and stocks...

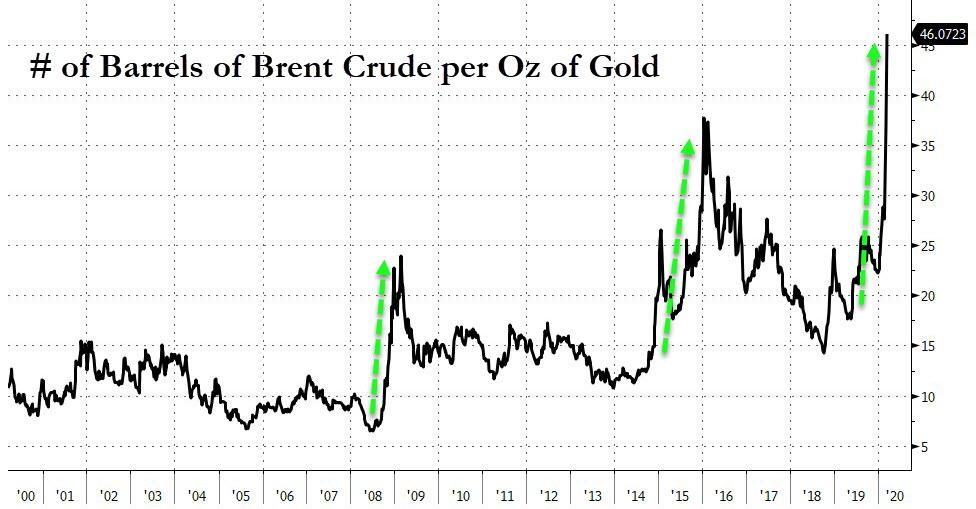

And for a sense of just how much oil has crashed, the number of barrels that an ounce of gold can buy is exploding...

Source: Bloomberg

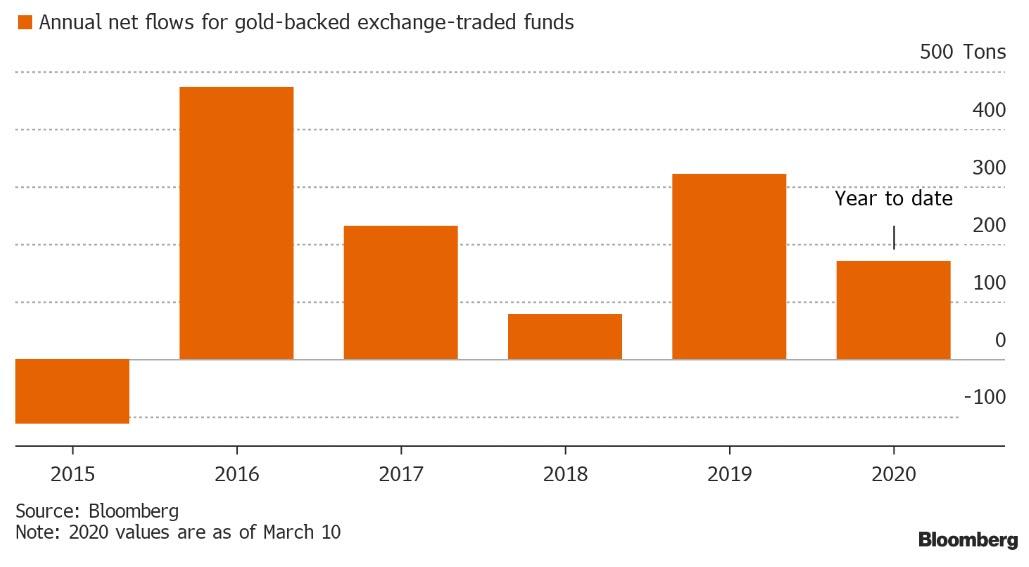

Finally, Bloomberg notes that investors are piling into gold day-after-day as concerns escalate about the impact of the coronavirus, markets gyrate, and rate-cut expectations jump. Holdings in bullion-backed exchange-traded funds expanded 55 tons in the three days to Tuesday, with increases seen both on days when S&P 500 Indexsank, as well as posting gains. The tally stands at a fresh record, and year-to-date inflows already total more than half of the 323.4 tons added in 2019.

Source: Bloomberg

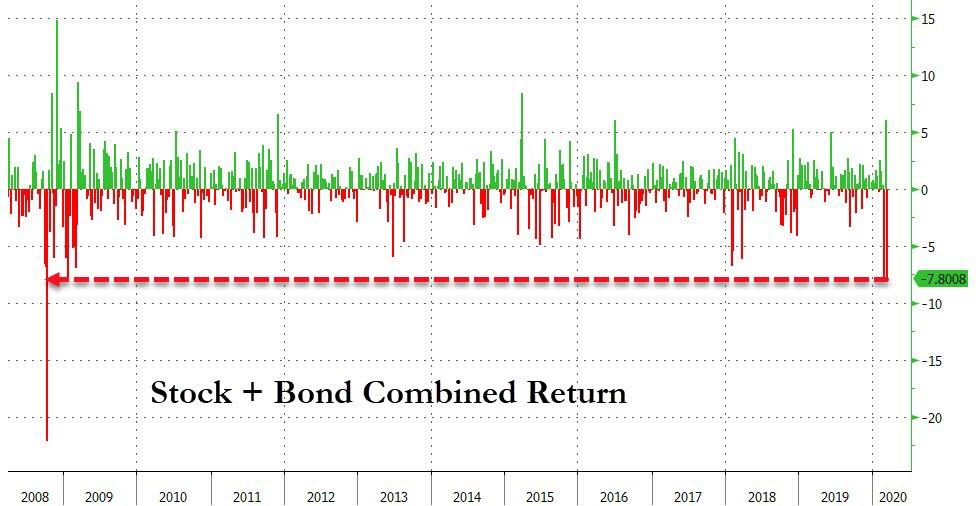

This week is the worst for a stock/bond portfolio since Lehman...

Source: Bloomberg

And investors have swung from "Extreme Greed" to "Extreme Fear" at the fastest pace on record...

No comments:

Post a Comment

Note: only a member of this blog may post a comment.