As of now, the Hang Seng is down 3.9% and the NZ stock

exchange down 2.7%.

exchange down 2.7%.

Market Massacre: Oil

Crashes 30%, VIX

Explodes As S&P

Craters Limit Down

Craters Limit Down

8 March, 2020

Update

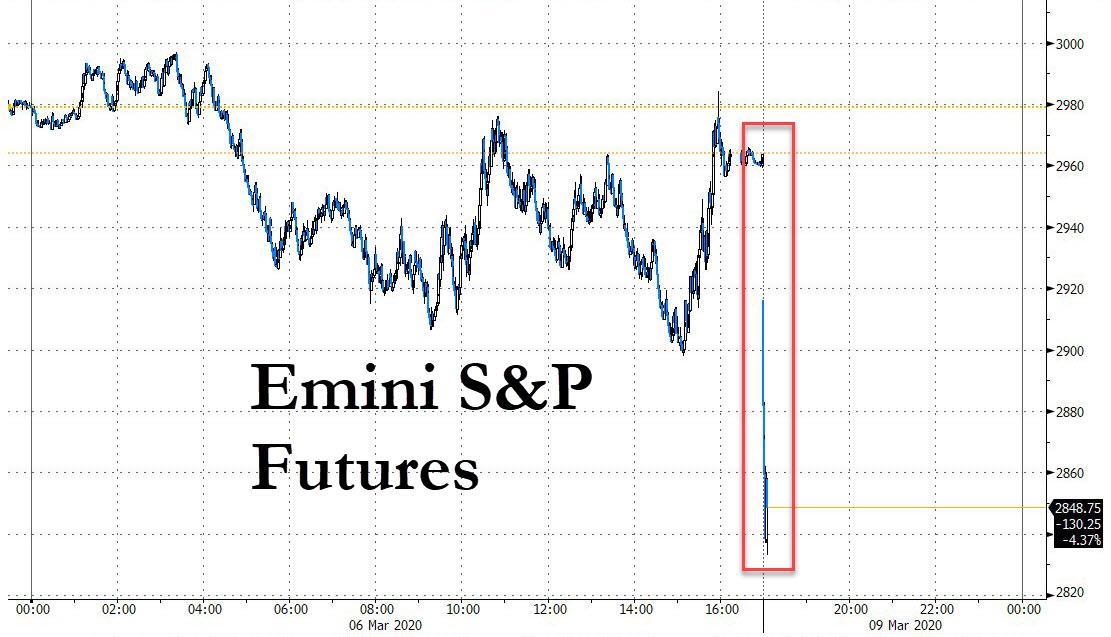

(2020ET): And there it is: for the first time since the financial

crisis, the emini S&P future has hit the limit down band of -5%,

something it failed to do even during the May 2010 flash crash.

This

means that no more trade are allowed below the limit down level until

the market opens at 9:30 am ET (assuming it opens of course). Trades

higher are still permitted, naturally, however that will probably not

be a great comfort to all those who are rushing to liquidate with

reckless abandon. But fear not: with the S&P now down more than

17% from its all-time highs just two weeks earlier, and just shy of a

bear market, those who want to sell will have ample opportunity to do

so in the days ahead.

* * *

Following

what may have been the most drama-filled weekend since "Lehman

Sunday", in which we saw not only another major spike in covid

cases around Europe and the US, but also the total collapse of OPEC

after Saudi Arabia unilaterally decided to flood the market with

deeply discounted oil in a desperate attempt to crush the competition

(yet which may backfire and soon lead to riots in Riyadh), markets

are reacting appropriately and just like during Lehman

Sunday, everything

is crashing:

-

S&P emini futures are down more than 4% in early trading, plunging as low as 2,845 and fast approaching their limit down price of 2,819 as investors around the world puke risk in an unprecedented fashion.

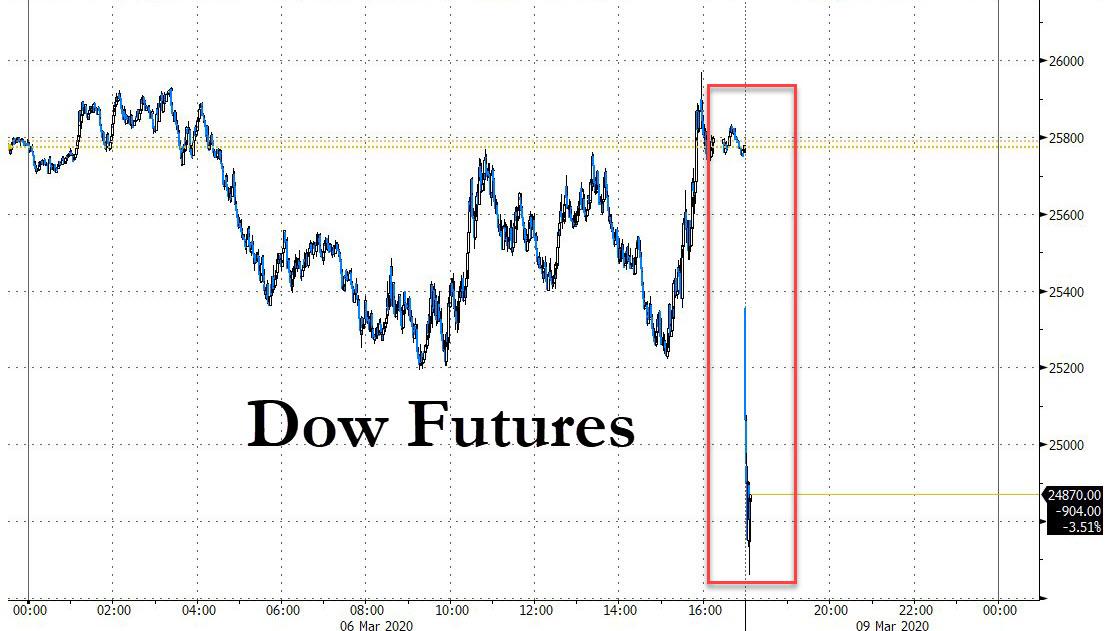

- Dow futures are down more than 1,000 points unwinding all of Friday's remarkable late-day rally and then some...

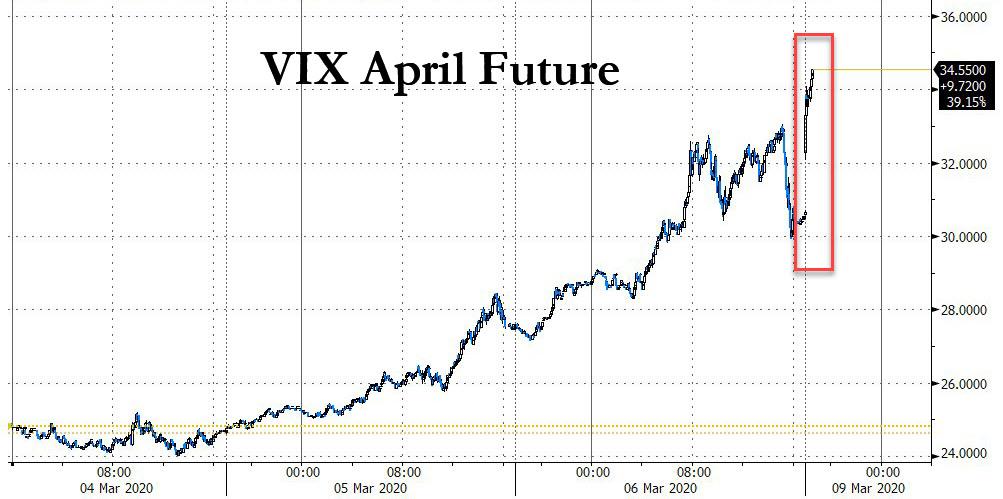

- VIX futures are up 16%, so one can only imagine where spot will be soon.

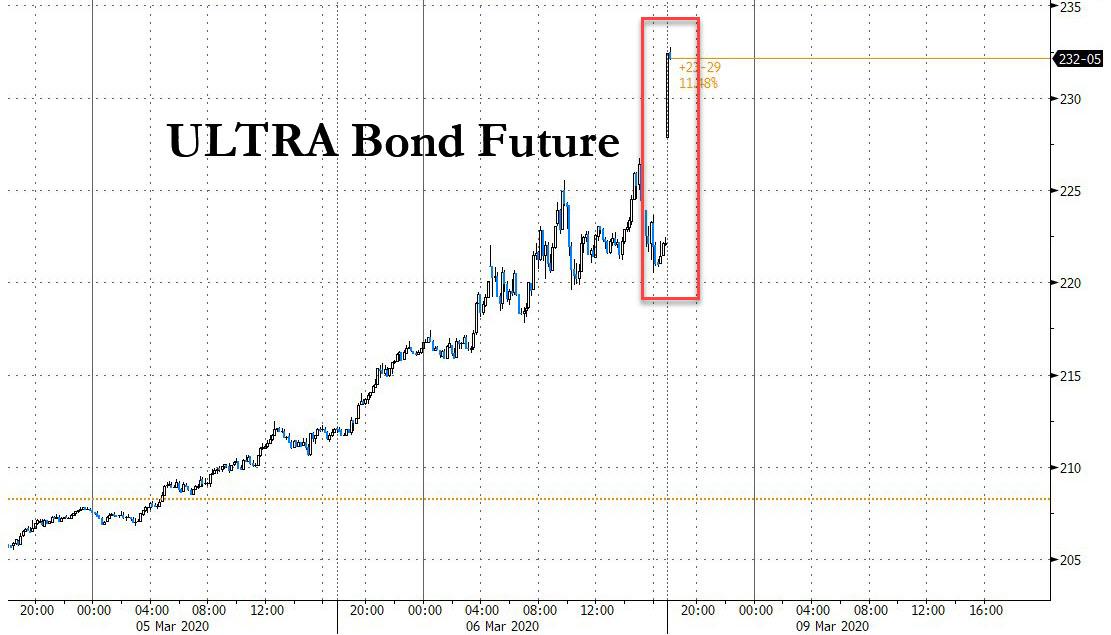

With

everyone rushing into safety, rates are soaring and the Ultra bond

future is already up a gargantuan 7 to 232-16 in a squeeze that will

surely lead to the failure of more than one macro fund still

short the long-end,

while the 10Y yield is on pace to hit a record all time low of 0.50%,

one which screams recession.

- Naturally, the oil complex is imploding, with WTI down 27% to $30...

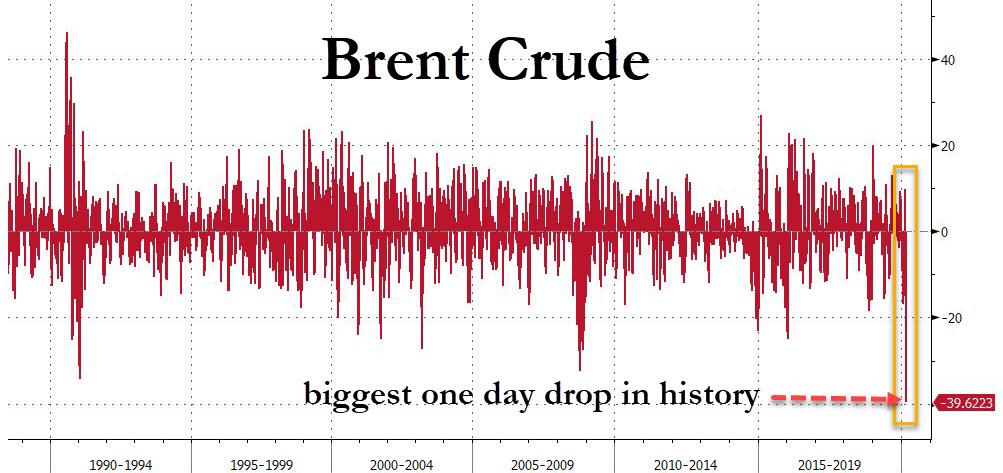

- ... while Brent has dropped as much as 31%, to just $33 in early Sunday trading in what Bloomberg dubbed "one of the most dramatic bouts of selling ever"...

... and indeed, today's move is the biggest one-day drop in Brent on record.

...

in line with Goldman's shocking price target cut, which now expected

Brent dropping into the $20s.

FX,

as discussed earlier, is in freefall, with carry trades getting

unwound, while commodity pairs are getting anihilated:

-

NORWEGIAN KRONE FALLS TO LOWEST SINCE AT LEAST 1985 VS DOLLAR

-

FALLS EXTEND IN CANADIAN DOLLAR, NORWEGIAN KRONE, MEXICAN PESO

Finally,

gold, also known to certain WSJ "experts" as a pet rock, it

just spiked above $1,700 for the first time since 2012.

What

happens now? Well, earlier today Morgan Stanley said

that to stabilize markets,

the Fed would need to announce not only a rate cut but also resume

official QE...

We believe equity markets will struggle until policy-makers get back ahead of the curve with more interest rate cuts and an extension of the current balance sheet expansion and/or an official quantitative easing program – something we think is likely coming

...

and with spot VIX likely set to trip 60 or more, the Fed will need to

do something or risk another Great Depression, although how sending

nominal bond yields into negative territory across the board will

help markets remains to be seen. Maybe the Fed's time has finally run

out?

Or

maybe Trump - who provoked the market gods one too many times with

his relentless stock market boasts as stocks hit artificial high

after artificial high - actually has something up his sleeve, because

moments after futures opened, he tweeted a rather cryptic "nothing

can stop what's coming."

Some hours after this news came out there is NO MENTION of this in the NZ media. I wonder if they are waiting for instructions on how to spin this.

Kuwait

Stock Market

Plunges 10% Today; Trading

SUSPENDED

8

March, 2020

This

comes as two issues slam the Middle East in particular: Coronavirus

and and Oil Price War.

The

oil price war began Friday, when Russia refused to agree to OPEC

production cuts. Saudi Arabia then declared they would INCREASE

their national production to more than ten million barrels per day,

and would even go as high as TWELVE MILLION, to gain market share.

This

caused an immediate plunge in oil prices, which obviously will impact

things economically throughout the Middle East and the world.

The

outbreak of Coronavirus is spreading worldwide, and the Middle East

is no exception. The virus is already saturating Egypt and is

suspected to be heavily spreading in Arab nations, albeit without

official recognition.

This

virus outbreak is reducing consumer activities, which is also having

a very significant economic impact on firms in the Middle East.

Hence, today's plunge in Kuwaiti stocks.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.