Texas Frozen Chaos Becomes Global Oil Market Nightmare With 40% Of US Crude Production Offline

18 February, 2021

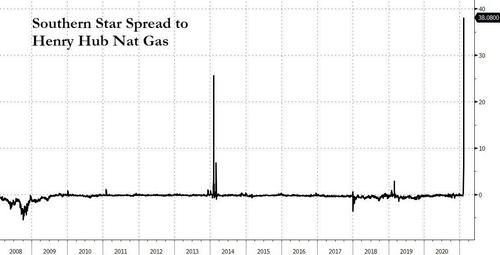

One week ago, when virtually nobody was following the sudden surge in certain obscure mid-continent nat gas prices...

... we warned that the ripple effects of the freezing vortex-induced calamity, which led to near record-low temperatures across the plains states, would ripple far and wide sparking logistical and commodity shockwaves not only in Texas and the continental US, but also around the world. Sure enough, just a few days later, Texas has been hit by a humanitarian crisis the likes of which it has never before seen with millions of people without electricity and increasingly without running water.

And even though Texas is doing everything in its power to contain the fallout that, it appears that the crisis is now spreading, because as a result of the persistent freeze and rampant "force majeueres" across the industry, more than 4 million barrels a day of output - almost 40% of the nation’s crude production - is now offline, Bloomberg reports citing traders and executives.

This is because not only has Texas - one of the world’s biggest oil refining centers - seen output drastically cut back but the waterways that help U.S. oil flow to the rest of the world have been disrupted for much of the week. The country’s largest refiner, Motiva in Port Arthur, has closed and at least 3 million barrels a day of processing got taken offline.

“The market is underestimating the amount of oil production lost in Texas due to the bad weather,” said Ben Luckock, co-head of oil trading at commodity giant Trafigura Group.

As a result of the collapse in output, late on Thursday night Brent briefly surged above $65 a barrel, a level not seen since last January. Spreads indicating supply tightness also soared.

While historically weather-related disruption would have been mostly a U.S. issue, it is now "unmistakably global":

Crude markets in Europe are rallying as traders replace lost U.S. exports. OPEC and its allies must decide how much longer they keep millions of barrels of their supply off the market.

Adding to the misery is that what was expected to be a brief production setback is becoming longer by the day. As Bloomberg notes, estimates for how long the outages may last have gotten progressively longer in recent days as analysts try to figure out the timespan involved in thawing out infrastructure, especially in those areas where freezing weather isn’t the norm (read the following from Bloomberg for some more details: "How Do You Restart an Oil Well That’s Frozen Solid?").

While initially traders and analysts expected the hit to US production to last between two and three days, it's now looking unlikely that things will start to recover much before the weekend, and a full resumption could take weeks. That means that ever more barrels are being removed from the global market, just as demand returns slowly back to normal around the world.

Some estimates, such as Citigroup's, expect a production loss of 16 million barrels through early March, but some trader estimates are now almost double that as vast swaths of production in the Permian - ground zero of U.S. shale output - have been shut in. The result is a surge in the value of crude barrels in other parts of the world. North Sea traders have been frantically bidding for the region’s cargoes this week as replacements are sought for U.S. crude exports. As Europe’s supplies have gotten more expensive, Asian buyers have been snapping up Middle Eastern shipments at higher premiums.

And while headline crude futures are at their highest level in over a year, they’re yet to rip higher because the loss of refining capacity is equally acute. It's why traders are rushing to send millions of barrels of diesel across the Atlantic to the U.S., a potential boon for Europe’s downtrodden refining industry.

“The Gulf Coast is a gasoline machine and sends products across the U.S. as well as international markets,” said Kitt Haines, an analyst at consultant Energy Aspects. “For a brief period at least, this could help European refining.”

The result is going to mean a mixed picture for U.S. inventories in the coming weeks. While gasoline production has been hit by the spate of refinery outages, there are also far fewer drivers on the roads than normal. Stockpiles of heating fuels like propane and diesel -- for which demand was already soaring before this week’s weather -- are set to fall sharply.

Needless to say, the chaos has left Saudi Arabia and its OPEC+ allies closely watching the forecast for Texas’s weather. As we discussed yesterday, while the group has yet to decide on its output plans for April, the WSJ reported that Saudi Arabia is now contemplating restoring 1mm barrels in output in the coming months after it unexpectedly cut an extra million barrels a day of supply in February and March.

“The market is turning into a wild animal for OPEC+ to control,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. He said Wednesday that he saw 5 million barrels a day of U.S. supply offline. “The weather is having an unbelievable impact on global supply and demand,” he said.

There is some good news: a thaw - literally - is coming, with temperatures in Midland -- the capital of shale production -- expected to hit 45 Fahrenheit on Friday before rising to 56 Fahrenheit on Saturday, allowing crude production to restart. On Monday, Midland hit -2 Fahrenheit, its lowest temperature in more than 30 years.

Of course, the great unknown remains how long output - and the rest of the region’s oil infrastructure - will take to recover in full.

“Evidence from the last great Permian freeze off is that it can come back very quickly,” said Paul Horsnell, head of commodities research at Standard Chartered Plc. “But refineries are more likely to be prone to prolonged damage.”

No comments:

Post a Comment

Note: only a member of this blog may post a comment.