Nasdaq and S&P futures hit 5% crash limit, Mexican peso sent into tailspin by US elections

While

the winner of the US presidential race is yet to be announced, Donald

Trump’s strong performance has had a turbulent impact on the

markets. Both Nasdaq and S&P futures have hit their five percent

down limits, triggering a trade halt.

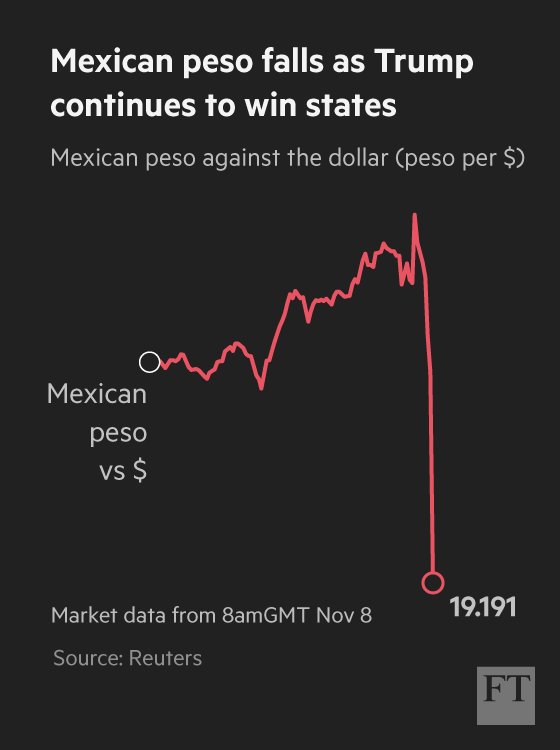

The

currency market is seeing a strong hit as Trump takes the election

lead with the Mexican peso witnessing a strong nosedive along with

the US dollar at the start of trade in Asia.

The

Mexican Peso sank over 10 percent to 20.20 pesos to $1 as Trump

steamed ahead in the polls.

BREAKING: #DonaldTrump has taken the crucial swing state of Ohio, leads #Clinton 168-109

“Markets

[are] getting increasingly nervous about the outcome,” Andres

Jaime, global FX and rates strategist at Barclays told CNBC.

Prior

to voting, the Mexican peso strengthened 1.3 percent against the

American dollar on Tuesday, as Democratic nominee Hillary Clinton

looked like she had consolidated a firm lead against her Republican

opponent just ahead of the election.

Breaking News: The Mexican peso has seen its steepest dive in more than 20 years tonight http://on.ft.com/2fYGRPo

US

crude oil futures have also taken a hit, falling 4 percent below the

previous $43.17 per barrel. The Dow Jones Industrial Futures fell 500

points, or nearly 3 percent.

Overall

stocks in Tokyo, Hong Kong and other major markets fell by as much as

2 percent as Trump began to extend his lead, The New York Times

reported.

In

the meantime gold and government bonds surged, with the precious

metal rising over 3 percent to $1,315 per troy ounce.

On

Wall Street, Dow Jones industrial average futures slid more than 700

points at one point on news of Trumps steering to victory. The

Standard & Poor’s 500-stock index sank more than 100 points,

while the tech-heavy Nasdaq dropped over 200 points, Washington Post

noted.

RT America

RT America

Financial Times

Financial Times

Dan Stewart, CFA

Dan Stewart, CFA

No comments:

Post a Comment

Note: only a member of this blog may post a comment.