'It's Not Getting Better': Biden Says US Economic Crisis Is Deepening

22 January, 2021

US President Joe Biden's economic relief plan rollout comes a day after the US Department of Labor announced some 900,000 additional Americans filed for unemployment insurance during the week ending in January 16.

While delivering remarks on the economy Thursday, Biden presented a grim outlook by asserting the US is currently facing uncommon economic hurdles that will require federal intervention within the next several months.

“We remain in a once-in-a-century public health crisis that has led to the most unequal job and economic crisis in modern history. And the crisis is only deepening,” he remarked during an address held on his second full day in office.

The US president also stressed that it is necessary that Congress looks at his $1.9 trillion COVID relief bill, which includes the third round of direct relief payments to Americans and $416 billion in funding for the administration's push to vaccinate 100 million Americans and reopen US schools within the first 100 days of the presidency.

"We cannot, will not, let people go hungry. We cannot let people be evicted because of nothing they did themselves," he declared. "We cannot watch people lose their jobs and we have to act. We have to act now. It's not just to meet the moral obligation to treat our fellow Americans with the dignity and respect they deserve."

Biden went on to sign two executive orders, one of which seeks to increase food aid and assist unemployed Americans. The other order lays the groundwork for federal workers and contractors to get a $15-an-hour minimum wage.

"Today, I am signing an executive order that directs the whole of government effort to help millions of Americans who are badly hurting, requires all federal agencies to do what they can do to do to provide relief to families, small businesses and communities. In the days ahead I expect agencies to act," Biden said during a signing ceremony on Friday.

President specifically asked the Department of Agriculture to look for immediate measures "to make it easier for the hardest-hit families to enroll and claim more generous benefits in the critical food and nutrition assistance area."

The US president's executive intervention comes a day after new figures from the DoL showed US jobless claims sitting at 900,000 Mark Zandi, a chief economist for Moody's Analytics, says claims would be somewhere around 200,000 in a "typical economy."

The still-high unemployment rate comes amid the US' steadily growing COVID-19 death toll.

"A lot of America is hurting. The virus is surging. We are [at] 400,000 dead [and] expected to reach over 600,000," Biden highlighted Friday.

Overall, the US has logged more than 24.7 million cases of the novel coronavirus and at least 412,780 deaths related to the contagious disease, according to the Johns Hopkins University COVID-19 dashboard.

Obviously, I am NOT in favour of the Keystone XL Pipeline

Biden Warns ‘Economic Crisis

Deepening’ After Killing Tens

of Thousands of Jobs His First

Day in Office (VIDEO)

Joe Biden was all doom and gloom Friday after he destroyed tens of thousands of jobs his first day in office.

After his bizarre inaugural behind fences and 20,000 military troops, Biden hobbled to the Oval Officer were he signed several executive orders including the end of construction of the Keystone XL Pipeline and the end of construction of the Trump border wall.

Canceling the Keystone Pipeline costs over 11,000 construction jobs and 42,100 jobs throughout the US during the construction process according to the US State Department.

Canceling the Trump border wall will cost 10,000 jobs

TRENDING: President Trump Gives Permission for US Troops to Stay at Trump Hotel in Washington DC (VIDEO)

That’s a total of 52,100 jobs lost in his first 8 hours in office.

Biden also suspended new oil/gas leasing on federal lands and water.

According to Congressman Kevin Brady (T-TX) if Biden’s war on gas and oil is permanent, 120,000 Texas jobs will be lost.

120,000 more jobs lost in Texas!

After proudly destroying tens of thousands of jobs in two days in the middle of a pandemic, Joe Biden warned of a deepening economic crisis.

Biden looked totally lost and sounded exhausted.

This is the guy who supposedly got 81 million votes…sure.

WATCH:

Investing Legend Sees "Spectacular" Crash In "The Next Few Months"

https://www.zerohedge.com/markets/investing-legend-sees-spectacular-crash-next-few-months

Two weeks ago, investing icon Jeremy Grantham turned apocalyptic and warned that the "Bursting Of This "Great, Epic Bubble" Will Be "Most Important Investing Event Of Your Lives." Since then the market has generally continued to melt up, yet Grantham's conviction that all this will end in tears has only grown, and in an interview with Bloomberg today, the co-founder of GMO who correctly called the last two crashes, now predicts that Joe Biden’s economic-recovery plan will propel stocks to perilous new heights, followed by an inevitable crash.

“We will have a few weeks of extra money and a few weeks of putting your last, desperate chips into the game, and then an even more spectacular bust,” the value-investing legend said in a Bloomberg “Front Row” interview.

“When you have reached this level of obvious super-enthusiasm, the bubble has always, without exception, broken in the next few months, not a few years.”

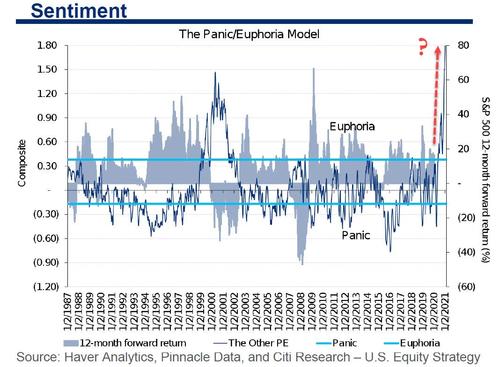

Amid market euphoria the likes of which have - literally - never been seen before as the following chart from Citi shows...

... and which prompted Citi, BofA and Goldman to all warn that a selloff appears imminent, and which was fueled by risk-taking behavior funded by the latest round of pandemic-relief checks, Grantham has “no doubt” at least some of the $1.9 trillion in federal aid Biden is seeking from Congress will end up being spent on stocks instead of food or shelter.

While that will help push stocks even higher, Grantham then sees it all ending in tears, or rather a collapse rivaling the 1929 crash or the dot-com bust of 2000, when the Nasdaq cratered 80% before recovering thanks to trillions more in Fed "stimmy" checks.

And while some (increasingly fewer) investors claim that today’s valuations are justified by the growth potential of transformative technologies and new business models, Grantham, 82, dismisses that argument as fanciful, and rejects the popular theory that the Federal Reserve can cushion or even the next crash with even more QE or easing.

“At the lowest rates in history, you don’t have a lot in the bank to throw on the table, do you?” he said.

Unfortunately for Grantham, and his now cemented reputation as a perma-bear who misses out on rallies, the stock market has sneered at all warnings it will crash and just keeps on rising.

To be sure, as we reported last year, GMO’s bearish stance has been costly as assets under management fell by tens of billions of dollars during the decade-long bull market, as the firm steered clear of growth stocks. Then in April, GMO doubled down, insulating its portfolios from directional bets on the market and largely missing out on the second leg of the 2020 rebound.

As Bloomberg notes, Grantham thought the economy was on shaky ground even before the pandemic and he was concerned about the steady decline in U.S. productivity, warning that the Fed had only succeeded in blowing out the inequality and income gap to record wides, amid worries that the profit-at-all-costs nature of American capitalism was destroying the environment and fraying the social fabric.

For Grantham, the combination of fiscal stimulus and emergency Fed programs led to “spectacular excesses” and pushed an already overvalued market into bubble territory.

Echoing BofA's earlier note, Grantham believes that the Fed's "Immoral hazard" will have other devastating consequences as well:

“If you think you live in a world where output doesn’t matter and you can just create paper, sooner or later you’re going to do the impossible, and that is bring back inflation,” Grantham said. “Interest rates are paper. Credit is paper. Real life is factories and workers and output, and we are not looking at increased output.”

As a reminder, earlier today, BofA's CIO Michael Hartnett - who is similarly concerned about the near-future - warned that asset price (hyper)inflation will eventually drag Main Street inflation higher, risking a disorderly rise in bond yields, which results in a taper tantrum, tighter financial conditions and "volatility events", i.e., a market crash.

Grantham agrees and warns that the threat of inflation is the biggest risk, which is why he also thinks that bonds are risky. He also has reservations about gold because it generates no income. And in his view Bitcoin is make-believe nonsense.

In short, he is an asset manager who sees no attractive assets, and who is prohibited from shorting because the Fed will just keep ramping prices ever higher.

While selling everything and holding cash is one option, Grantham said his best advice for long-term investors is to focus on low-growth stocks that are cheap relative to benchmark indexes, emerging markets and companies fighting climate change with renewable energy and electric-car technology.

“You will not make a handsome 10- or 20-year return from U.S. growth stocks,” he said. “If you could do emerging, low-growth and green, you might get the jackpot.”

All this and much more in his full 38 minute interview with Bloomberg's Erik Schatzker below:

d

"Probably nothing"

No comments:

Post a Comment

Note: only a member of this blog may post a comment.