Xi

Sends Trump A Message: Rare-Earth Export Ban Is Coming

Google

has suspended its licenses and product-sharing agreements with

Chinese communications giant Huawei, as Washington accuses the

company of spying for Beijing.

Following

in the footsteps of Google, a number of top American chipmakers –

including Intel, Qualcomm, and Broadcom – halted their business

transactions with Huawei, after Donald Trump’s executive order that

declared Chinese tech giant Huawei a national security risk . The

companies are said to have told their employees that no new shipments

will be made “until further notice.”

20 May, 2019

Back in April of 2018, when the trade war with China was still in its early stages, we explained that among the five "nuclear" options Beijing has to retaliate against the US, one was the block of rare-earth exports to the US, potentially crippling countless US supply chains that rely on these rare commodities, and forcing painful and costly delays in US production as alternative supply pathways had to be implemented.

As a result, for many months China watchers expected Beijing to respond to Trump's tariff hikes by blocking the exports of one or more rare-earths, although fast forwarding one year later this still hasn't happened. But that doesn't mean it won't happen, and overnight President Xi Jinping’s visit to a rare earths facility fueled speculation that the strategic materials will soon be weaponized in China’s tit-for-tat war the US.

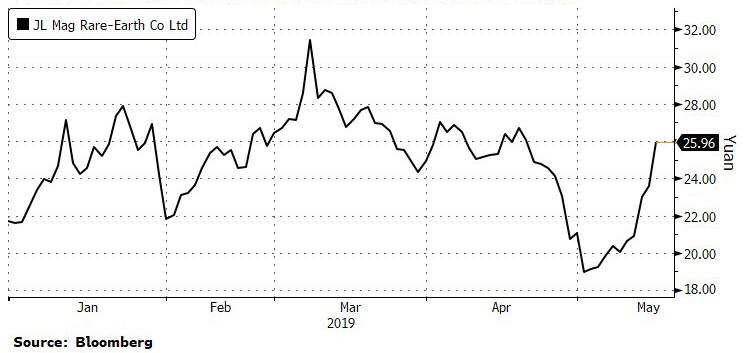

As Bloomberg reported overnight, shares in JL MAG Rare-Earth surged by the daily limit on Monday after Xinhua said the Chinese president had stopped by the company in Jiangxi, a scripted move designed to telegraph what China could do next.

The reason for the dramatic market response is that the presidential visit flags policy priorities, and "rare earths have featured in the escalating trade spat between the U.S. and China." Specifically, as Bloomberg notes, China raised tariffs to 25% from 10% on American imports, while the U.S. excluded rare earths from its own list of prospective tariffs on roughly $300 billion worth of Chinese goods to be targeted in the next wave of measures. And just in case the White House missed the message, Xi was accompanied on the trip to JL MAG by Liu He, the vice premier who has led the Chinese side in the trade negotiations.

Why does China have a clear advantage in this area? Simple: the U.S. relies on China, the dominant global supplier, for about 80% of its rare earths imports.

The visit “sends a warning signal to the U.S. that China may use rare earths as a retaliation measure as the trade war heats up,” said Pacific Securities analyst Yang Kunhe. That could include curbs on rare earth exports to the U.S., he said.

Xi's visit came just hours after the Trump administration on Friday blacklisted Huawei and threatened to cut it off from the U.S. software and semiconductors it needs to make its products. A spokesman for China’s foreign ministry told reporters Monday to “please wait and see” how the government and companies respond.

Of course, a Chinese export curb, or ban, would also cripple domestic producers, as domestic rare earth miners would be hurt, and likely need state subsidies, similar to US soybean farmers. But curbs could potentially help companies like JL MAG, which makes magnets containing rare earths that are used in products including electric vehicles and wind turbines.

Finally, to those looking to trade a potential rare-earth export ban, one place would be to go long the REMX rare earth ETF, which after hitting an all time high of $114 in 2011 during the first rare-earth "scare" during the China-Japan trade war, is trading some 90% lower as the market has all but discounted any possibility of a price spike.

Needless to say, should China lock out the US, the price of rare earths could soar orders of magnitude higher.

Huawei's

5G 'will absolutely not be affected' by US blacklist, founder says

RT,

20 May, 2019

Huawei isn't going away just because the US government has tried to ban it from its markets, company founder Ren Zhengfei has said, declaring that the Trump administration "underestimates our strength."

"Huawei's 5G will absolutely not be affected" by the Commerce Department's ban on selling or transferring US technology to the company, Ren told Chinese state media. "In terms of 5G technologies, others won't be able to catch up with Huawei in two or three years."

The 90-day grace period before Huawei is officially blacklisted from doing business with US companies does not have much impact on the company, Ren claimed, adding: "We are ready."

A Huawei spokesperson assured reporters that nothing would change for US residents with Huawei devices, or even those planning to buy a device in the future – possibly because the Chinese firm is already in talks with Google on how to manage the ban.

Huawei has bracing for such a ban after the company watched fellow Chinese telecom ZTE struggle with a similar blacklisting maneuver last year. Unable to do business with US firms and unable to fill the equipment void itself, ZTE closed its doors for four months, throwing itself on the mercy of the US government and reopening its business more than $1 billion poorer. Not so for Huawei: not only has it been developing its own mobile operating system since 2012 to break dependence on Google's Android, but it already makes half the chips used in its devices.

"We cannot be isolated from the world," Ren boasted, adding that while Huawei was at odds with the US government, it was not the enemy of US companies.

While Trump's emergency order last week did not mention China or Huawei by name, it clearly targets both, giving the Secretary of Commerce the right to block any activity posing an "unacceptable risk to the national security of the United States or the security and safety of United States persons." The Commerce Department then moved to blacklist Huawei and 68 related companies from doing business with US firms.

The US has tried to convince its allies that Huawei is an unconscionable security risk, feeding information directly to the Chinese government through backdoors in its equipment. For its part, Huawei has accused the US of discrimination, claiming American telecoms cannot handle competition and pointing out the US' own record of backdooring allies' communications. Washington’s efforts to convince the EU and its member nations to bar Huawei from their 5G networks have failed so far – although Australia has agreed to adopt such a ban.

The battle over Huawei reflects the ongoing trade war between the US and China. Both countries have slapped additional tariffs onto the other's exports after trade talks fell apart earlier this month, and Trump has threatened to dramatically expand the categories of goods taxed this summer.

Restrictions on Huawei - Report

The US Department of Commerce has restored Huawei's ability to maintain its networks and provide software updates to existing Huawei handsets within the US, Reuters reported Monday.

A temporary general license, which was posted for public inspection, scales back restrictions imposed earlier by Washington on Huawei Technologies Co Ltd's ability to buy US goods as a means to help existing customers, according to Reuters. The temporary license lasts until 19 August.

Huawei has recently faced global scrutiny over allegations that the company is linked to the Chinese government and has been conducting surveillance on its behalf.

Last week, the US Department of Commerce said Huawei Technologies and its entities had been placed on a US trade blacklist for engaging in activities that go against the interests of US national security. US President Donald Trump issued an executive order declaring a national emergency over telecommunications technologies and services linked to foreign adversaries, prohibiting US companies from engaging in transactions with companies from the co-called adversary countries.

Although both Huawei and the Chinese government have firmly refuted the claims, Australia, Japan, New Zealand and the United States banned Huawei from participating in government contracts last year.

China's Premier Li Keqiang rejected the espionage charges against telecommunications companies from China, noting that there is no specific evidence to prove the allegations.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.