Why We Have An Oversupply Of Almost Everything

Gail

Tverberg

7

May, 2015

The

Wall Street Journal recently ran an article called, Glut

of Capital and Labor Challenge Policy Makers:

Global oversupply extends beyond commodities, elevating deflation

risk. To me, this is a very serious issue, quite likely signaling

that we are reaching what has been calledLimits

to Growth,

a situation modeled in 1972 in a book by that name.

What

happens is that economic growth eventually runs into limits. Many

people have assumed that these limits would be marked by high prices

and excessive demand for goods. In my view, the issue is precisely

the opposite one: Limits

to growth are instead marked by low prices and inadequate

demand. Common

workers can no longer afford to buy the goods and services that the

economy produces, because of inadequate wage growth. The price of all

commodities drops, because of lower demand by workers.

Furthermore, investors

can no longer find investments that provide an adequate return

on capital,

because prices for finished goods are pulled down by the low demand

of workers with inadequate wages.

Evidence

Regarding the Connection Between Energy Consumption and GDP Growth

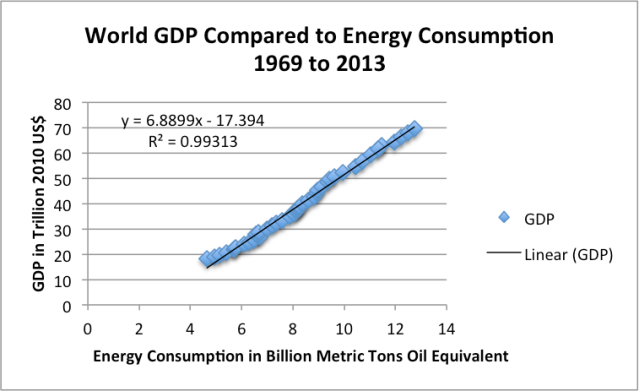

We

can see the close connection between world energy consumption and

world GDP using historical data.

Figure

1. World GDP in 2010$ compared (from USDA) compared to World

Consumption of Energy (from BP Statistical Review of World Energy

2014).

This

chart gives a clue regarding what is wrong with the economy. The

slope of the line implies that adding one percentage point of

growth in energy usage tends to add less and less GDP growth over

time, as I have shown in Figure 2. This means that if we want to

have, for example, a constant 4% growth in world GDP for the period

1969 to 2013, we

would need to gradually increase the rate of growth in energy

consumption from

about 1.8% = (4.0% – 2.2%) growth in energy consumption in 1969 to

2.8% = (4.0% – 1.2%) growth in energy consumption in 2013. This

need for more and more growth in energy use to produce the same

amount of economic growth is taking place despite all of our efforts

toward efficiency, and despite all of our efforts toward becoming

more of a “service” economy, using less energy products!

Figure

2. Expected change in GDP growth corresponding to 1% growth in total

energy, based on Figure 1 fitted line.

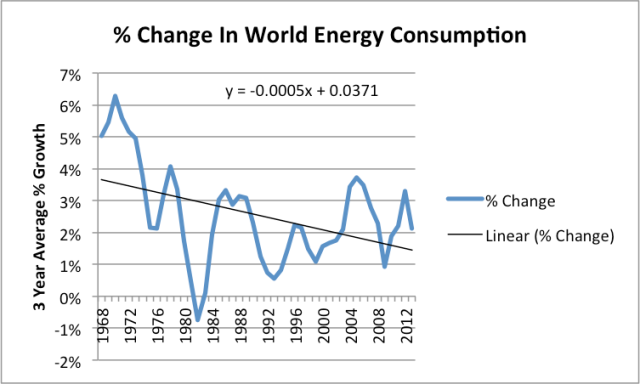

To

make matters worse, growth in world energy supply is generally

trending downward as well. (This

is not just oil supply whose growth is trending downward; this is oil

plus everything else, including “renewables”.)

Figure

3. Three-year average percent change in world energy consumption,

based on BP Statistical Review of World Energy 2014 data.

There

would be no problem, if economic growth were something that we could

simply walk away from with no harmful consequences. Unfortunately, we

live in a world where there are only two options–win or lose. We

can win in our contest against other species (especially microbes),

or we can lose. Winning looks like economic growth; losing looks like

financial collapse with huge loss of human population, perhaps to

epidemics, because we cannot maintain our current economic system.

The

symptoms of losing the game are the symptoms we are seeing today–low

commodity prices (temporarily higher, but nowhere nearly high enough

to maintain production), not enough good paying jobs for common

workers, and lack of investment opportunities, because workers cannot

afford the high prices of goods that would be required to provide

adequate return on investment.

How

We Have Won in Our Contest with Other Species–Early Efforts

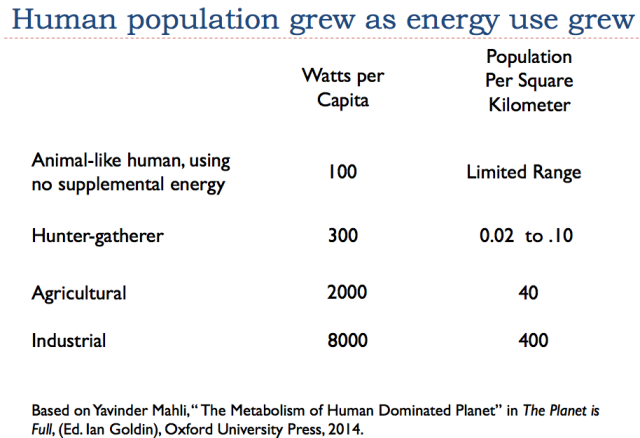

The

“secret formula” humans have had for winning in our competition

against other species has been the use of supplemental energy, adding

to the energy we get from food. There is a physics reason why this

approach works: total

population by all species is limited by available energy supply.

Providing our own external energy supply was (and still is) a great

work-around for this limitation.

Even in the days of

hunter-gatherers, humans used three times as much energy as could be

obtained through food alone (Figure 1).

Earliest

supplementation of food energy came by burning sticks and other

biomass, starting

one million years ago.

Using this approach, humans were able to gain an advantage over other

species in several ways:

- We were able to cook some of our food. This made a wider range of plants and animals suitable for food and made the nutrients from these foods more easily available to our bodies.

- Because less energy was needed for chewing and digesting, our bodies could put energy into growing a larger brain, thus giving us an advantage over other animals.

- The use of cooked food freed up time for such activities as hunting and making clothes, because less time was needed for chewing.

- Heat from burning plant material could be used to keep warm in cold areas, thereby extending our range and increasing total human population that could be supported.

- Fire could be used to chase off predatory animals and hunt prey animals.

Our

bodies are now adapted to the need for supplemental energy. Our teeth

our smaller, and our jaws and digestive apparatus have shrunk in

size, as our brain has grown. The large population of humans that are

alive today could not survive without supplemental energy for many

purposes, such as cooking food, heating homes, and fighting illnesses

that spread when humans are in as close proximity as they are today.

Our

Modern Formula For Winning the Battle Against Other Species

In

my view, the formula that has allowed humans to keep winning the

battle against other species is the following:

- Use increasing amounts of inexpensive supplemental energy to leverage human energy so that finished goods and services produced per worker rises each year.

- Pay for this system with debt, because (if supplemental energy costs are cheap enough), it is possible to repay the debt, plus the interest on the debt, with the additional goods and services made possible by the cheap additional energy.

- This system gradually becomes more complex to deal with problems that come with rising population and growing use of resources. However, if the output of goods per worker is growing rapidly enough, it should be possible to pay for the costs associated with this increased complexity, in addition to interest costs.

- The whole system “works” as long as the total quantity of finished goods and services rises rapidly enough that it can fund all of the following: (a) a rising standard of living for common workers so that they can afford increasing amounts of debt to buy more goods, (b) debt repayment, and interest on the debt of the system, and (c) and an increasing amount of “overhead” in the form of government services, medical care, educational services, and salaries of high paid officials (in business as well as government). This overhead is needed to deal with the increasing complexity that comes with growth.

The

formula for a growing economy is now failing. The rate of economic

growth is falling, partly because energy supply is slowing (Figure

3), and partly because we need more and more growth of energy supply

to produce a given amount of economic growth (Figure 2). With this

lowered world economic growth, the amount of goods and services being

produced is not rising fast enough to support all of the functions

that it needs to cover: interest payments, growing wages of common

workers, and growing “overhead” of a more complex society.

*

* *

Some

Reasons the Economic Growth Cycle is Now Failing

Let’s

look at a few areas where we are reaching obstacles to this continued

growth in final goods and services. An overarching problem is

diminishing returns, which is reflected in increasingly higher prices

of production.

1.

Energy supplies are becoming more expensive to extract.

We

extract the easiest to extract energy supplies first, and as these

deplete, need to use the more expensive to extract energy

supplies. We hear much about “growing efficiency” but, in

fact, we are becoming less efficient in the production of energy

supplies.

In

the US, EIA data shows that we are becoming less efficient at coal

production, in terms of coal production per worker hour (Figure 5).

With

oil, growing inefficiency is shown by the steeply rising cost of oil

exploration and production since 1999 (Figure 6).

Figure

6. Figure by Steve Kopits of Douglas-Westwood showing trends in

world oil exploration and production costs per barrel.

Thus,

it is for a fairly recent period, namely the period since about 2000,

that we have been encountering rising costs both for US coal and for

worldwide oil extraction.

The

extra workers and extra costs required for producing the same amount

of energy counteract the tendency toward growth in the rest of

the economy. This occurs because the rest of the economy must produce

finished products with fewer workers and less resources as a result

of the extra demands on these resources by the energy sector.

2.

Other materials, besides energy products, are experiencing

diminishing return.

Other

resources, such as metals and other minerals and fresh water, are

also becoming increasingly expensive to extract. The issue with

mineral ores is similar to that with fossil fuels. We start with a

fixed amount of ores in good locations and with high mineral

percentages. As we move to less desirable ores, both human labor and

more energy products are required, making the extraction process less

efficient.

With

fresh water, the issue is likely to be a need for desalination or

long distance transport, to satisfy the needs of a growing

population. Workarounds again involve more human labor and more

resource use, making the production of fresh water less efficient.

In

both of these cases, growing inefficiency leaves the rest of the

economy with less human energy and less energy products to produce

the finished goods and services that the economy needs.

3.

Growing pollution is taking its toll.

Instead

of just producing end products, we are increasingly finding ourselves

fighting pollution. While this is a benefit to society, it really is

only offsetting what would otherwise be a negative. Thus, it acts

like overhead, rather than producing economic growth.

From

the point of view of workers having to pay for higher cost energy in

order to fight pollution (say, substitution of a higher cost energy

source, or paying for more pollution controls), the additional cost

acts like a tax. Workers need to cut back on other expenditures to

afford the pollution control workarounds. The effect is thus recessionarх.

4.

The amount of “overhead” to the world economy has been growing

rapidly in recent years, for a number of reasons:

- The amount of overhead is growing because we are reaching natural barriers. For example, population per acre of arable land is growing, so we need more intensity of development to produce food for a rising population.

- With greater population density and increased bacterial antibiotic resistance, disease transmission becomes a more of a problem.

- Increasing education is being encouraged, whether or not there are jobs available that will make use of that education. Education that cannot be used in a productive way to produce more goods and services can be considered overhead for the economy. Educational expenses are frequently financed by debt. Repayment of this debt leads to a decrease in demand for other goods, such as new homes and vehicles.

- We have more elderly to whom we have promised benefits, because with the benefit of better nutrition and medical care, more people are living longer.

5.

We are reaching debt limits.

As

economic growth has slowed, we have been adding more and more debt,

to try to mitigate the problem. This additional debt becomes a

problem in many ways: (a) without cheap energy to leverage human

labor, there are not many productive investments that can be made;

(b) the addition of more debt leads to a need for more interest

payments; and (c) at some point debt ratios become overwhelmingly

high.

At

least part of the slowdown in economic growth that we are seeing

today is coming from a slowdown in the growth of debt. Without debt

growth, it is hard to keep commodity prices high enough. Investment

in new manufacturing plants is also affected by low growth in debt.

*

* *

Reasons

for Confusion in Understanding Our Current Predicament

1.

Not understanding that all of the symptoms we are seeing today are

manifestations of the same underlying “illness”.

Most

analysts think that the economy has stubbed its toe and has a

headache, rather than recognizing that it has a serious underlying

illness.

2.

Academia is focused way too narrowly, and tied too closely to what

has been written before.

Academics,

because of their need to write papers, focus on what previous papers

have said. Unfortunately, previous papers have not understood the

nature of our problem. Academics have developed models based on our

situation when we were away from limits. The issues we are facing

cover such diverse subjects as physics, geology, and finance. It is

hard for academics to become knowledgeable in many areas at once.

3.

Models that seemed to work before are no longer appropriate.

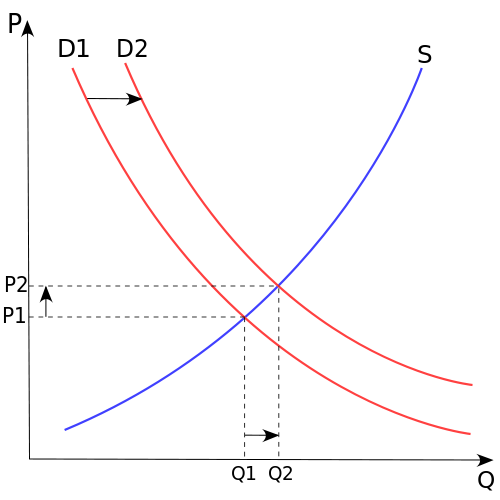

We

take models like the familiar supply and demand model of economists

and assume that they represent everlasting truths.

Figure

7. (Source Wikipedia). The price P of a product is determined by a

balance between production at each price (supply S) and the desires

of those with purchasing power at each price (demand D). The diagram

shows a positive shift in demand from D1 to D2, resulting in an

increase in price (P) and quantity sold (Q) of the product.

Unfortunately,

as we get close to limits, things change. Both wage levels and debt

levels have an impact on demand; the quantity goods available is also

affected by diminishing returns. The model that worked in the past

may be totally inappropriate now.

Even

a complex model like the climate change model being used by the IPCC

is likely to be affected by financial limits. If near-term financial

limits are to be expected, IPCC’s estimate of future carbon from

fuels is likely to be too high. At a minimum, the findings of the

IPCC need to be framed differently: climate change may be one of a

number of problems facing those people who manage to survive a

financial crash.

4.

Too much wishful thinking.

Everyone

would like to present a positive result, especially when grants are

being given for academic research will support some favorable

finding.

A

favorite form of wishful thinking is believing that higher costs of

energy products will not be a problem. Higher cost energy products,

whether they are renewable or not, are a problem for many reasons:

- They represent growing inefficiency in the economy. With growing inefficiency, we produce fewer finished goods and services per worker, not more.

- Countries using more of the higher cost types of energy become less competitive in the world market, and because of this, may develop financial problems. The countries most affected by the Great Recession were countries using a high percentage of oil in their energy mix.

- The amount workers have available to spend is limited. If a worker has $100 to spend on energy supply, he can buy 100 times as much in energy supplies priced at $1 as he can energy supplies priced at $100. This same principle works even if the cost difference is much lower–say $3.50 gallon vs. $3.00 gallon.

5.

Too much faith in, “We pay each other’s wages.”

There

is a common belief that growing inefficiency is OK; the wages we pay

for unneeded education will work its way through the system as more

wages for other workers.

Unfortunately,

the real secret to economic growth is not paying each other’s

wages; it is growing output of finished products per worker through

increased use of cheap energy (and perhaps technology, to make this

cheap energy useful).

Increased

overhead for the system is not helpful.

6.

An “upside down” peak oil story.

Most

people in the peak oil community believe what economists say about

supply and demand–namely, that oil prices will rise if there is a

supply problem. They have not realized that in a networked economy,

wages and prices are tightly linked. The way limits apply is not

necessarily the way we expect. Limits may come through a lack of good

paying jobs, and because of this lack of jobs, inability to purchase

products containing oil.

The

connection between energy and jobs is clear. Good jobs require the

use of energy, such as electricity and oil; lack of good-paying jobs

is likely to be a manifestation of an inadequate supply of cheap

energy. Also, high paying jobs are what allow rising buying power,

and thus keep demand high. Thus, oil limits may appear as a demand

problem, with low oil prices, rather than as a high oil price

problem.

In

my opinion, what we are seeing now is a manifestation of peak oil. It

is just happening in an upside down way relative to what most were

expecting.

*

* *

Conclusion

One

way of viewing our problem today is as a crisis

of affordability. Young

people cannot afford to start families or buy new homes because of a

combination of the high cost of higher education (leading to debt),

the high cost of fuel-efficient new cars (again leading to debt), the

high cost of resale homes, and the relatively low wages paid to young

workers. Even older workers often have an affordability problem. Many

have found their wages stagnating or falling at the same time that

the cost of healthcare, cars, electricity, and (until recently) oil

rises. A recent

Gallop Survey showed an

increasing share of workers categorize themselves as “working

class” rather than “middle class.”

It

is this affordability crisis that is bringing the system

down. Without

adequate wages, the amount of debt that can be added to the system

lags as well. It

becomes impossible to keep prices of commodities up at a high enough

level to encourage production of these commodities.

Return on investment tends to be low for the same reason. Most

researchers have not recognized these problems, because they are

narrowly focused and assume that models that worked in the past will

continue to work today.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.