We have a case of mass denial now that New Zealand is sliding into depression which it is trying to paper up with creating debt to the tune of $50,000,000,000.

The Left, that couldn't keep quiet about John Key's debt (which also came out of a national crisis) now will do anything to explain this away.

They say this reflects National hypocrisy (which in part, it does, but they ARE in opposition).

They say you can't compare because Greece's debt came out of irresponsible spending ( a lie - they were manipulated into this) and because New Zealand isn't.

We have a (manufactured) crisis in covid 19 so any explanation will do - and any amount of helicopter money - anything to paper of the cracks and pretend that the situation is other than what it is.

I even got told that the comparison is irrelevant because "Greece has a different tax structure". Excuse me!

John Key did it and now Jacinda Adern is doing it on an epic scale.

Helicopter Money Could Be Coming To New Zealand

27 May, 2020

The latest on the list of Central Banks to do away with any thoughts of moral hazard in favor of simply printing and distributing money comes from New Zealand.

Finance minister Grant Robertson said late last week that the country is considering "distributing free cash directly to individuals as a way of policy stimulus" to deal with the effects of the coronavirus pandemic, according to Reuters.

He was asked about the government's ideas for "helicopter money" and exactly how the central bank would get the money to the country's citizens. While he says the concept is still being discussed, “it’s not something that has got to that level of discussion at all,” he told the media.

“I am pretty keen on making sure that fiscal policy remains the role of the government,” he said.

We'll give it a couple more days and ask again...

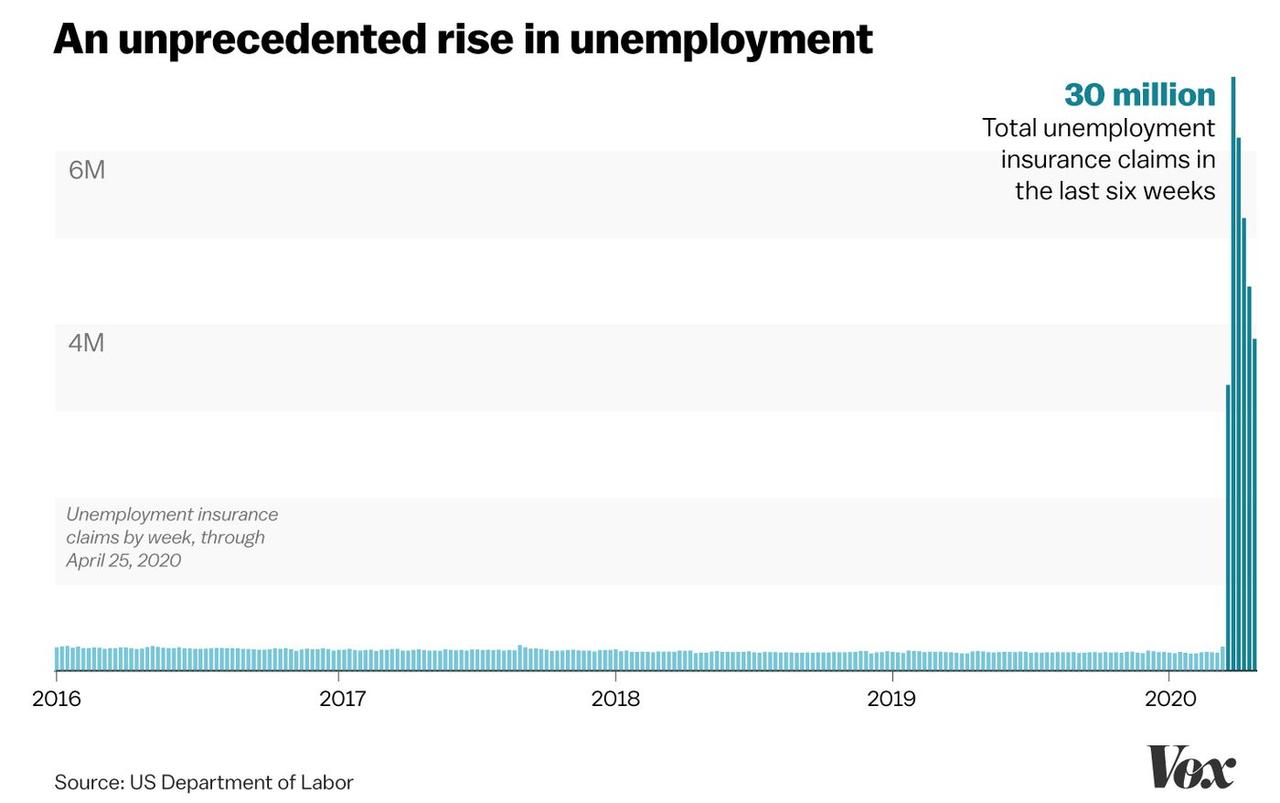

The idea of helicopter money continues to gain in popularity with Central Banks across the globe as governments look to a way to try and stimulate their way out of a pandemic-induced recession that has made even some numbers from the Great Depression look meaningless.

Despite its appeal, no major countries have embarked on direct helicopter money (money has been issued from the state after Central Bank asset purcahses, but not directly from Central Banks), as it calls further into question Central Bank independence (we'll pause for laughter) and - even for the MMT crowd - raises the question of inflation.

New Zealand's economy is export-reliant and expected to contract a stunning 21.8% in the current quarter due to the pandemic.

For now, New Zealand's Central Bank has cut interest rates to a record low of 0.25% as a result and has doubled its bond buying program to NZ$60 billion. It has also telegraphed a potential coming shift to negative rates.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.