Trade

War Chaos Collapses Farm Equipment Sales Across Midwest

11 August, 2019

Reuters spoke with dozens of John Deere Stores across the Central and Midwest US to get a better understanding of what the trade war and adverse weather conditions have had on tractor sales this year. What they discovered was an ominous sign of an agriculture bust that has triggered massive tractor sales declines at dozens of John Deere Stores.

About a half dozen stores across the Midwest told Reuters sales in 1H19 collapsed. One store, in Geneseo, Illinois, saw sales crash 50% in 1H19 YoY.

A Salem, Wisconsin-based store said sales dropped 15% in 1H19, led by the rapid decline of large farm equipment. Already, sales orders for tractors next season are down 25%, an indication the farm bust will continue through 2020.

We reported several months ago that JPMorgan told clients the American agriculture complex is on the verge of disaster, with farmers caught in the crossfire of an escalating trade war.

"Overall, this is a perfect storm for US farmers," JPMorgan analyst Ann Duignan warned investors.

With a farm crisis currently underway, Duignan downgraded John Deere's stock to underweight in May, citing fundamentals in the Midwest are "rapidly deteriorating."

The rapid decay in fundamentals Duignan was speaking about is the collapse in tractor sales across the Midwest. Deere derives 60% of its sales from the US and Canada. The company is expected to announce a decline in its agriculture & turf segment when it reports next Friday.

Dave Schmidt, president, Schmidt Implement Co. (a John Deere dealer in Salem, Wis.), warned: "We are not expecting demand for planting equipment to come back up this year."

Meanwhile, China imported $9.1 billion of US farm products in 2018, down from $19.5 billion in 2017.

Earlier this week, China said it would suspend its purchases of US agricultural products and wouldn't rule out increasing import tariffs on American farm imports purchased after Aug. 3.

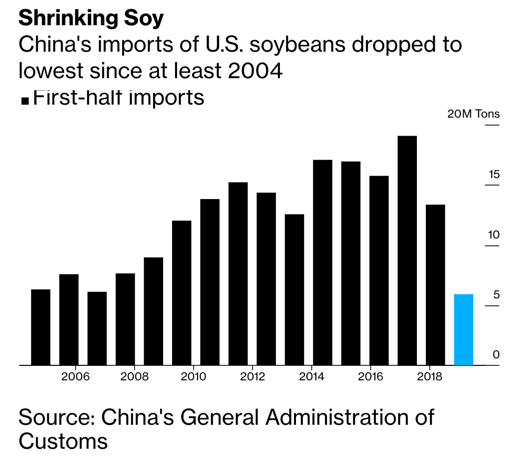

US shipments of soybean to China plunged to a 16-year low last year as Beijing has effectively ditched US markets for Latin America countries, like Brazil, Argentina, and Paraguay, leaving American farmers hanging dry with massive surpluses.

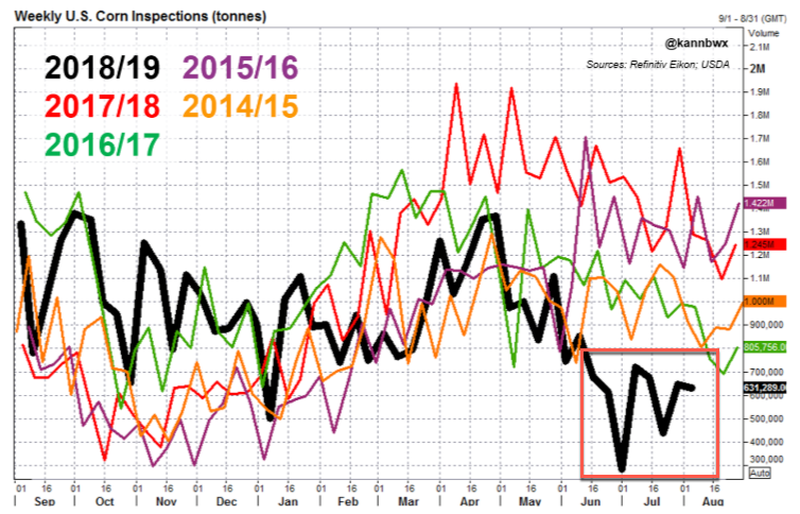

US shipments of corn to China dropped to a 19-month low in June as China continued sourcing agriculture products from Latin America countries.

China increasing its agriculture product sourcing from Latin America has given John Deere rival CNH Industrial ample demand for its farm equipment this year.

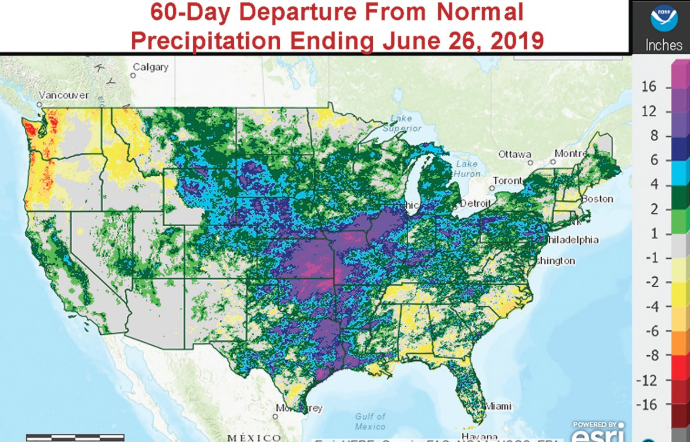

Torrential rains and wicked floods across the Midwest US in spring has inflected horrible economic pain on soybean and corn farmers, particularly those who couldn't plant this year due to waterlogged fields, to only find out by late summer that their export channels into China have been completely severed.

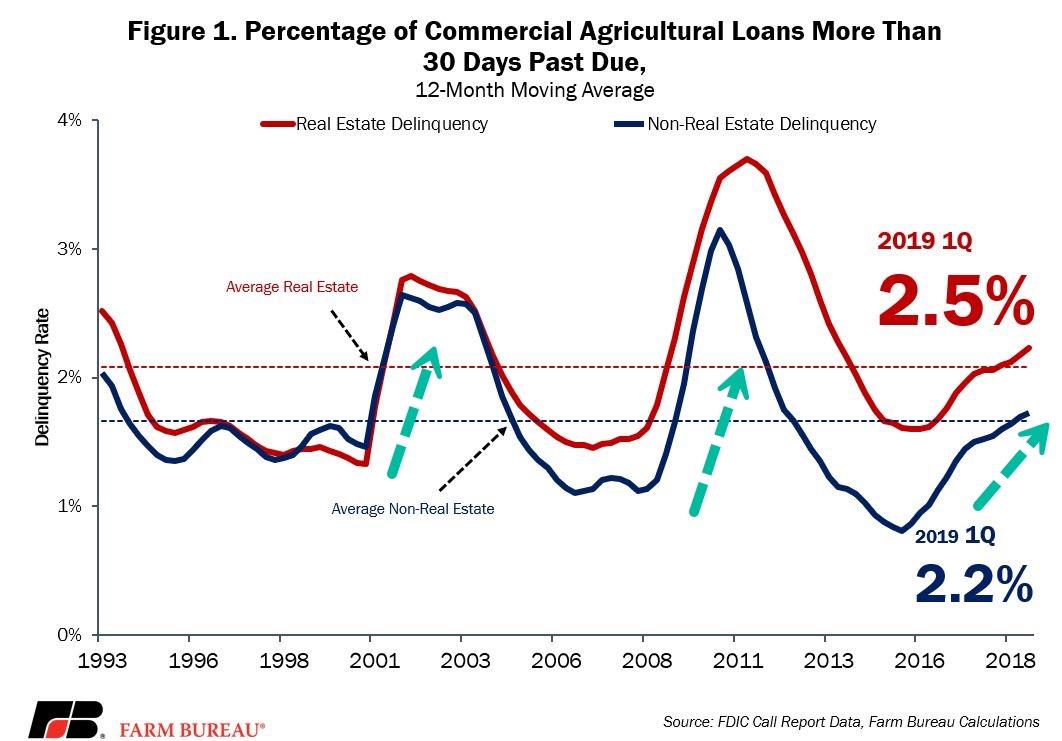

On top of that, rising debt loads, declining farm property prices, low spot prices for commodities, and crashing farm incomes have sent bankruptcies across the farm belt to seven or so year highs.

The farm bust is here - this is what farmers are saying:

Ohio farmer (who voted for Trump) tells @SullyCNBC the multiple ways Trump has failed as president, and that he won't be voting for him again.

This is not good for agriculture product and Agriculture seed industry.

ReplyDelete