Chinese

Banks No Longer Trust One Another As Repo Rates Skyrocket

11 August, 2019

For those who have grown bored with the ongoing US-China trade war whose escalation was obvious to all but the dumbest BTFD algos, the biggest news of the past week was that yet another Chinese bank was bailed out by the Chinese government - the third in the past three months - and a substantial one at that: with over 1.4 trillion yuan in assets ($200BN), Hang Feng Bank's nationalization was certainly large enough to make a dent on the Chinese financial system and on the Chinese Sovereign Wealth Fund, which drew the short straw and was told to bailout the troubled Chinese bank (more here).

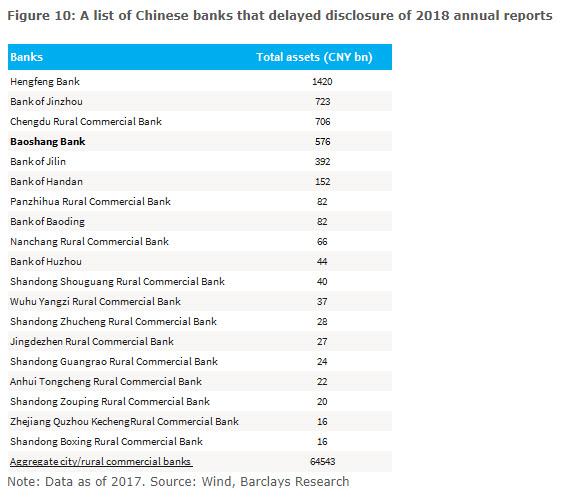

Hang Feng's bailout followed those of Baoshang and Bank of Jinzhou, which means that 3 of the top 4 most troubled banks have now been either nationalized by an SOE or seized by the government, which is effectively the same thing.

Of course, to regular readers this development was hardly surprising, especially after our post in mid-July when we saw the $40 trillion Chinese banking system approach its closest encounter with the proverbial "Lehman moment" yet, when inexplicably the four-day repo rate on China’s government bonds (i.e., the cost for investors to pledge their Chinese government bond holdings for short-term funding) on the Shanghai exchange briefly spiked to 1,000% in afternoon trading.

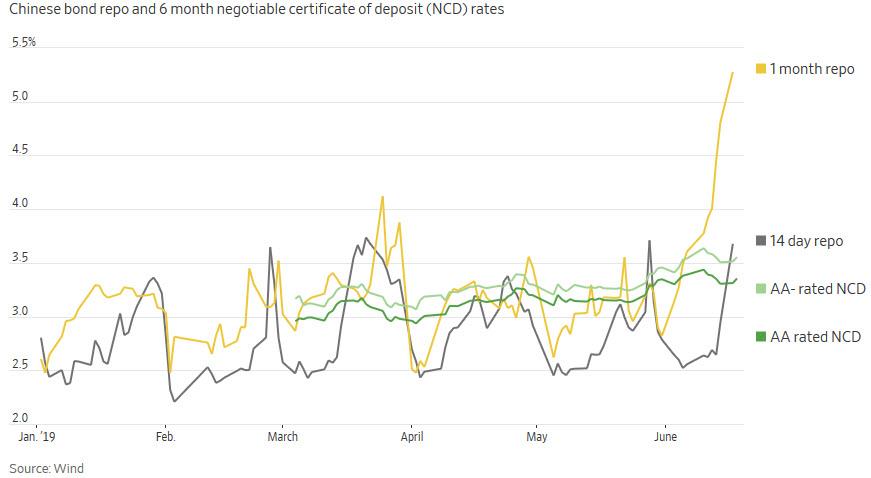

While some attributed the surge to a fat finger, far more ominous signs were already present, and in the aftermath of the Baoshang failure, which has sent Chinese banking stocks tumbling, one-day and seven-day weighted average borrowing rates had remained low thanks to huge central bank cash injections - such as the 250BN yuan we described back in May - longer tenors such as the 1 month repo have marched sharply higher.

And now, none other than Goldman points out that something is clearly breaking inside China's banking system as one after another small bank domino falls, and as following the Baoshang Bank takeover in late May, interbank lenders have become more cautious towards the credit risk of smaller and weaker financial institutions.

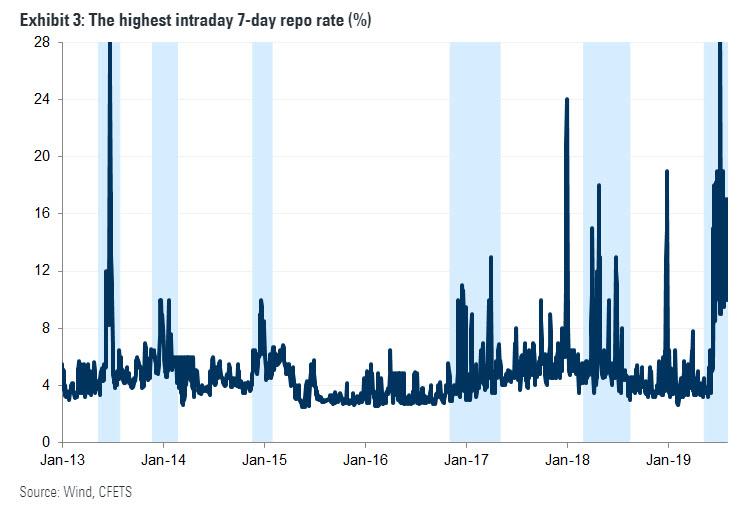

The result: a Chinese banking system in which banks have lost trust in one another, manifested itself in much tighter liquidity in the interbank market, with the highest intraday 7-day repo rates staying above 8% over the past month as questions swirl over the viability of the underlying collateral. In fact, as shown in the chart below, the creeping funding freeze among Chinese banks is now even worse compared to the historic episode in the summer of 2013 when following an aggressive ramp up in Beijing's deleveraging campaign, repo rates exploded to the point that banks effectively stopped interacting with each other.

As Goldman observes, "the sustained spikes in intraday repo rates suggest that some banks are still under pressure and are having to pay higher costs to obtain funding in the interbank market. A number of action has been taken to ease concerns regarding credit risk at smaller banks, including the recent equity injection into Bank of Jinzhou by ICBC Financial Asset Investment Company and China Cinda Asset Management."

Nonetheless, as the bank concludes, "it will take more time before market conditions will normalize." Meanwhile, if more banks from the list above, or worse, larger banks, end up failing - and so far there is every indication that the process is only getting worse - the Chinese funding freeze could get so large that the most dreaded event finally take place: a bank run among one of China's largest, state-owned banks, which as a reminder, are also the largest in the world.

The 4 largest banks in the world are Chinese:

1. ICBC: $4TN

2. China Construction: $3.4TN

3. Agri Bank of China: $3.3TN

4. Bank of China: $3.1TN

Now that we know China's response, it's time for the US counter-retaliation.

293 people are talking about this

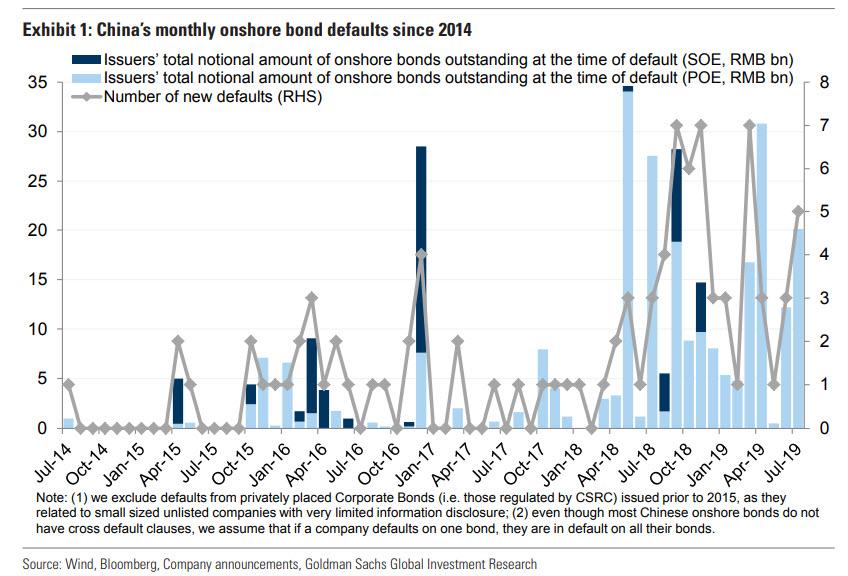

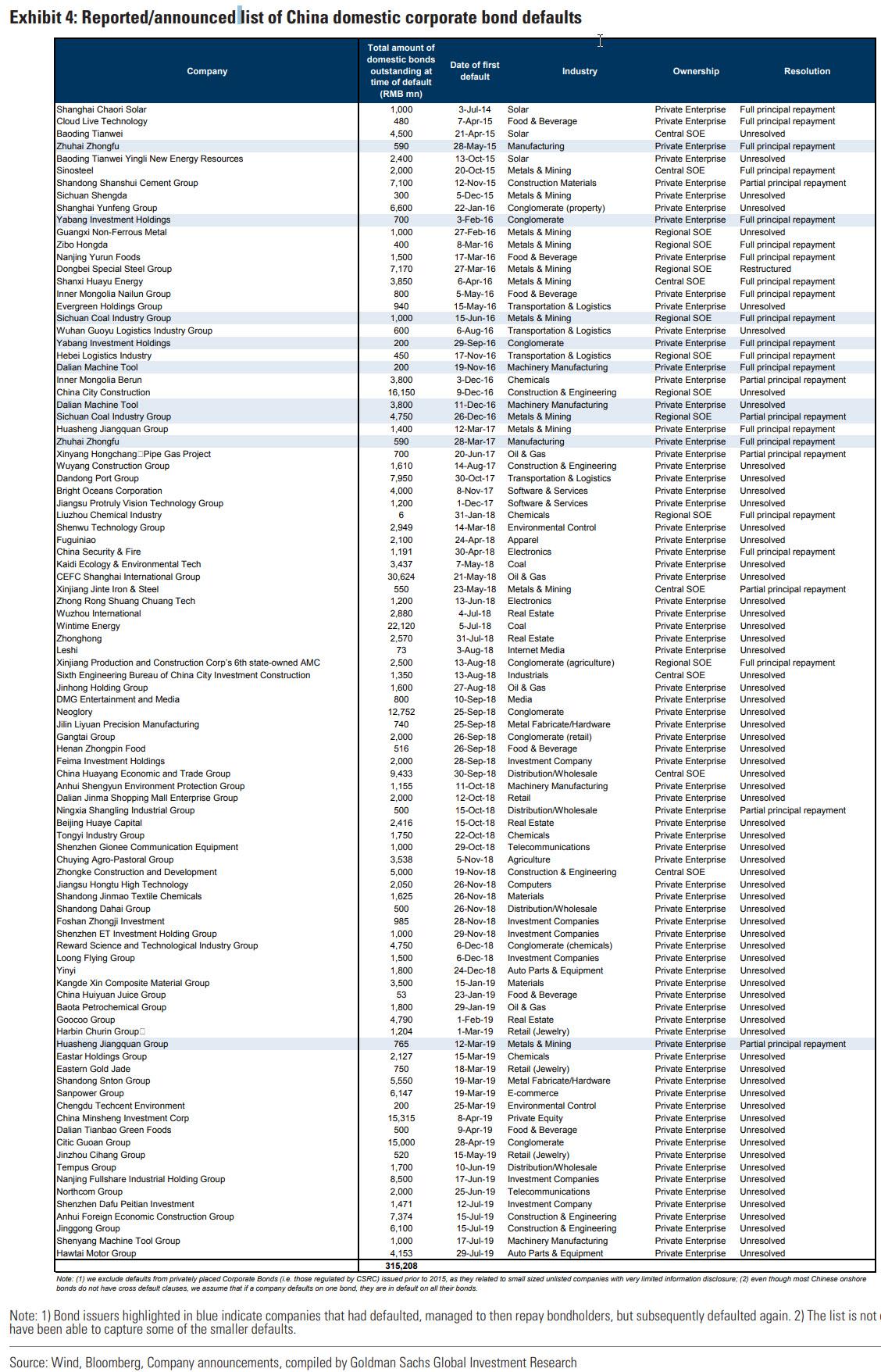

One final, if key, point: it's not just Chinese banks that are in funding peril, Chinese corporations are are on the firing line, and as Goldman points out in the same report, the pace of China onshore bond defaults is showing no signs of slowing down. According to the bank's estimates there were five new defaults in July, bringing the total number of new defaults this year to 23 (Exhibit 1), compared with 38 new defaults that occurred in 2018. These 23 issuers had RMB 90.5bn of onshore bonds outstanding at the time of default, equating to 0.5% of all onshore corporate bonds outstanding at the start of 2019. However, all the defaults so far this year are from privately owned enterprises (POEs), and the RMB 90.5bn of onshore bonds outstanding at the time of default equates to 3.5% of all POE bonds outstanding at the start of this year. To us, the elevated level of defaults continue to impact weaker credit, as the net issuance of bonds rated AA or lower turned negative in July.

For those curious, below is a comprehensive, if not complete, list of Chinese corporations that have defaulted since 2014, when China first started permitting corporations to fail (smaller companies have been omitted).

No comments:

Post a Comment

Note: only a member of this blog may post a comment.