I like nice simple explanations such as this on matters financial

"This is for you, Dad.

"I remember when the housing collapse sent a torpedo through my family. My father's concrete company collapsed almost overnight. My father lost his home. My uncle lost his home. I remember my brother helping my father count pocket change on our kitchen table. That was all the money he had left in the world. While this was happening in my home, I saw hedge funders literally drinking champagne as they looked down on the Occupy Wall Street protestors. I will never forget that.

"My Father never recovered from that blow. He fell deeper and deeper into alcoholism and exists now as a shell of his former self, waiting for death.

"This is all the money I have and I'd rather lose it all than give them what they need to destroy me. Taking money from me won't hurt me, because i don't value it at all. I'll burn it all down just to spite them.

"This is for you, Dad."

ROBINHOOD-WINKED:

GLOBAL ELITES STEAL BACK

FROM THE PEASANTS

Today on TruNews, we discuss the war on people being waged by the kings and queens of globalism, as everything from crazy Q-Anon to daring to day trade is now a crime in the new America.

We detail the real story behind the fortification of the Capitol and the criminalization of buying Gamestop ‘stonks’ on Robinhood after hearing about billionaire hedge funds conspiring to destroy childhood memories.

We also address the death investors who made a killing during the pandemic, as the SEC gives a by to billionaires Jeff Bezos and Bill Gates for ‘insightful’ stock trading, while setting Peter Strzok’s spurned wife loose on the revolutionaries ransacking Wall Street through Reddit.

Doc Burkhart, Edward Szall, Matt Skow. Airdate 01/29/2021

Watch the broadcast HERE

Understanding the Whole

"Gamestop" Debacle on Wall

Street this week

29 January, 2021

There is gigantic tumult taking place this week on Wall Street, with the entire Stock and Bond market talking about Gamestop.

Here's an explanation of what went on:

So some bigshots in Hedge Funds on Wall Street got beaten at their own game, and now they're all screaming that the general public should not be allowed to do what Wall Street itself has been doing for decades!

Put simply, for the filthy rich, it's somehow OK for THEM to manipulate pricing to grab other people's money, but when the general public gets together to do the exact same thing (and thereby wipe out the filthy rich) it should somehow be illegal.

A bunch of Day-Traders who talk amongst each other on a chat server named "WallStreetBets" hosted by DISCORD, realized they could act together and drive the value of a stock up to their own benefit because a Hedge Fund publicly reported they had a position in that stock (Gamestop). So the Day Traders began buying Gamestop stocks and the price went up.

Firs thing that happened was the rich guys, who saw themselves starting to lose Billions to these Day Traders, had the chat hosting server SHUT OFF to prevent people from talking about it!

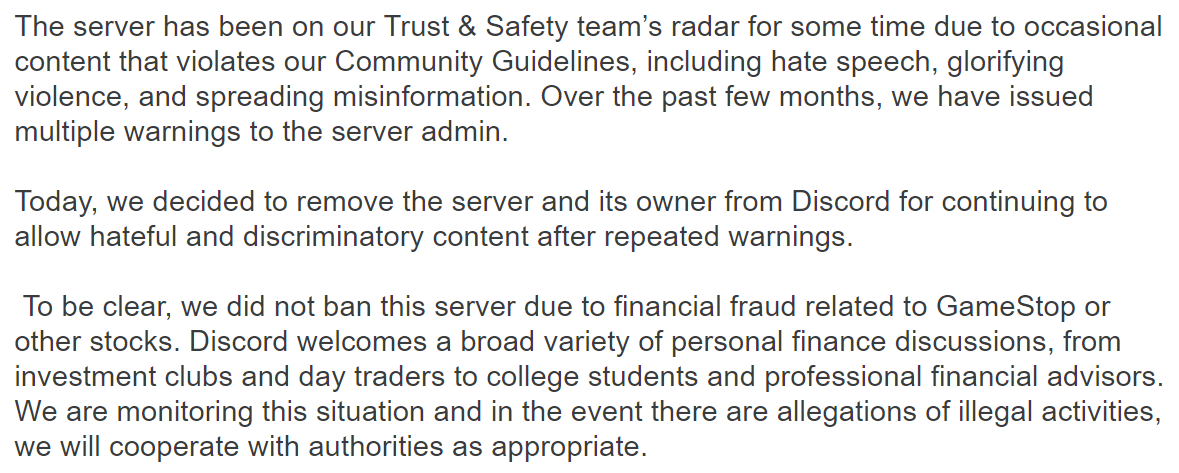

The chat server, a company named DISCORD, shut down the chat server then apparently lied about why they did it. Here's the DISCORD explanation:

Oh, so group buying of stocks is now "Hate Speech?" "Racism?" Even the Wall Street Journal called it "Straight up White Supremacy." (HT Remark: WOW, these filthy rich guys pull out all the stops when trying to justify their manipulation of the markets! ! ! ! )

Now Reddit Investors Are

Talking About Targeting

Silver, And That Could Change

EVERYTHING

Making matters worse is what Stock Brokerage Houses did during this fiasco: They took it upon THEMSELVES to prevent their customers from buying more stick in Gamestop! This meant that the general public was being prevented from buying more of the stocks, and thereby putting more of a hurt on certain of their Hedge Fund buddies! That's price-fixing and it is a violation of the Sherman Anti-Trust Act . . . but the Brokerage Houses did it anyway.

Then, in an even more spectacular act, at least one Brokerage House, Robinhood, decided it would begin SELLING the stocks held by their customers, **** WHETHER THE CUSTOMER WANTED TO SELL OR NOT ****

This had the effect of driving DOWN the price of the stock, thus saving the Hedge Fund and screwing their customers out of profits.

The Stock Market showed itself to be completely "rigged" this week, with the ultra rich who own Stock Brokerages, showing they are perfectly willing to engage in outright price-Fixing and actually STEAL their own customer's stocks (by selling them without authorization) so as to protect their rich buddies.

If people leave their money in Stock Brokerages after this brazen display of criminality, they're fools. People should start pulling ALL their money out of stock brokerages that committed these acts and drive those brokerages out of business immediately.

(Securities Laws require me to tell you that "I am NOT a licensed financial planner and cannot give financial advice. Consult a licensed professional -- the same type that did the price-fixing and stealing -- before making any financial decisions.)

For decades, the big fish on Wall Street have been able to do virtually anything that they want, but now the small fish are fighting back and it has been a beautiful thing to watch. Finally it is payback time, and the losses have been absolutely staggering. In fact, Reuters is reporting that short sellers have lost more than 70 BILLION dollars so far this year. But nobody should be crying for the short sellers. As Charles Payne pointed out during an epic rant on Fox Business, the short sellers have ruthlessly crushed countless businesses over the years, and they did so without showing any mercy whatsoever.

So now the big hedge funds want mercy themselves?

It’s not likely to happen.

After sending GameStop, AMC and other beleaguered stocks into the stratosphere, now investors on Reddit are talking about going after a really huge whale.

The silver market is perfectly primed for an epic short squeeze, and a coordinated assault by retail investors could make it happen.

The following is an excerpt from the post on the “WallStreetBets” Reddit subgroup that everyone is talking about…

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It’s not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they’ve done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn’t the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren’t halted and that’s what will make this so fun when the true squeeze happens.

That post has already been upvoted more than 9,400 times, and it appears that a consensus is building that this is going to be the next big thing after the raid on GameStop short sellers is done.

On Thursday, the price of gold was up 4.5 percent in anticipation that something might happen, and much of that price movement was apparently caused by short sellers that feverishly rushed to close their positions…

“After watching GameStop (NYSE:GME) and other shorts getting blasted, rumours that silver could be targeted has traders preemptively covering shorts just in case,” said Tai Wong, a trader at investment bank BMO in New York.

As Eric King has pointed out, if Reddit investors really do decide to go all-in on silver, they could do some serious damage…

“Chris, I just calculated the last 4 trading days in GameStop (GME) in dollar terms and it totals $82.3 billion. I think annual silver production is roughly 1 billion ounces and at current prices that would total about $25 billion. That means yesterday’s trading volume in GameStop of $29.9 billion would have purchased more than the entire annual silver mine production! And the last 4 trading days in GameStop ($82.3 billion in dollar terms) would have purchased more than a staggering 3-times the entire annual global silver mine production! This type of buying would obviously create one hell of a violent short squeeze in the silver market.”

Of course the other side doesn’t exactly play fair.

On Thursday, Robinhood and other trading platforms suddenly restricted trading in some of the key stocks that retail investors have been targeting…

Shares of AMC Entertainment Holdings, BlackBerry Ltd., Bed Bath & Beyond Inc., Express Inc., GameStop Corp., Koss Corp., Naked Brand Group and Nokia Corp. have been restricted to “position closing only,” Robinhood said in a blog post.

The decision means traders cannot initiate new positions in shares of those companies and can only sell existing holdings. The company also raised margin requirements for certain securities.

There are allegations that Robinhood and other trading platforms were persuaded to shut down trading in those stocks by the big fish on Wall Street, but Robinhood and the other trading platforms are denying this.

And Robinhood is also denying that it forced some users to suddenly dump their shares in GameStop and other key stocks…

No, Robinhood tells The Verge, it didn’t sell off full shares of GameStop, AMC, and other buzzy stocks without permission from its traders.

That contradicts the stories of twelve people who spoke with The Verge, saying that the app unexpectedly sold off their holdings in some of these companies. Quite a number of Robinhood users expressed their surprise on social media today that the app was selling off their stakes, and we tracked down a dozen of them. These traders didn’t believe they had prompted the sales, and they said they weren’t aware of anything on their account that would have automatically triggered them.

Hopefully authorities will investigate and get to the bottom of what actually happened.

At this point, Robinhood has already been slapped with two lawsuits because of what took place on Thursday…

Two Robinhood users filed separate lawsuits against the brokerage app Thursday after it and other apps restricted trading of certain securities.

The first lawsuit filed in the Southern District Court of New York alleges that Robinhood “purposefully, willingly, and knowingly” restricted certain securities transactions, including GameStop. The other filed in the Northern District Court of Illinois alleges that the app manipulated its platform.

And it is being reported that the House and the Senate will both be holding hearings on the matter…

The U.S. House Financial Services and Senate Banking committees said on Thursday they will hold hearings on the stock market after users of investment apps faced trading limits following the “Reddit rally” that put a charge into GameStop and other volatile stocks that were touted in online forums.

“We must deal with the hedge funds whose unethical conduct directly led to the recent market volatility and we must examine the market in general and how it has been manipulated by hedge funds and their financial partners to benefit themselves while others pay the price,” said Representative Maxine Waters, a Democrat who heads the House panel.

After everything that just went down, I don’t know how Robinhood is going to survive.

There are also rumors of a “liquidity crisis” at Robinhood, but the company insists that those rumors are simply not true.

Meanwhile, the firm has “tapped at least several hundred million dollars” in emergency credit in recent days…

Robinhood Markets, the trading app that’s popular with investors behind this month’s wildest stock swings, has drawn down some of its bank credit lines to ensure it has enough cash to clear trades, according to people with knowledge of the matter.

The firm, according to one of the people, has tapped at least several hundred million dollars, a significant amount of money for a firm that was valued at about $12 billion a few months ago. Robinhood’s lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc., according to data compiled by Bloomberg. Representatives for Robinhood and those banks declined to comment.

I have a feeling that this story is not going to end well for Robinhood.

But for the retail investors that are changing the course of history, this is truly an amazing time.

Finally, the small fish are standing up for themselves and are fighting back against the big fish, and the big fish have good reason to be quite scared.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.