You would have to be a fool not to read the tea leaves

Gold Hits Record Highs!

Gold Hits Record Highs!

6 August, 2019

Gold hit record highs in a number of currencies this week as trade war worries, geopolitical uncertainty and expectations of a slowing economy drove investors to seek safe haven.

While the yellow metal has soared in USD terms in recent weeks, as global geopolitical tensions rise and the "policy-maker idiocy" proxy spikes ($15 trillion of negative-yielding debt)...

Topping $1500 in gold futures tonight for the first time since 2013...

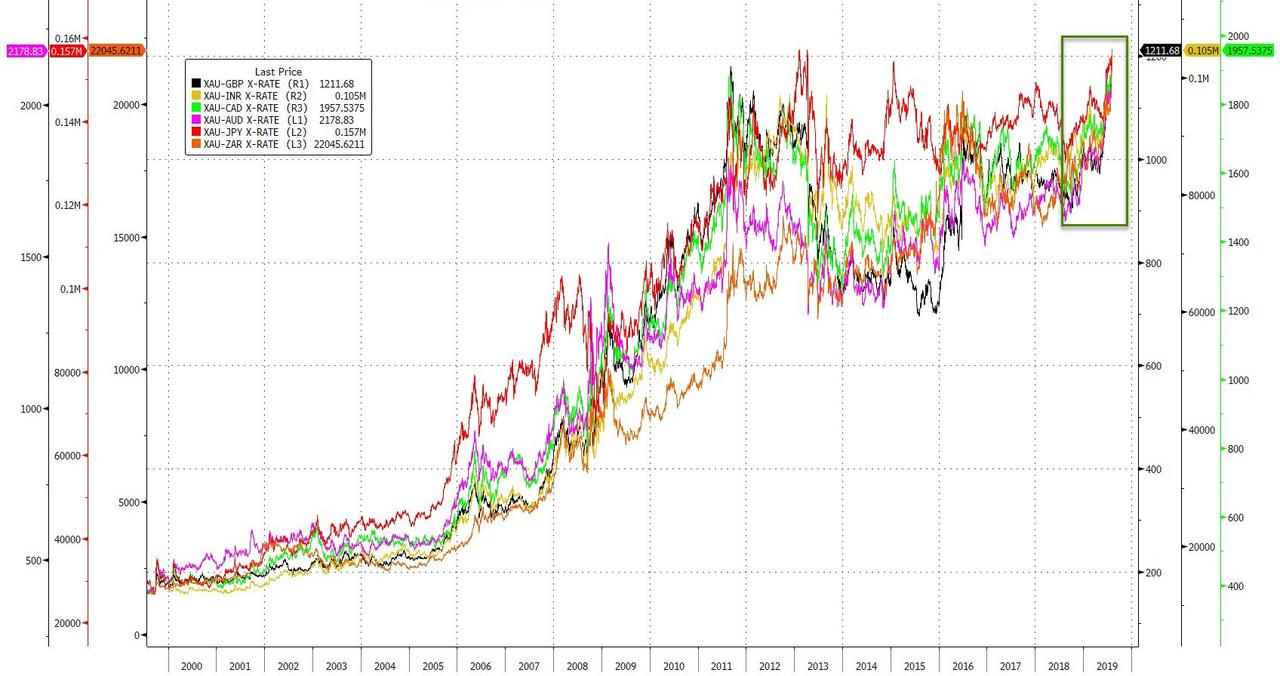

It was in other currencies that gold really shone...

Record Gold Prices

- British pound – £1,209.55

- Indian rupee – Rs 103,837.75

- Canadian dollar – CAD $1,938

- Australian dollar – AUD $2,180

- Japanese yen – ¥155,550

- South African rand – ZAR R21,929

As SchiffGold.com notes, the price of gold also saw big jumps in several other currencies. The yellow metal was dramatically higher in China at CNY ¥10,400...

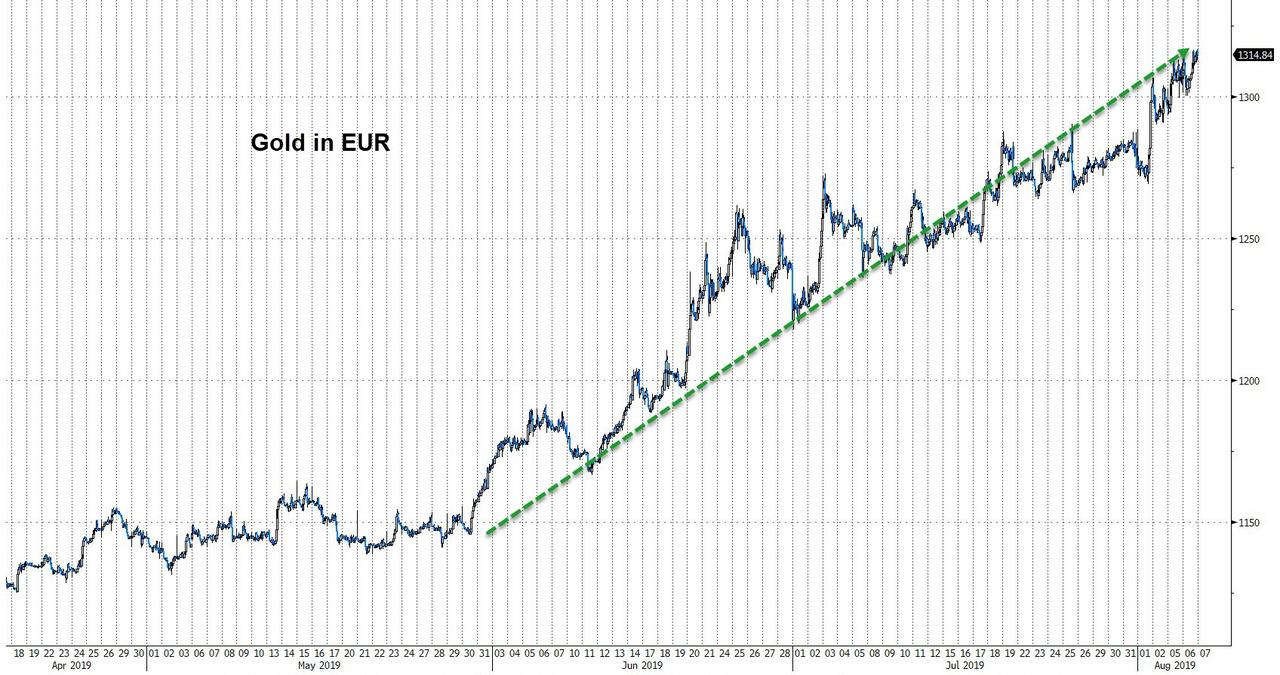

Gold rallied notably in euros.

More trade war tension was a big driver in the gold rally, but the recent surge in gold prices isn’t an isolated event. The yellow metal has been rallying for months. The yellow metal is up 17% since last December when plunging stock markets drove the Fed to initiate the “Powell Pause.”

The trade war isn’t the only factor pushing gold higher. For instance, Brexit uncertainty is driving the yellow metal up in the United Kingdom. The gold price in British pounds has skyrocketed 25% since May.

Generally weak economic data is also driving investor worry. Despite assurances from Powell and US government officials that the American economy is strong, the data tells a different story. Even as Powell was assuring us the domestic economy is fine, and the Fed’s worries are all global, we got more gloomy economic numbers. Data showed the ISM manufacturing index dropped to 51.2% in July. That’s the lowest level since mid-2016. Construction spending also declined by 1.3% in June. Meanwhile, jobless claims climbed modestly by 8,000 to 215,000 at the end of July.

Philips Futures analyst Benjamin Lu told CNBC he thinks all of the uncertainty will lead to more Fed rate cuts.

All this volatility, growth fears, persistent weakness in economic data will be good enough for a risk-off environment.”

Peter Schiff has been saying we are going back to zero all along, and the Fed is going to have to launch more QE. He reiterated this point in his Fox Business appearance.

He’s trying to pretend it’s because of concerns about the overseas economy. It is really the US economy that is driving the Fed. That’s why this is just the first step on the road back to zero. And you know, it was a mistake when the Fed went back to zero the last time; it’s going to be an even bigger mistake when they do it next time. And they’re also going to go back to quantitative easing. You know, they announced yesterday the end of quantitative tightening, but the next step is to go back to QE, and QE 4 is going to be bigger than QE 1, 2 and 3 combined.”

This is exactly why Peter is saying to buy gold now.

The trade – get out of the dollar and look at gold … People are totally on the wrong side of this trade right now. People don’t own gold and silver. They’re too long the dollar. They have no idea just how much inflation the Federal Reserve is going to be unleashing. And it’s not going to be good for stock prices. The inflation is going to be in the supermarket, not in the stock market.”

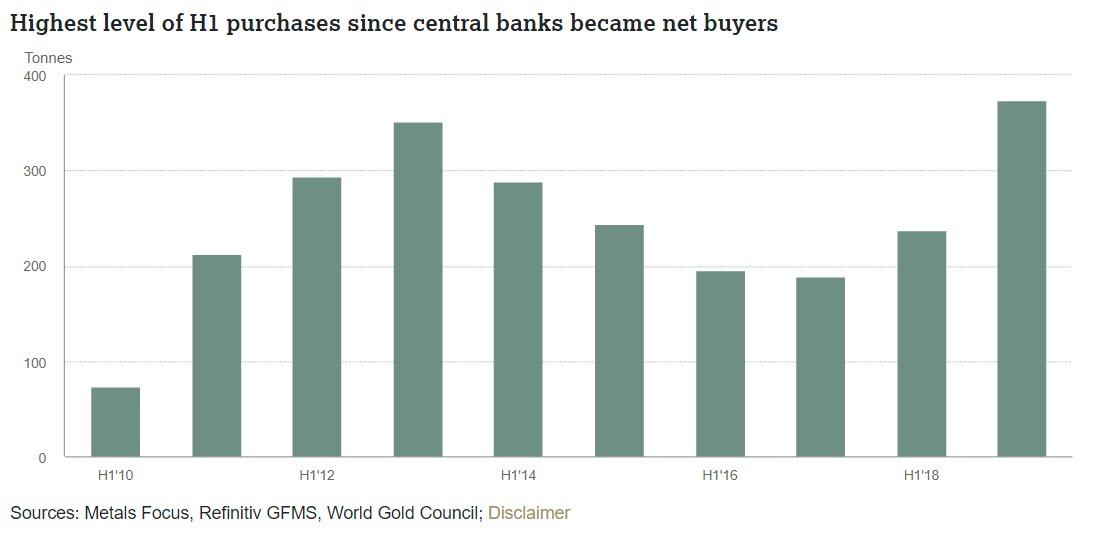

And that is, and has been, exactly what the world's central banks have been doing.

As The FT reports, central banks purchased a record $15.7bn of gold in the first six months of the year in an effort to diversify their reserves away from the US dollar as global trade tensions continue to simmer.

Data released by the World Gold Council last week showed central banks, led by Poland, China and Russia, bought 374 tonnes of gold - the largest acquisition of the precious metal on record by public institutions in the first half of a year. Central banks accounted for nearly one-sixth of total gold demand in the period.The pattern advances on last year’s activity in which central banks hoovered up more gold than at any time since the end of the gold standard (where a country could link the value of its currency to the precious metal) in 1971.The shift in attitude towards gold since the financial crisis was highlighted by a European Central Bank decision last week to cease an agreement to limit sales of gold, as the region’s institutions are no longer selling it in large volumes and are instead now net purchasers.

“June was a big month for gold,” said Alistair Hewitt, head of market intelligence at the WGC. “While the Fed’s dovish turn was the key driver for this, it also builds on a strong first half of the year, which saw gold demand hit a three-year high, underpinned by extremely strong central bank buying.”

Poland’s giant purchase bumped Russia into a Q2 second place. Poland, which had previously boosted its gold reserves by 25.7t in 2018, followed this up with a whopping 100t purchase in Q2. This is the highest quarterly purchase by a single central bank since India bought 200t from the IMF in November 2009.2 National Bank of Poland President Professor Adam Glapiński indicated that this purchase was strategic, with the intention of further safeguarding the financial security of the country.

As Juan Carlos Artigas WGC director of investment research told Kitco News in April:

“What is more interesting to understand in the case of Russia... is not just these large numbers, but the trend. Emerging market central banks have been buying gold fairly consistently since 2010 ... because central banks are looking to diversify their reserves, they are looking for safety and gold provides that to them.’’

Russian gold reserves rose by 38.7t in Q2, bringing y-t-d net purchases to 94t, compared with 105.3t in H1 2018. Gold reserves stood at 2,207t at the end of June, equal to 19% of total reserves. In May, the central bank discounted its purchase price to encourage domestic producers to export more gold. Governor, Elvira Nabiullina stated:

“We introduced discounts for the purchase of gold because we saw that vendors were selling gold mainly to the central bank,” and “The discount aligns domestic conditions with external ones and motivates gold producers to... export too”.

Chinese gold reserves grew by 74t in H1. The volume of monthly net purchases increased marginally in Q2, bringing the monthly average for 2019 to 12.3t (11t in Q1).

Adrian Ash, Director of Research at BullionVault says Putin’s heavy gold buying is bad for world peace:

“Heavy gold-buying by governments or central banks is rarely a good sign for world peace and co-operation.”

So, while "Don't fight The Fed" is a mantra many live by, perhaps it should be "don't fight the rest of the world's central bankers" in order to really protect one's wealth.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.