Stocks Suffer Most Since Xmas Eve As 'Big Trouble' In China Spreads

22 January, 2019

But, but, but last week the China talks were going great and everything was awesome? Now, talks are off and The IMF says the global economy has shit the bed?

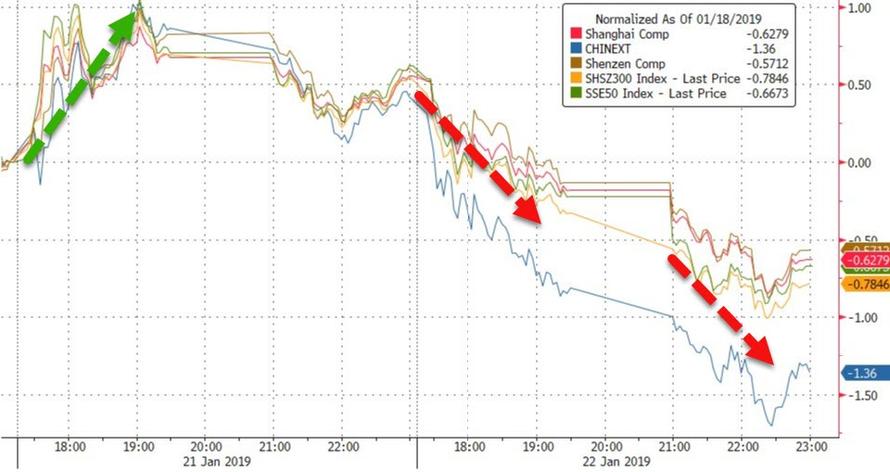

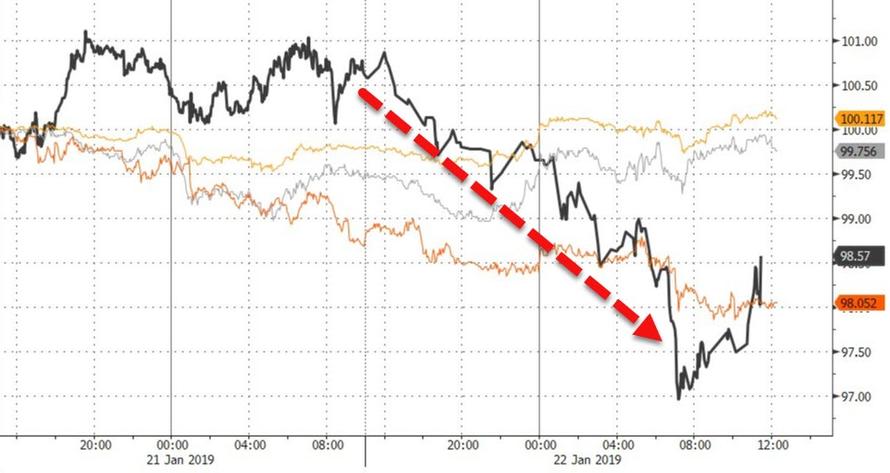

China stocks started badly and never got any better after the shitty data hit... No National Team?

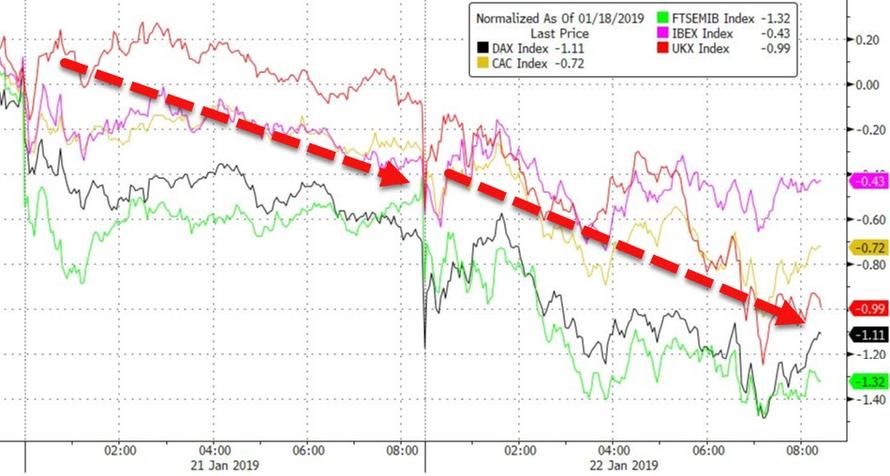

European stocks extended yesterday's losses...

US markets were weak overnight after dismal China data (worst annual GDP growth in 28 years) and trade talks headlines (confirming "little progress") but when the "U.S. TURNS DOWN CHINA OFFER OF PREPARATORY TRADE TALKS" headline hit, stocks tanked...

And then - as if on cue with the dow down 450 points - Larry Kudlow shows up on TV and proclaims: "REPORT THAT WHITE HOUSE CANCELED CHINA MTG NOT TRUE... KUDLOW REJECTS FT REPORT ON U.S. TURNING DOWN CHINA PREP TALKS" which sent stocks spiking higher.. but that did not last... but then a mysterious panic bid appeared at the bell (which lifted all indices above their 50DMAs)

By the close, Nasdaq and Trannies were worst (both down over 2%)...some panic buying in the last few seconds...

From Friday's cash open, the Nasdaq has erased all the trade hope gains...

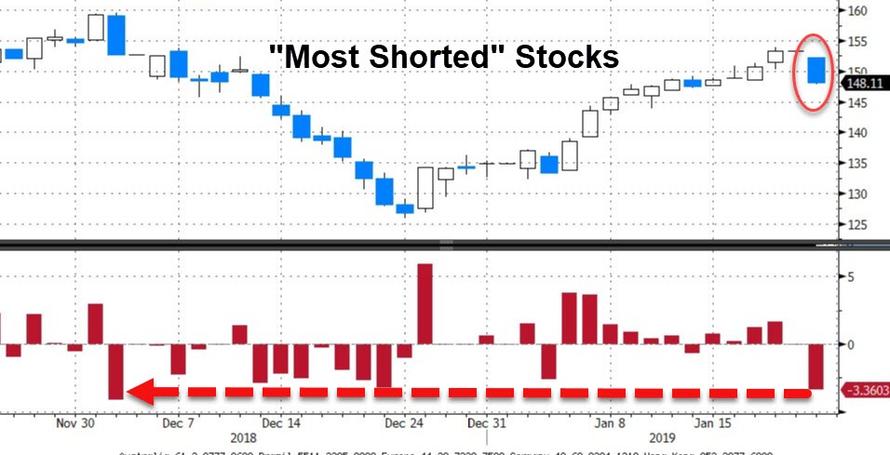

"Most Shorted" stocks fell over 3% today - their biggest drop in six weeks...

Volume was above average today but not huge.

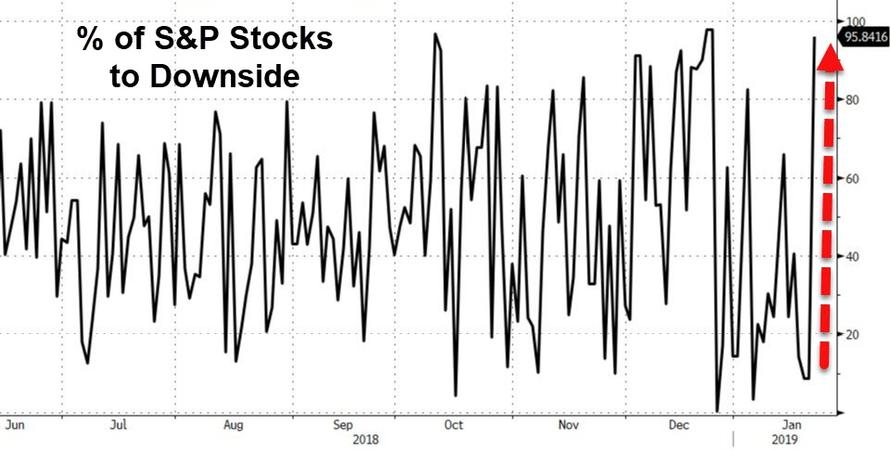

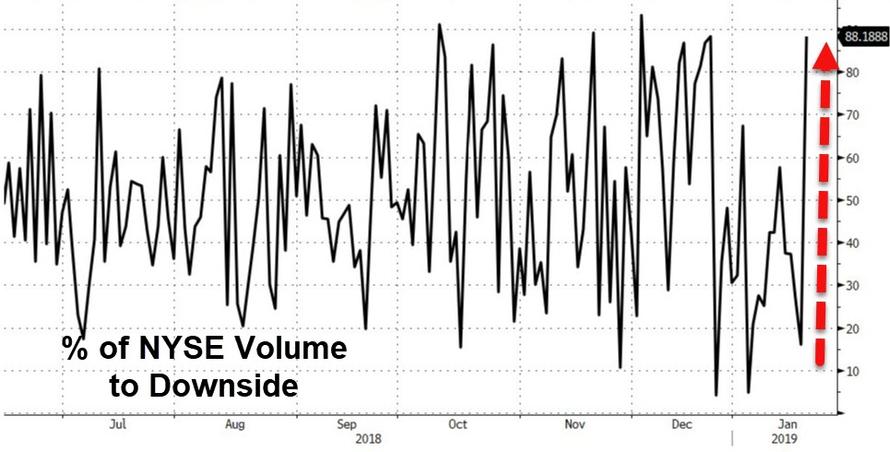

But...95% of S&P 500 stocks were to the downside today - this is the worst tumble, breadth-wise, since December 24.

From a volume perspective, it's also an ugly day... 88% of NYSE volume is in declining stocks, which rivals the 88.4% seen on December 24...

All the major US equity indices broke back below their 50-day moving averages...but bounced back above it thanks to Kudlow and some panic-buying at the bell.

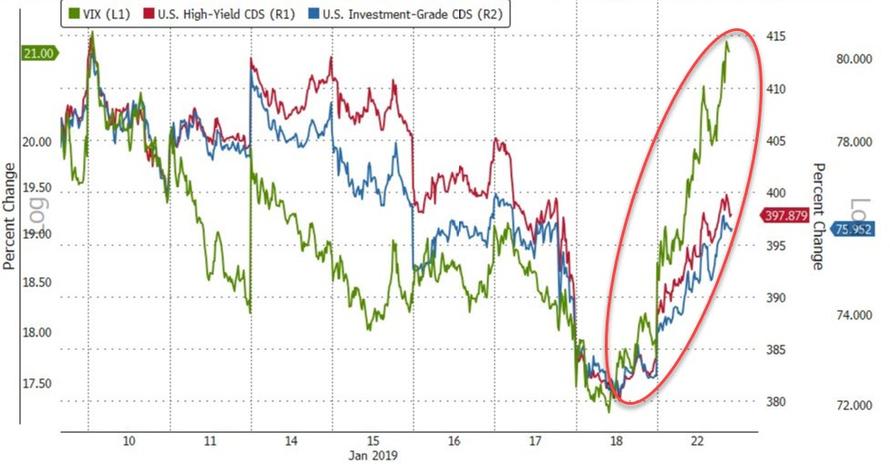

Equity (VIX) and Credit (CDX) protection markets soared higher today...

Treasury yields tumbled between 3 and 5bps on the day...

30Y Yields fell to one-week lows before Kudlow hit...

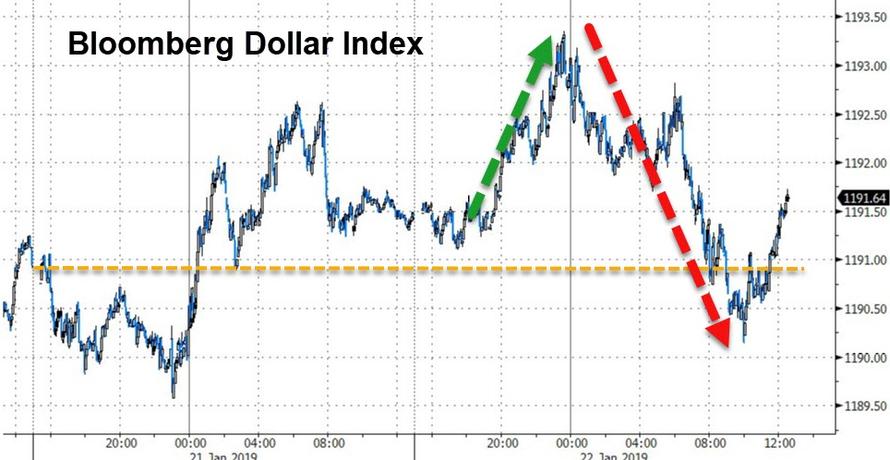

The dollar is up from Friday's close but roundtripped today to close almost unchanged (The dollar was bid as China data hit)...

Cryptos bounced today pushing Litecoin and Bitcoin Cash green for the week...

PMs managed modest gains as copper and crude were clubbed after China data...

WTI rebounded to $53 after sliding all day...

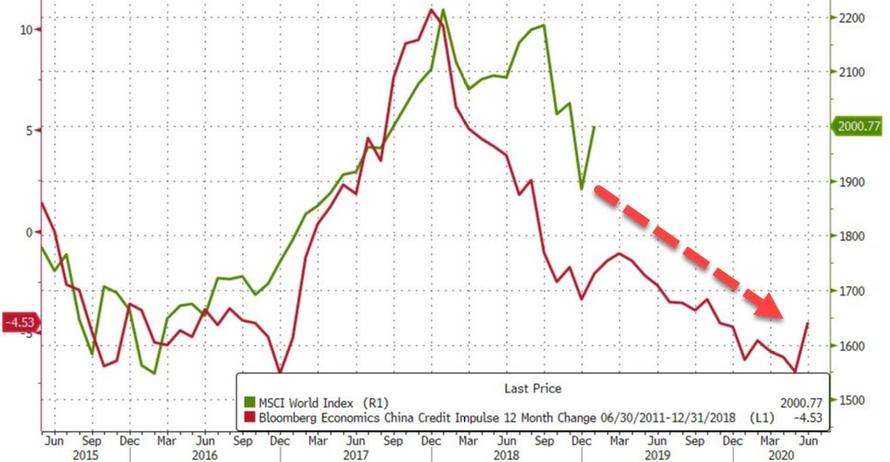

Finally, history appears to be written as the lagged effects of China's collapsing credit impulse (not offset by central bank balance sheet expansion) are not sending happy signals for global shareholders...

But in the US, it's time for some catch down...

Dow Tumbles 450 Points, All Major US Indices Break Key Technical Support

This is the last thing investors worried about slowing growth in China wanted to see

Stocks took another leg lower Tuesday afternoon after the Financial Times reported that the US had effectively canceled the next round of US-China trade talks, which were expected to take place between senior officials. The talks were expected to set the table for a visit by a delegation led by China's Liu He later this month. The report also calls into question President Trump's rosy outlook on the trade talks.

This week’s planned trip by Wang Shouwen and Liao Min was intended to pave the way for a higher-level meeting in Washington on January 30 and 31 by Liu He, China vice-premier, and Robert Lighthizer, US trade representative. But, according to people briefed on the negotiations, US officials cancelled this week’s face-to-face meetings with Mr Wang, a vice-minister of commerce, and Mr Liao, a vice-minister of finance, because of a lack of progress on “forced” technology transfers and potentially far-reaching “structural” reforms to China’s economy.

The US refused the offer because Beijing has refused to offer concrete proposals about how they would curb IP theft and also implement certain structural reforms.

Trump’s negotiators wanted Mr Liao, one of Mr Liu’s closest aides, and Mr Wang to come to face-to-face talks in Washington with a written offer outlining how Beijing intended to address US complaints about technology transfers and structural reforms.

But, according to the people briefed on the stalemate, Mr Xi’s negotiators are refusing to alter their long-standing position that foreign companies are not forced to transfer technology to Chinese companies.

They also argue that Beijing’s recent offer to improve market access for foreign investors in certain sectors — and strengthen protection of intellectual property — should address US concerns.

Notably, the report follows a WSJ report earlier in the day which cited the work of independent business groups who found that China is moving ahead with its "Made in China 2025" initiative despite rumors late last year that China would move away from the policy. The Trump administration has repeatedly criticized the policy as an example of anti-competitive state support for domestic industry.

Dow futures are down over 400 points, accelerating losses on the trade headlines...

No comments:

Post a Comment

Note: only a member of this blog may post a comment.