Trump

makes unprecedented demands to US companies in China

Donald

Trump launched a Twitter tirade declaring a trade war with China, and

handed the US Federal Reserve Chair a brutal message.

24 August, 2019

Donald Trump launched a tirade on Twitter today, declaring that China has “been taking advantage of the United States”.

The US President ordered that he would increase taxes on products from China to 30 per cent from October 1.

Mr Trump’s tweet storm came as Wall Street tumbled after the US-China trade war escalated in dramatic fashion, with Trump demanding American companies seek alternatives to doing business with China after Beijing announced its own slate of retaliatory measures.

All three major US stock indexes ended the session sharply lower, posting their fourth consecutive weekly declines.

For many years China (and many other countries) has been taking advantage of the United States on Trade, Intellectual Property Theft, and much more. Our Country has been losing HUNDREDS OF BILLIONS OF DOLLARS a year to China, with no end in sight....

25.9K people are talking about this

....Sadly, past Administrations have allowed China to get so far ahead of Fair and Balanced Trade that it has become a great burden to the American Taxpayer. As President, I can no longer allow this to happen! In the spirit of achieving Fair Trade, we must Balance this very....

7,735 people are talking about this

Mr Trump said products coming from China that were slated to be hit with a 10 per cent tariff on September 1 will now face a 15 per cent tariff. He announced that goods and products currently being taxed at 25 per cent will be taxed at 30 per cent from October.

Trump’s comments come after China said it would pursue new tariffs of 5 per cent and 10 per cent on $US75 billion of American products.

‘Taking advantage’. US President Donald Trump has launched a sensational Twitter tirade about US-China taxes. Picture: AFPSource:AFP

The tariffs would take place in two steps, just as the US said it would do earlier this month in imposing 10 per cent tariffs on $US300 billion of Chinese goods.

The rising tensions between the world’s two biggest economies unnerved investors already on edge.

The latest exchanges in the long-running tariff row triggered a broadbased sell-off that hit shares of companies with high exposure to China the hardest, such as chipmakers and other top technology names.

Dow Jones Industrials components Intel and Apple dropped 3.9 per cent and 4.6 per cent respectively.

The developments overshadowed a highly anticipated speech from US Federal Reserve Chair Jerome Powell, in which he reiterated a pledge the central bank would “act as appropriate” to support the economy.

...unfair Trading Relationship. China should not have put new Tariffs on 75 BILLION DOLLARS of United States product (politically motivated!). Starting on October 1st, the 250 BILLION DOLLARS of goods and products from China, currently being taxed at 25%, will be taxed at 30%...

16.4K people are talking about this

...Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

25.4K people are talking about this

Powell stopped short of committing to the series of rapid-fire rate cuts Trump has been demanding.

At a press conference, Trump said that he would not stand in the way of beleaguered Federal Reserve chief Powell if he decided to quit.

Asked if he wanted Powell to resign, Trump told reporters: “If he did, I wouldn’t stop him.” Trump suggested earlier Friday that he regarded Powell as a bigger “enemy” than China, with whom he has been waging a trade war.

TRUMP: ‘WE DON’T NEED CHINA’

The dramatic fallout on Wall Street came as Trump “ordered” American companies to find alternatives to doing business in China.

The Dow Jones Industrial Average plummeted more than 700 points, or about 2.7 per cent, directly after Trump launched into a Twitter tirade lambasting China for intellectual property theft and fentanyl shipments to the US, the New York Post reports.

The Dow Jones ended trading down 622 points, or 2.4 per cent.

Our Country has lost, stupidly, Trillions of Dollars with China over many years. They have stolen our Intellectual Property at a rate of Hundreds of Billions of Dollars a year, & they want to continue. I won’t let that happen! We don’t need China and, frankly, would be far....

53.5K people are talking about this

“We don’t need China and, frankly, would be far … better off without them. The vast amounts of money made and stolen by China from the United States, year after year, for decades, will and must STOP.” Trump said in a series of earlier tweets.

“Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing your companies HOME and making your products in the USA,” Trump said.

Both the S&P 500 and Nasdaq joined in the bloodbath, closing down 2.5 per cent and 3 per cent respectively.

Mr Trump also directed Fed-Ex, Amazon, UPS and the US Post Office to “search for & refuse” fentanyl shipments from China and other countries.

President Donald Trump says his country has lost “trillions of dollars with China over many years.” Picture: AFPSource:AP

Shares of Amazon dropped 1.9 per cent while FedEx and UPS shares were off 2.6 per cent and 2.4 per cent, respectively, as of 11:35am.

Apple, which makes many of its products in China, dropped 3.8 per cent to $US204.2 ($A302) a share.

Mr Trump’s remarks came following China announcing that it plans to impose $US75 billion ($A111.1 billion) of tariffs on US goods, including agricultural products and small aircraft as well as resume tariffs on US autos. The tariffs are set to go into effect in two stages on September 1 and December 15, mimicking the schedule the US plans for instituting tariffs on Chinese goods.

Mr Trump said he will be responding to China’s tariffs this afternoon.

CHINA HITS BACK IN US TARIFFS WAR

China announced tariff hikes on $US75 billion ($A111.1 billion) of US

products in retaliation for Mr Trump’s latest planned increase, deepening a conflict over trade and technology that threatens to tip a weakening global economy into recession.

China also will increase import duties on US-made autos and auto parts, the Finance Ministry announced.

24 August, 2019

As widely expected, and as he himself previewed earlier in the day, Trump was set to unveil a major development in the US-China trade war this afternoon. That happened moments ago, when the president, in a series of 4 tweets, confirmed that he indeed was hiking tariffs on both existing and future China tariffs.

Specifically, Trump announced that in response to the $75 billion in tariffs that China just imposed on the US this morning - which "should not have" been put on as they were "politically motivated" - starting October 1, the existing 25% tariffs on $250BN in Chinese goods would rise to 30%, and the 10% tariffs on $300 billion in Chinese goods set to begin on September 1 will be 15%.

Here is the Trump announcement:

For many years China (and many other countries) has been taking advantage of the United States on Trade, Intellectual Property Theft, and much more.Our Country has been losing HUNDREDS OF BILLIONS OF DOLLARS a year to China, with no end in sight.Sadly, past Administrations have allowed China to get so far ahead of Fair and Balanced Trade that it has become a great burden to the American Taxpayer.As President, I can no longer allow this to happen! In the spirit of achieving Fair Trade, we must Balance this very unfair Trading Relationship.China should not have put new Tariffs on 75 BILLION DOLLARS of United States product (politically motivated!).Starting on October 1st, the 250 BILLION DOLLARS of goods and products from China, currently being taxed at 25%, will be taxed at 30%.Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

And the tweets themselves:

....Sadly, past Administrations have allowed China to get so far ahead of Fair and Balanced Trade that it has become a great burden to the American Taxpayer. As President, I can no longer allow this to happen! In the spirit of achieving Fair Trade, we must Balance this very....

7,784 people are talking about this

...Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

25.5K people are talking about this

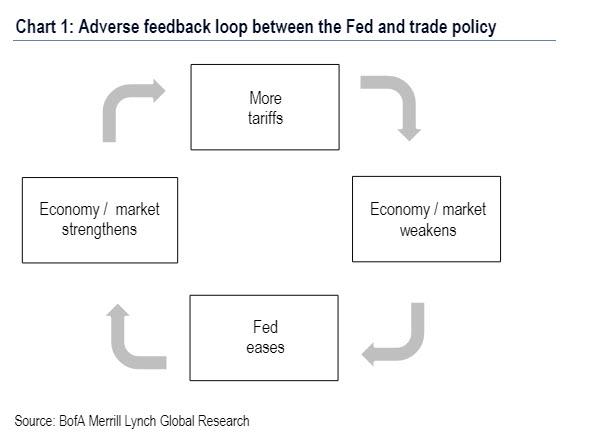

Of course, all of this was perfectly predictable the moment Jerome Powell underwrote Trump's trade war, when he said on July 31 the Fed is now focusing on "global developments", effectively assuring he would keep cutting rates the more trade war between the US and China escalated.

And now we await China's retaliation as Beijing has no choice but to retaliate again in tit-for-tat fashion, and is likely to hike the rate on its own tariffs targeting US goods, which will then prompt Trump to raise tariffs even more, at which point China will retaliate in kind, until eventually all trade between the US and China grinds to a halt, at which point the question is which country will succumb to recession and/or social unrest first.

Meanwhile, the real news this afternoon, is that there was still no announcement of currency intervention by Trump, or rather not yet. We expect that to come some time in the next 2-4 weeks.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.