Trend

is Clear – Rapid Decline of World Economy – Egon von Greyerz

12

December, 2018

Financial

and precious metals expert Egon von Greyerz (EvG) says don’t expect

the global financial situation to get better anytime soon. EvG says,

“You know what the politicians are doing now? Theresa May is my

best example. These politicians are just running around posing and

acting, but they are not achieving anything, and they are not

achieving anything because the world is in a mess. What we are seeing

the beginning of is the decline of the western world economy, which

means the whole world economy. . . . There is no use in putting a

time period on it, that it’s going to happen this year or next

year. The trend is clear. We know that the world economy is in a

mess. It’s going to decline, and in my view, it’s going to be a

rapid decline.. . . Gold will reflect all of this, and currencies

will be totally debased. . . . You don’t need a lot, you might only

need another few snowflakes to trigger this avalanche. It could come

in a month or in three months time because the system is a fake

system. . . . I count $2 quadrillion in money. If you add debt,

unfunded liabilities and the risk of derivatives, you come up to $2

quadrillion of debt and liabilities. The global

GDP is $70 trillion.

. . . So, you are talking about 30 times global GDP.”

What

could go wrong? EvG says, “You don’t need much to go wrong. It

will happen. They have no remedy anymore. 2007 to 2009, I have said

many times that was a rehearsal. The real thing is coming now or in

the next few years, and no money printing will ever stop it. They

will try, but they will fail. This is why you will get the

depressionary hyperinflation, and when that fails you get the

implosion of the system. All values will shrink to very low numbers,

all assets and debts will shrink together. That is the longer term

play. It’s not going to be nice for the world. It’s going to be

horrible for the world.”

In

closing, EvG says, “Because of the artificial control of the

system, the cycles becomes ten times or a hundred times bigger than

they would have been by natural forces. We have had a hundred years

of excesses in the world and artificial wealth creation. Now, in the

coming years, we will have a very long period of the opposite. Wealth

will disappear. A lot of people will suffer, and, sadly, there will

be famine. There will be misery. The world has gone through this

before, but this will be bigger than it ever has been. The world will

survive this, but there will be a lot of suffering when this

implodes. . . . The fear hasn’t started yet, but it will, and then

there will be a rush into gold and silver. Our clients are increasing

their positions. . . . In my view, 25% of total net worth is the

minimum (to invest in gold and silver), and, personally, I would not

have any major assets in the bank because I don’t think the banking

system will survive. If it survives, it will not be in its present

form. Stocks, in relation to gold, will go down 90% to 95%. They went

down 90% in 1929 to 1932. . . . There will be the most massive wealth

destruction ever.”

Greyerz – We Have Just Seen A Huge Warning That A Global Collapse Is About To Unfold

16

December, 2018

As

the world edges closer to the next crisis, today the man who has

become legendary for his predictions on QE and historic moves in

currencies just warned King World News that we have just seen a huge

warning that a global collapse is about to unfold.

Unprecedented

Risks And The Wisdom Of Plato

Egon von Greyerz: “As we approach the beginning of the biggest wealth destruction in history, it is timely to turn to the wisdom of one of the great philosophers. Plato (428-348 BC) stated:

“The

greatest wealth is to live content with little.”

And

that is the lesson that most people in the world will need to learn

the hard way in coming years. We are now at the end of an era which

has created unreal wealth for a few and massive debt for most of the

world. As all the bubble markets in stocks, bonds, property and other

financial assets implode, together with the debt that has fueled it

all, 100s of trillions of dollars will just vanish and never return.

The consequences will be both shocking and devastating for most

people…

Egon

von Greyerz continues: “It

is interesting how few people, especially in the West, heed the wise

words of Plato. We all come into this world alone with absolutely

nothing and we leave the world in the same way – alone with

nothing. And in between most people try to accumulate as many

possessions as they possibly can, although we can take nothing with

us when we leave. I have recently had discussions with a couple of

different friends who have expressed content with what they have and

are in no need of amassing material wealth.

These are both people of

great intellect and integrity and also with many interests which are

both stimulating and free. It is refreshingly uplifting to meet such

people who are totally content with their lives.

Interestingly,

both of these people are holding gold. Most people we know, clients

or friends, who own gold, do not hold it in order to become wealthy.

They do it because they see the unprecedented risks in the world, in

markets and in the financial system. They see gold as the best form

of insurance or wealth preservation against these risks. Anyone who

buys gold to make short term gains has misunderstood the purpose of

holding physical gold.

Gold

is not a “get rich quick” investment. The people who buy gold

when it goes up and sell when it goes down are just opportunistic

speculators. They don’t understand the purpose of holding gold.

Gold is not an investment. Gold is money and the only money which has

survived in history. Over time, gold assures stable purchasing power.

One ounce of gold buys a good quality suit for a man, just like it

did 2,000 years ago.

Paper

Money Is Disappearing

Paper

Money Is DisappearingPaper money is gradually disappearing in country after country. I was recently in Sweden and the eastern European beggars have virtually disappeared. Why, you wonder? The reason is that cash has virtually disappeared in Sweden and nobody carries cash. So there is no money for the beggars. Many shops don’t accept cash, even low value shops like bakers only take credit cards. In many EU countries, the maximum daily withdrawal is EUR 1,000 and cash transactions over that amount are illegal. In Venezuela, bank accounts of ordinary people are frozen to “Fight Terrorism.”

So

it is only a matter of time before cash disappears altogether. This

gives the authorities around the world total control of money, and we

hear that banks around the world are preparing for this. When the

next financial crisis starts, it will be very easy to turn off cash

machines and to block all transactions by credit card of, say, more

that 100 dollars or euros daily. At some point, private

cryptocurrencies will also be banned and replaced by government

cryptos.

“Money

is gold and nothing else,” said

J P Morgan in 1912. Again, this time the only real money that will

survive is gold. The Greek philosopher Aristoteles, who was Plato’s

student, defined what sound money must be:

– Durable

– Portable

– Divisible

– Intrinsically valuable

– Portable

– Divisible

– Intrinsically valuable

Only

physical gold fulfills these criteria and this is why gold is the

only surviving currency in history.

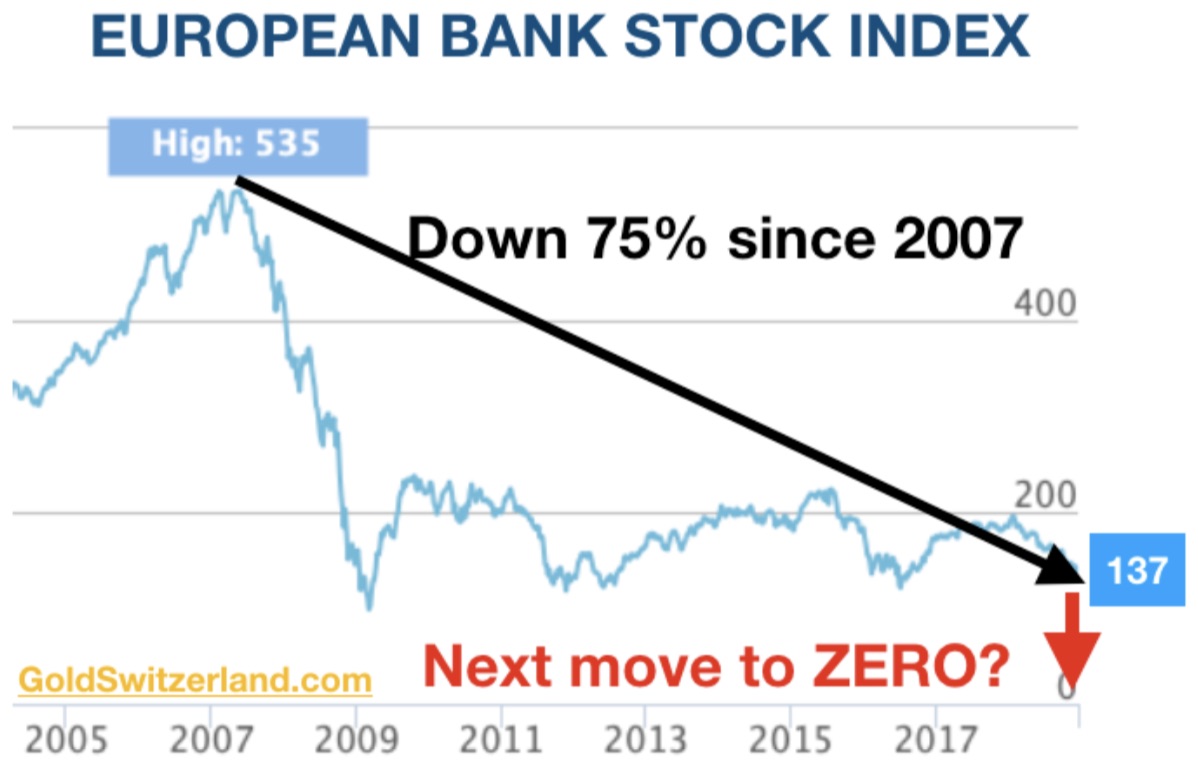

A Huge Warning That A Global Collapse Will Unfold

The stocks in the banking sector are giving us a clear warning that the financial system is unlikely to survive in its present form. Many bank stocks are down over 90% since 2007. Deutsche Bank, for example, is down 94%. Looking at the European Banking Index STOXX 600, it has lost 75% since 2007, and in 2018 it is has collapsed by 1/3. The index has never recovered from the last crisis, and as the chart below shows, prices have been going sideways at the bottom. This is a very bearish sign which indicates that this chart will soon crash again and the European banking system with it.

A

Crisis Of Much Greater Magnitude

The continuation of the 2007-9 crisis is just around the corner. Governments and bankers around the world have managed to postpone the inevitable for 10 years. That will result in a crisis of a much greater magnitude. This time around there is not much margin for lowering rates since they are already negative or very low in most countries. And the coming money printing on a global scale is very unlikely to save the system. The fake financial system based on credit and printed money will soon be revealed. Finally, the world will soon realize that it has been living on a lie as printed money can never create wealth. Printing money is like piling Pelion on Ossa. Thus, a fruitless effort just like it was for the Centaurs in Greek mythology to pile one mountain upon another to reach heaven and destroy the gods.

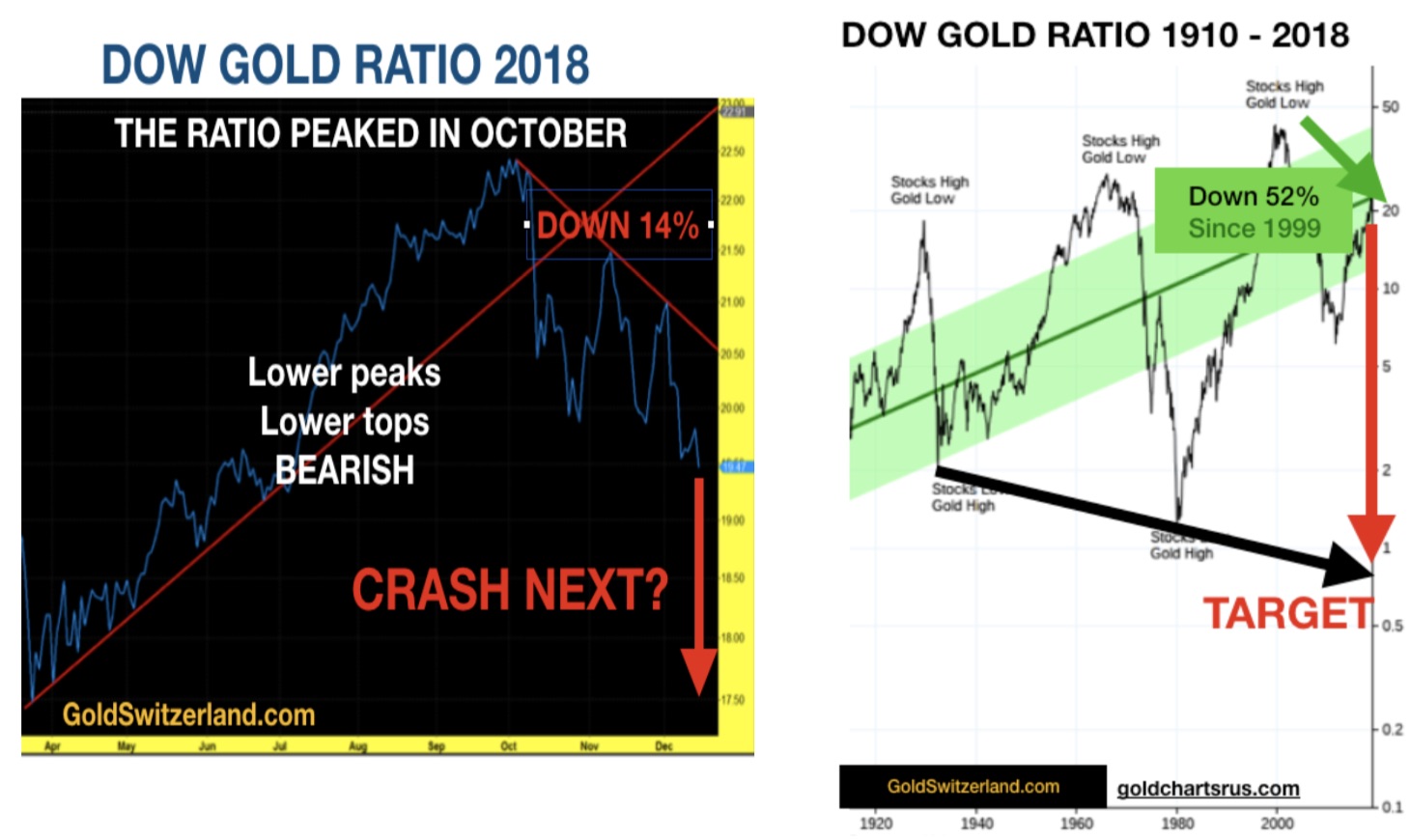

The

best illustration of what will happen in the next few years as wealth

is destroyed is the chart of the Dow – Gold ratio.

When

this ratio goes up, it means that the Dow is going up against gold,

and when it goes down, gold is gaining against the Dow. Stocks

bottomed versus gold in 1980 as the gold price reached $850.

Subsequently, stocks rose strongly as gold fell to $250 at the end of

the 1990s. The Dow then fell 87% versus gold from 2000 to 2011. Since

2009 we have seen a strong stock market and lower gold. In spite of

that the Dow is still down 52% versus gold since 1999. The correction

now seems to be over and we have seen the ratio fall 14% since

October 2018 as the daily black chart above (for 2018) shows.

A

Stock Market Crash Is Imminent

The long term fall, which started in 1999, is now likely to resume in earnest. A stock market crash is imminent. The ratio reached 1 in 1980 (see right hand chart above), which means that the Dow and Gold were at the same level around 850. We are likely to at least reach the trend line which is at 0.75, but most likely overshoot and see the ratio below 0.5. This means that the gold price will be at least twice as high as the Dow. Whether that is $20,000 gold and 10,000 Dow, time will tell. It could also be $50,000 gold and 25,000 Dow with hyperinflation. It is of course impossible to forecast the exact level but what is clear is that stocks, together with most assets, will decline dramatically in real terms (versus gold).

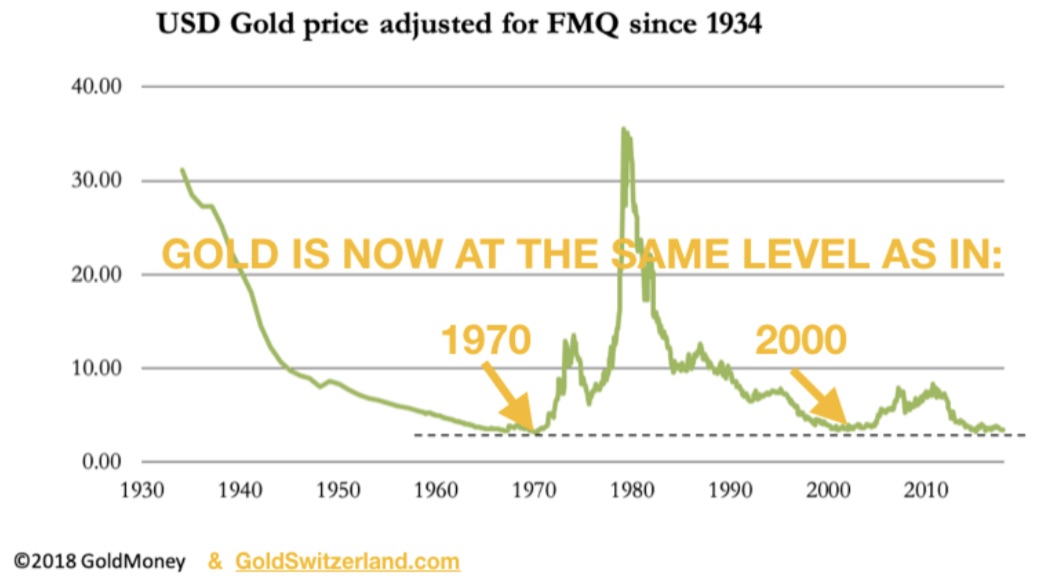

Finally,

let us look at the gold price adjusted for real money supply or FMQ

(Fiat Quantity Money). As the chart below shows, the gold price is

now at the same level as in the late 1960s and early 1970s ($35)

before Nixon closed the gold window. Gold is also at the level where

it was at the turn of this century around $300. What this clearly

shows is that gold, on any criteria, is severely undervalued, whether

it is versus money supply or stocks.

But

the reason for owning gold should not be primarily based on the

incredible undervaluation but on the fact that gold represents the

best insurance as well as the ultimate wealth preservation against

the imminent collapse of most assets and also of the financial

system.

For

those who would like to read more of Egon von Greyerz’s fantastic

articles CLICK

HERE.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.